SunTrust 2007 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

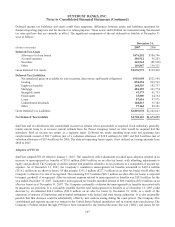

years 1997 and 1998 are still in dispute. The Company has paid the amounts assessed by the IRS in full and has filed refund

claims with the IRS related to the disputed issues. The Company’s 1999 through 2004 Federal income tax returns are

currently under examination by the IRS. Generally, the state jurisdictions in which the Company files income tax returns are

subject to examination for a period from three to seven years after returns are filed. The Corporation’s current estimate of the

resolution of these various examinations is reflected in accrued income taxes; however, final settlement of the examinations

or changes in the Corporation’s estimate may result in future income tax expense or benefit.

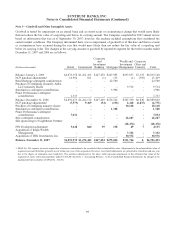

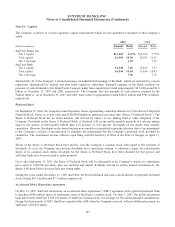

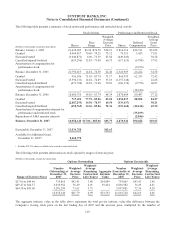

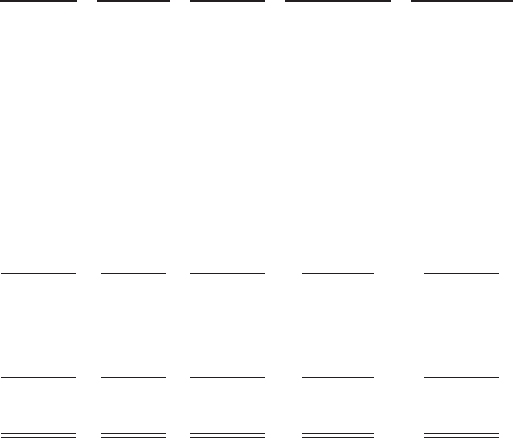

The following table rolls forward the activity related to the Company’s unrecognized tax benefits (“UTBs”) from January 1,

2007 to December 31, 2007:

(Dollars in thousands)

Federal

and state

tax

Accrued

interest

Gross

UTBs

Deferred

federal and

state income

tax benefit

UTBs net of

deferred

federal and

state

benefits

Balance at January 1, 2007 $288,146 $56,966 $345,112 ($75,527) $269,585

Increases for unrecognized tax benefits related to prior

years 9,197 33,932 43,129 (12,880) 30,249

Decreases for unrecognized tax benefits related to prior

years (17,577) (7,625) (25,202) 8,395 (16,807)

Increases for unrecognized tax benefits related to the

current year 54,696 - 54,696 (13,571) 41,125

Decreases to unrecognized tax benefits related to lapse of

the applicable statue of limitations (1,635) (2,774) (4,409) 1,543 (2,866)

Decreases for unrecognized tax benefits related to acquired

entities in prior years, offset to goodwill (7,426) (459) (7,885) 2,760 (5,125)

Balance as of December 31, 2007 325,401 80,040 405,441 (89,280) 316,161

Less: Unrecognized tax benefits included above that relate

to acquired entities that would impact goodwill if

recognized1(43,252) (10,623) (53,875) 15,159 (38,716)

Total unrecognized tax benefits that, if recognized, would

impact the effective tax rate as of December 31, 2007 $282,149 $69,417 $351,566 ($74,121) $277,445

1Upon the adoption of SFAS 141R on January 1, 2009, the Company will no longer recognize changes in unrecognized tax benefits through goodwill. The

amounts disclosed herein do not reflect the anticipated impact of SFAS 141R’s adoption.

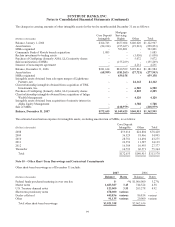

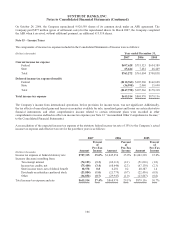

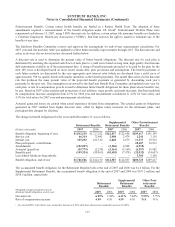

Note 16 – Employee Benefit Plans

SunTrust sponsors various incentive plans for eligible employees. The Management Incentive Plan for key employees

provides for potential annual cash awards based on the attainment of the Company’s earnings and/or the achievement of

business unit and individual performance objectives. The Performance Unit Plan (“PUP”) for key executives provides

potential cash awards based on multi-year earnings performance in relation to earnings goals established by the

Compensation Committee of the Company’s Board of Directors. Compensation expense related to the Management Incentive

Plan and PUP for the years ended December 31, 2007, 2006 and 2005 totaled $48.5 million, $72.6 million and $57.3 million,

respectively.

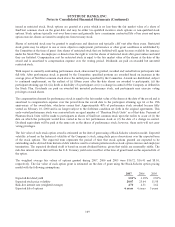

Stock Based Compensation

The Company provides stock-based awards through the SunTrust Banks, Inc. 2004 Stock Plan (“Stock Plan”) under which

the Compensation Committee (the “Committee”) has the authority to grant stock options, restricted stock, and performance-

based restricted stock (“performance stock”) to key employees of the Company. Under the 2004 Stock Plan, a total of

14 million shares of common stock is authorized and reserved for issuance, of which no more than 2.8 million shares may be

108