SunTrust 2007 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

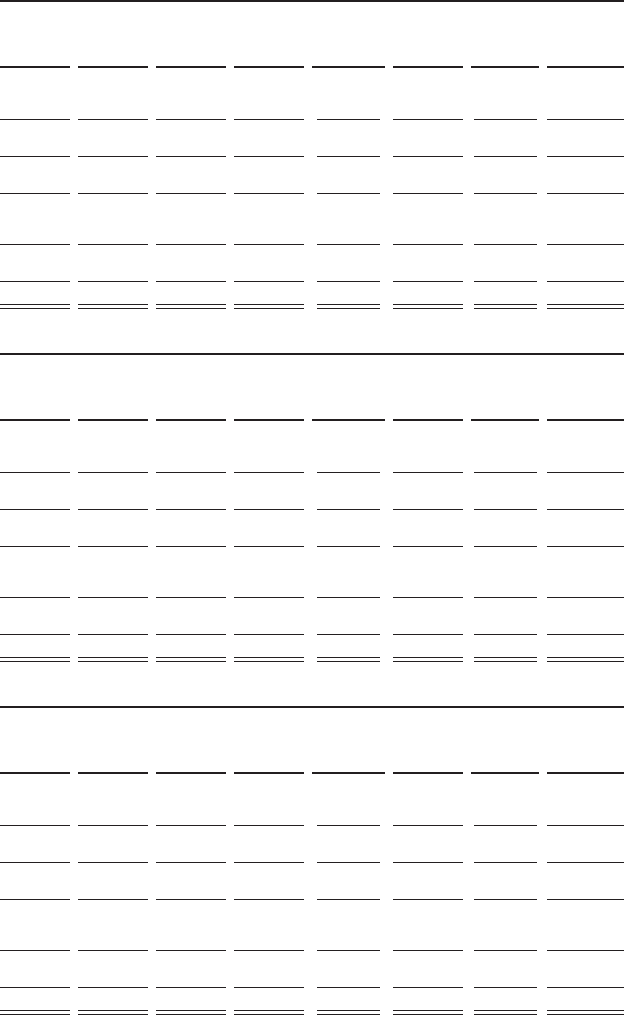

The application and development of management reporting methodologies is a dynamic process and is subject to periodic

enhancements. The implementation of these enhancements to the internal management reporting methodology may

materially affect the net income disclosed for each segment with no impact on consolidated amounts. Whenever significant

changes to management reporting methodologies take place, the impact of these changes is quantified and prior period

information is reclassified wherever practicable. The Company will reflect these reclassified changes in the current period

and will update historical results.

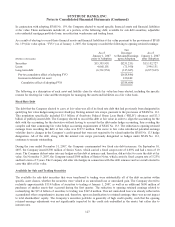

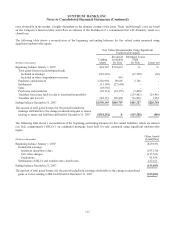

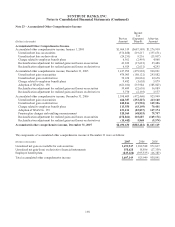

Twelve Months Ended December 31, 2007

(Dollars in thousands) Retail Commercial

Corporate

and

Investment

Banking Mortgage

Wealth and

Investment

Management

Corporate

Other and

Treasury

Reconciling

Items Consolidated

Average total assets $38,007,827 $35,415,346 $24,353,571 $45,554,333 $8,901,646 $23,980,022 $1,582,773 $177,795,518

Average total liabilities 69,087,135 19,164,955 9,207,334 2,718,817 10,434,428 49,278,490 96,346 159,987,505

Average total equity ----- -17,808,013 17,808,013

Net interest income $2,286,775 $870,321 $174,848 $527,079 $347,052 ($182,218) $695,687 $4,719,544

Fully taxable-equivalent adjustment (FTE) 136 37,144 47,481 - 54 17,837 28 102,680

Net interest income (FTE)12,286,911 907,465 222,329 527,079 347,106 (164,381) 695,715 4,822,224

Provision for loan losses2266,566 22,187 37,722 81,157 8,519 6,692 242,079 664,922

Net interest income after provision for loan losses 2,020,345 885,278 184,607 445,922 338,587 (171,073) 453,636 4,157,302

Noninterest income 1,103,873 298,564 377,980 365,746 807,955 498,363 (23,797) 3,428,684

Noninterest expense 2,181,804 721,215 489,762 823,793 1,008,603 32,329 (23,729) 5,233,777

Net income before taxes 942,414 462,627 72,825 (12,125) 137,939 294,961 453,568 2,352,209

Provision for income taxes3340,283 89,532 27,227 (20,053) 53,043 70,977 157,185 718,194

Net income $602,131 $373,095 $45,598 $7,928 $84,896 $223,984 $296,383 $1,634,015

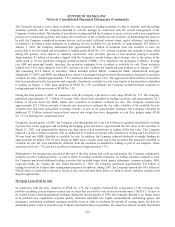

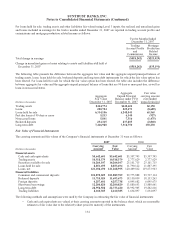

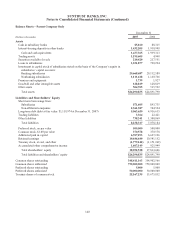

Twelve Months Ended December 31, 2006

Retail Commercial

Corporate

and

Investment

Banking Mortgage

Wealth and

Investment

Management

Corporate

Other and

Treasury

Reconciling

Items Consolidated

Average total assets $37,772,328 $35,000,439 $23,881,973 $42,014,601 $8,933,309 $30,680,991 $2,031,505 $180,315,146

Average total liabilities 69,847,793 18,297,220 8,835,694 2,151,683 10,021,965 53,688,167 (74,116) 162,768,406

Average total equity ----- -17,546,740 17,546,740

Net interest income $2,344,972 $916,699 $203,132 $603,116 $369,484 ($145,682) $368,744 $4,660,465

Fully taxable-equivalent adjustment (FTE) 116 40,942 31,449 - 71 15,437 (49) 87,966

Net interest income (FTE)12,345,088 957,641 234,581 603,116 369,555 (130,245) 368,695 4,748,431

Provision for loan losses2105,985 9,701 113,933 8,748 3,696 4,076 16,397 262,536

Net interest income after provision for loan losses 2,239,103 947,940 120,648 594,368 365,859 (134,321) 352,298 4,485,895

Noninterest income 1,050,855 284,053 667,570 379,424 1,096,046 16,329 (25,905) 3,468,372

Noninterest expense 2,164,717 679,725 492,348 601,670 1,001,607 (36,246) (23,961) 4,879,860

Total contribution before taxes 1,125,241 552,268 295,870 372,122 460,298 (81,746) 350,354 3,074,407

Provision for income taxes3409,665 127,811 105,715 126,413 171,141 (105,611) 121,802 956,936

Net income $715,576 $424,457 $190,155 $245,709 $289,157 $23,865 $228,522 $2,117,471

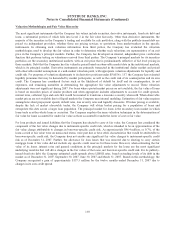

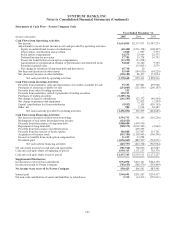

Twelve Months Ended December 31, 2005

Retail Commercial

Corporate

and

Investment

Banking Mortgage

Wealth and

Investment

Management

Corporate

Other and

Treasury

Reconciling

Items Consolidated

Average total assets $36,900,830 $33,127,140 $21,135,360 $33,031,775 $8,561,002 $32,810,621 $2,522,043 $168,088,771

Average total liabilities 65,897,208 17,042,341 8,617,720 1,871,113 9,937,605 48,391,891 (195,391) 151,562,487

Average total equity ----- -16,526,284 16,526,284

Net interest income $2,186,036 $865,541 $232,544 $554,542 $350,330 ($1,041) $391,014 $4,578,966

Fully taxable-equivalent adjustment (FTE) 83 37,722 22,484 - 64 15,138 1 75,492

Net interest income (FTE)12,186,119 903,263 255,028 554,542 350,394 14,097 391,015 4,654,458

Provision for loan losses2138,322 27,666 12,503 5,614 8,880 5,798 (21,897) 176,886

Net interest income after provision for loan losses 2,047,797 875,597 242,525 548,928 341,514 8,299 412,912 4,477,572

Noninterest income 1,020,119 270,528 636,349 239,299 942,466 76,818 (30,535) 3,155,044

Noninterest expense 2,048,975 670,006 478,543 516,328 932,559 74,863 (30,545) 4,690,729

Total contribution before taxes 1,018,941 476,119 400,331 271,899 351,421 10,254 412,922 2,941,887

Provision for income taxes3378,760 103,833 151,835 92,003 133,031 (57,247) 152,433 954,648

Net income $640,181 $372,286 $248,496 $179,896 $218,390 $67,501 $260,489 $1,987,239

1 Net interest income is fully taxable equivalent and is presented on a matched maturity funds transfer price basis for the line of business.

2 Provision for loan losses represents net charge-offs for the lines of business.

3 Includes regular income tax provision and taxable-equivalent income adjustment reversal.

137