SunTrust 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

a loan in accordance with the contractual terms of a loan classified as nonaccrual, the loan may be returned to accrual status.

If a nonaccrual loan is returned to accruing status, the accrued interest at the date the loan is placed on nonaccrual status, and

foregone interest during the nonaccrual period, are recorded as interest income only after all principal has been collected for

commercial loans. For consumer loans and residential mortgage loans, the accrued interest at the date the loan is placed on

nonaccrual status, and forgone interest during the nonaccrual period, are recorded as interest income as of the date the loan

no longer meets the applicable criteria. (See “Allowance for Loan and Lease Losses” section of this Note for further

discussion of impaired loans.)

The Company accounts for loans in accordance with SFAS No. 15 “Accounting by Debtor and Creditors for Troubled Debt

Restructurings,” when due to a deterioration in a borrower’s financial position, the Company grants concessions that would

not otherwise be considered. Troubled debt restructured loans are tested for impairment under SFAS No. 114, “Accounting

by Creditors for Impairment of a Loan,” and placed in non-accrual status. If borrowers perform pursuant to the modified loan

terms for at least six months and the remaining loan balances are considered collectible, the loans are returned to accrual

status. When the Company modifies the terms of an existing loan that is not considered a troubled debt restructuring, the

Company follows the provisions of EITF No. 01-7, “Creditor’s Accounting for a Modification or Exchange of Debt

Instruments.”

For loans accounted for at carrying value, fees and incremental direct costs associated with the loan origination and pricing

process, as well as premiums and discounts, are deferred and amortized as level yield adjustments over the respective loan

terms. Premiums for purchased credit cards are amortized on a straight-line basis over one year. Fees received for providing

loan commitments that result in loans are deferred and then recognized over the term of the loan as an adjustment of the

yield. Origination fees and costs are recognized in noninterest income at the time of origination for newly originated loans

that are accounted for at fair value.

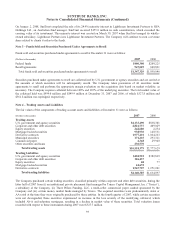

Allowance for Loan and Lease Losses

The Company’s allowance for loan and lease losses is the amount considered adequate to absorb probable losses within the

portfolio based on management’s evaluation of the size and current risk characteristics of the loan portfolio. Such evaluation

considers prior loss experience, the risk rating distribution of the portfolios, the impact of current internal and external

influences on credit loss and the levels of nonperforming loans. Specific allowances for loan and lease losses are established

for large impaired loans evaluated on an individual basis. The specific allowance established for these loans and leases is

based on a thorough analysis of the most probable source of repayment, including the present value of the loan’s expected

future cash flows, the loan’s estimated market value, or the estimated fair value of the underlying collateral. General

allowances are established for loans and leases grouped into pools based on similar characteristics. In this process, general

allowance factors established are based on an analysis of historical charge-off experience and expected loss given default

derived from the Company’s internal risk rating process. Other adjustments may be made to the allowance for the pools after

an assessment of internal and external influences on credit quality that are not fully reflected in the historical loss or risk

rating data. Unallocated allowances relate to inherent losses that are not included elsewhere in the allowance. The qualitative

factors associated with unallocated allowances are subjective and require a high degree of management judgment. These

factors include the inherent imprecisions in models and lagging or incomplete data.

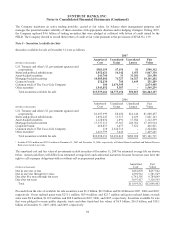

Our charge-off policy meets or exceeds regulatory minimums. Losses on unsecured consumer loans are recognized at

90-days past-due compared to the regulatory loss criteria of 120 days. Secured consumer loans, including residential real

estate, are typically charged-off between 120 and 180 days, depending on the collateral type, in compliance with FFIEC

guidelines. Commercial loans and real estate loans are typically placed on nonaccrual when principal or interest is past-due

for 90 days or more unless the loan is both secured by collateral having realizable value sufficient to discharge the debt

in-full and the loan is in the legal process of collection. Accordingly, secured loans may be charged-down to the estimated

value of the collateral with previously accrued unpaid interest reversed. Subsequent charge-offs may be required as a result

of changes in the market value of collateral or other repayment prospects.

Premises and Equipment

Premises and equipment are carried at cost less accumulated depreciation and amortization. Depreciation is calculated

primarily using the straight-line method over the assets’ estimated useful lives. Certain leases are capitalized as assets for

84