SunTrust 2007 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

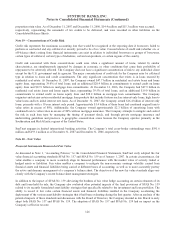

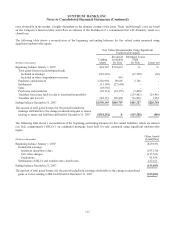

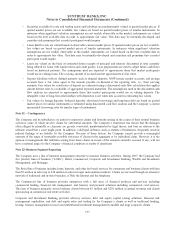

In conjunction with adopting SFAS No. 159, the Company elected to record specific financial assets and financial liabilities

at fair value. These instruments include all, or a portion, of the following: debt, available for sale debt securities, adjustable

rate residential mortgage portfolio loans, securitization warehouses and trading loans.

As a result of electing to record these financial assets and financial liabilities at fair value pursuant to the provisions of SFAS

No. 159 (fair value option, “FVO”) as of January 1, 2007, the Company recorded the following to opening retained earnings:

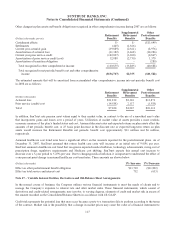

(Dollars in thousands)

As of

January 1, 2007

prior to Adoption

Net

Decrease

to Retained Earnings

upon Adoption

As of

January 1, 2007

after Adoption

Securities $15,383,938 ($231,211) $15,152,727

Loans 4,068,101 (71,950) 3,996,151

Long-term debt (6,561,954) (315,685) (6,877,639)

Pre-tax cumulative effect of adopting FVO ($618,846)

Increase in deferred tax asset 230,242

Cumulative effect of adopting FVO ($388,604)

The following is a description of each asset and liability class for which fair value has been elected, including the specific

reasons for electing fair value and the strategies for managing the assets and liabilities on a fair value basis.

Fixed Rate Debt

The debt that the Company elected to carry at fair value was all of its fixed rate debt that had previously been designated in

qualifying fair value hedges using receive fixed/pay floating interest rate swaps, pursuant to the provisions of SFAS No. 133.

This population specifically included $3.5 billion of fixed-rate Federal Home Loan Bank (“FHLB”) advances and $3.3

billion of publicly-issued debt. The Company elected to record this debt at fair value in order to align the accounting for the

debt with the accounting for the derivative without having to account for the debt under hedge accounting, thus avoiding the

complex and time consuming fair value hedge accounting requirements of SFAS No. 133. The reduction to opening retained

earnings from recording the debt at fair value was $197.2 million. This move to fair value introduced potential earnings

volatility due to changes in the Company’s credit spread that were not required to be valued under the SFAS No. 133 hedge

designation. All of the debt, along with the interest rate swaps previously designated as hedges under SFAS No. 133,

continues to remain outstanding.

During the year ended December 31, 2007, the Company consummated two fixed rate debt issuances. On September 10,

2007, the Company issued $500 million of Senior Notes, which carried a fixed coupon rate of 6.00% and had a term of 10

years. The Company did not enter into any hedges on this debt at issuance and, therefore, did not elect to carry the debt at fair

value. On November 5, 2007, the Company issued $500 million of Senior Notes, which carried a fixed coupon rate of 5.25%

and had a term of 5 years. The Company did enter into hedges in connection with this debt issuance and as a result elected to

carry this debt at fair value.

Available for Sale and Trading Securities

The available for sale debt securities that were transferred to trading were substantially all of the debt securities within

specific asset classes, whether the securities were valued at an unrealized loss or unrealized gain. The Company elected to

reclassify approximately $15.4 billion of securities to trading at January 1, 2007, as well as an additional $600 million of

purchases of similar assets that occurred during the first quarter. The reduction to opening retained earnings related to

reclassifying the $15.4 billion of securities to trading was $147.4 million. This net unrealized loss was already reflected in

accumulated other comprehensive income and, therefore, upon reclassification to retained earnings, there was no net impact

to total shareholders’ equity. The Company’s securities portfolio is generally of high credit quality, such that the opening

retained earnings adjustment was not significantly impacted by the credit risk embedded in the assets, but rather due to

interest rates.

127