SunTrust 2007 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

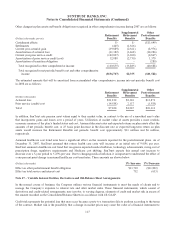

Deferred income tax liabilities and assets result from temporary differences between assets and liabilities measured for

financial reporting purposes and for income tax return purposes. These assets and liabilities are measured using the enacted

tax rates and laws that are currently in effect. The significant components of the net deferred tax liability at December 31

were as follows:

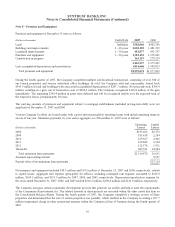

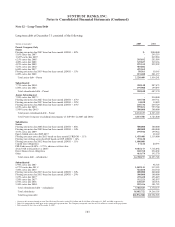

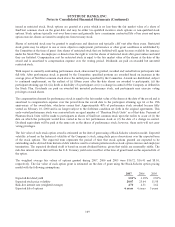

December 31,

(Dollars in thousands) 2007 2006

Deferred Tax Assets

Allowance for loan losses $474,252 $386,796

Accrued expenses 286,912 96,203

Securities 165,944 (89,910)

Other 169,867 136,321

Gross Deferred Tax Assets $1,096,975 $529,410

Deferred Tax Liabilities

Net unrealized gains on available for sale securities, derivatives, and benefit obligations $929,048 $521,568

Leasing 852,254 823,763

Employee benefits 148,529 185,737

Mortgage 484,459 311,774

Intangible assets 43,373 41,753

Fixed assets 33,800 44,334

Loans 87,616 97,971

Undistributed dividends 128,835 95,382

Other 97,164 80,381

Gross Deferred Tax Liabilities $2,805,078 $2,202,663

Net Deferred Tax Liability $1,708,103 $1,673,253

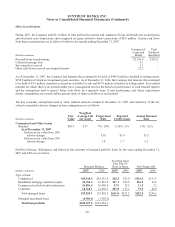

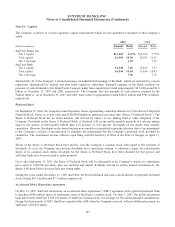

SunTrust and its subsidiaries file consolidated income tax returns where permissible or required. Each subsidiary generally

remits current taxes to or receives current refunds from the Parent Company based on what would be required had the

subsidiary filed an income tax return as a separate entity. Deferred tax assets resulting from state net operating loss

carryforwards consist of $83.7 million (net of a valuation allowance of $38.8 million) for 2007 and $62.6 million (net of

valuation allowance of $19.4 million) for 2006. The state net operating losses expire, if not utilized, in varying amounts from

2008 to 2027.

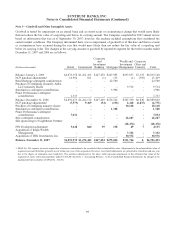

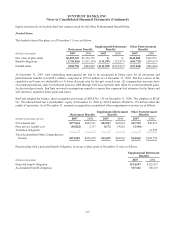

Adoption of FIN 48

SunTrust adopted FIN 48 effective January 1, 2007. The cumulative effect adjustment recorded upon adoption resulted in an

increase to unrecognized tax benefits of $55.0 million ($46.0 million on an after-tax basis), with offsetting adjustments to

equity and goodwill. The Company classifies interest and penalties related to its tax positions as a component of income tax

expense. As of December 31, 2007, the Company’s cumulative unrecognized tax benefits amounted to $405.4 million

($316.2 million on an after-tax basis). Of this amount, $351.5 million ($277.5 million on an after-tax basis) would affect the

Company’s effective tax rate, if recognized. The remaining $53.9 million ($38.7 million on after after-tax basis) is expected

to impact goodwill, if recognized. After-tax interest expense related to unrecognized tax benefits was $18.0 million for the

year ended December 31, 2007. Cumulative unrecognized tax benefits included interest of $80.0 million ($52.0 million on an

after-tax basis) as of December 31, 2007. The Company continually evaluates the unrecognized tax benefits associated with

its uncertain tax positions. It is reasonably possible that the total unrecognized tax benefits as of December 31, 2007 could

decrease by an estimated $40.0 million ($26.0 million on an after-tax basis) by December 31, 2008, as a result of the

expiration of statutes of limitations and potential settlements with federal and state taxing authorities. It is also reasonably

possible that this decrease could be substantially offset by new matters arising during the same period. The Company files

consolidated and separate income tax returns in the United States Federal jurisdiction and in various state jurisdictions. The

Company’s Federal returns through 1998 have been examined by the Internal Revenue Services (“IRS”) and issues for tax

107