SunTrust 2007 Annual Report Download - page 56

Download and view the complete annual report

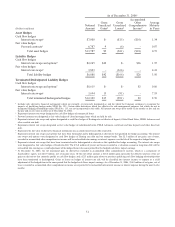

Please find page 56 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.over time, so the range of assumptions, and their impact on pension cost, is generally limited. We periodically review the

assumptions used based on historical and expected future experience.

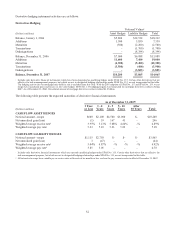

Healthcare Cost

Assumed healthcare cost trend rates also have an impact on the amounts reported for the postretirement plans. Due to

changing medical inflation, it is important to understand the effect of a one percent point change in assumed healthcare cost

trend rates. If we were to assume a one percent increase in healthcare cost trend rates, the effect on the other postretirement

benefit obligation and total interest and service cost would be a $13.7 million and $0.7 million increase, respectively. If we

were to assume a one percent decrease in healthcare trend rates, the effect on the other postretirement benefit obligation and

total interest and service cost would be a of $11.9 million and $0.6 million decrease, respectively.

To estimate the projected benefit obligation as of December 31, 2007, we projected forward the benefit obligations from

January 1, 2007 to December 31, 2007, adjusting for benefit payments, expected growth in the benefit obligations, changes in

key assumptions and plan provisions, and any significant changes in the plan demographics that occurred during the year,

including (where appropriate) subsidized early retirements, salary changes different from expectations, entrance of new

participants, changes in per capita claims cost, Medicare Part D subsidy, and retiree contributions.

ENTERPRISE RISK MANAGEMENT

In the normal course of business, we are exposed to various risks. To manage the major risks that we face and to provide

reasonable assurance that key business objectives will be achieved, we have established an enterprise risk governance

process and formed the SunTrust Enterprise Risk Program (“SERP”). Moreover, we have policies and various risk

management processes designed to effectively identify, monitor and manage risk.

We continually refine and enhance our risk management policies, processes and procedures to maintain effective risk

management and governance, including identification, measurement, monitoring, control, mitigation and reporting of all

material risks. Over the last several years, we have enhanced risk measurement applications and systems capabilities that

provide management information on whether we are being appropriately compensated for the risk profile we have adopted.

We balance our strategic goals, including revenue and profitability objectives, with the risks associated with achieving our

goals. Effective risk management is an important element supporting our business decision making.

Corporate Risk Management’s focus is on synthesizing, assessing, reporting and mitigating the full set of risks at the

enterprise level, and providing senior management with a holistic picture of the organization’s risk profile. We have

implemented an enterprise risk management framework that has improved our ability to manage our aggregate risk profile.

At the core of the framework are our risk vision and mission.

Risk Vision: To deliver sophisticated risk management capabilities consistent with those of top-tier financial institutions

that support the needs of the business, enable risk-enlightened management and the optimal allocation of capital.

Risk Mission: To promote a strong risk management culture which facilitates accountability, risk-informed decisions

consistent with the bank’s strategic objectives and the creation of shareholder value.

Our Chief Risk Officer (“CRO”) reports to the Chief Executive Officer and is responsible for the oversight of the risk

management organization as well as risk governance processes. The CRO provides overall leadership, vision and direction

for our enterprise risk management framework.

In addition to the centralized Corporate Risk Management function, each line of business and corporate function has its own

Risk Manager and support staff. These Risk Managers, while reporting directly to their respective line of business or

function, facilitate communications with corporate risk functions and execute the requirements of the enterprise risk

management framework and policies. Corporate Risk Management works in partnership with the Risk Managers to ensure

alignment with sound risk management practices as well as industry best practices.

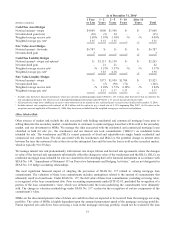

Organizationally, we measure and manage risk according to three main risk categories: credit risk, market risk (including

liquidity risk) and operational risk (including compliance risk). The Chief Credit Officer manages our credit risk program

and the Chief Market Risk Officer manages our market risk program. The Chief Operational Risk Officer manages our

operational risk program. These three areas of risk are managed on a consolidated basis under our enterprise risk

management framework, which also takes into consideration legal and reputational risk factors.

44