SunTrust 2007 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Exhibit Description

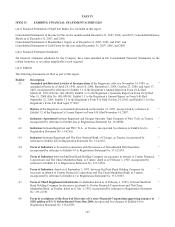

10.33 National Commerce Financial Corporation Directors’ Fees Deferral Plan and First

Amendment, effective January 1, 2002, and amendments effective January 1, 2005 and

November 14, 2006, incorporated by reference to Exhibit 10.64 to Registrant’s 2004 Annual Report

on Form 10-K, and Exhibits 10.1 and 10.2 to the Registrant’s Current Report on Form 8-K filed

February 16, 2007.

*

10.34 Crestar Financial Corporation Executive Life Insurance Plan, as amended and restated effective

January 1, 1991, and amendments effective December 18, 1992, March 30, 1998, and December 30,

1998, incorporated by reference to Exhibit 10.23 to Registrant’s 1998 Annual Report on Form 10- K

(File No. 001-08918).

*

10.35 Letter Agreement dated August 10, 2004 from Registrant to James M. Wells III, regarding split

dollar life insurance, incorporated by reference to Exhibit 10.1 to Registrant’s Quarterly Report on

Form 10-Q for the quarter ended September 30, 2004.

*

12.1 Ratio of Earnings to Fixed Charges and Preferred Stock Dividends. (filed

herewith)

21.1 Registrant’s Subsidiaries. (filed

herewith)

23.1 Consent of Independent Registered Public Accounting Firm. (filed

herewith)

23.2 Consent of Independent Registered Public Accounting Firm. (filed

herewith)

31.1 Certification of President and CEO, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to

Section 302 of the Sarbanes-Oxley Act of 2002.

(filed

herewith)

31.2 Certification of Chief Financial Officer and Corporate Executive Vice President, pursuant to 18

U.S.C. Section 1350, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

(filed

herewith)

32.1 Certification of President and CEO, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to

Section 906 of the Sarbanes-Oxley Act of 2002.

(filed

herewith)

32.2 Certification of Chief Financial Officer and Corporate Executive Vice President pursuant to 18

U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

(filed

herewith)

Certain instruments defining rights of holders of long-term debt of the Registrant and its subsidiaries are not filed herewith

pursuant to Item 601(b)(4)(iii) of Regulation S-K. At the Commission’s request, the Registrant agrees to give the

Commission a copy of any instrument with respect to long-term debt of the Registrant and its consolidated subsidiaries and

any of its unconsolidated subsidiaries for which financial statements are required to be filed under which the total amount of

debt securities authorized does not exceed ten percent of the total assets of the Registrant and its subsidiaries on a

consolidated basis.

*incorporated by reference

151