SunTrust 2007 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

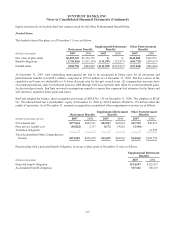

Postretirement Benefits. Certain retiree health benefits are funded in a Retiree Health Trust. The adoption of these

amendments required a remeasurement of the benefit obligation under US GAAP. Postretirement Welfare Plans were

remeasured on February 13, 2007, using 5.80% discount rate. In addition, certain retiree life insurance benefits are funded in

a Voluntary Employees’ Beneficiary Association (“VEBA”). SunTrust reserves the right to amend or terminate any of the

benefits at any time.

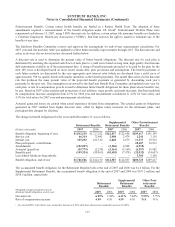

The SunTrust Benefits Committee reviews and approves the assumptions for end-of-year measurement calculations. For

2007 year-end, the mortality table was updated to reflect future mortality improvements through 2015. The discount rate and

salary scale were also reviewed and are discussed further below.

A discount rate is used to determine the present value of future benefit obligations. The discount rate for each plan is

determined by matching the expected cash flows of each plan to a yield curve based on long term, high quality fixed income

debt instruments available as of the measurement date. A string of benefit payments projected to be paid by the plan for the

next 100 years is developed based on most recent census data, plan provisions and assumptions. The benefit payments at

each future maturity are discounted by the year-appropriate spot interest rates (which are developed from a yield curve of

approximately 500 Aa quality bonds with similar maturities as the benefit payments). The model then solves for the discount

rate that produces the same present value of the projected benefit payments as generated by discounting each year’s

payments by the spot rate. This assumption is reviewed by the SunTrust Benefit Plan Committee and updated every year for

each plan. A rate of compensation growth is used to determine future benefit obligations for those plans whose benefits vary

by pay. Based on 2007 salary analysis and projections of real inflation, wage growth, and merit increases, SunTrust modified

its compensation increase assumption from 4.5% for 2006 year-end measurement calculations to 4.0% for base salary and

4.5% for total salary for 2007 year-end measurement calculations.

Actuarial gains and losses are created when actual experience deviates from assumptions. The actuarial gains on obligations

generated in 2007 resulted from higher discount rates, offset by higher salary increases for the retirement plans, and

participant data changes for all plans.

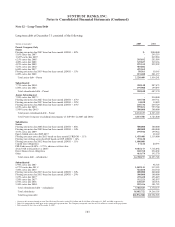

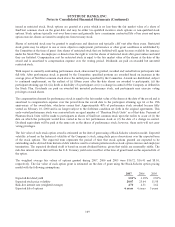

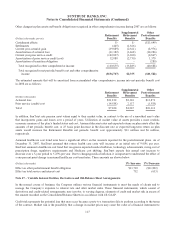

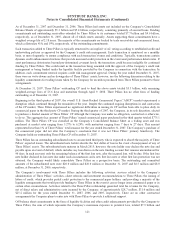

The change in benefit obligations for the years ended December 31 was as follows:

Retirement Benefits

Supplemental

Retirement Benefits

Other Postretirement

Benefits

(Dollars in thousands) 2007 2006 2007 2006 2007 2006

Benefit obligation, beginning of year $1,812,130 $1,727,282 $122,837 $122,698 $209,617 $191,199

Service cost 66,314 72,441 2,008 2,479 1,241 3,118

Interest cost 105,252 103,510 6,668 6,679 11,337 10,912

Plan participants’ contributions ----20,487 18,913

Amendments (102,027) -(3,960) 4,028 (6,930) -

Actuarial (gain)/loss (45,779) (2,238) (2,361) (5,569) (6,297) 16,982

Benefits paid (109,324) (88,865) (10,605) (7,478) (32,032) (34,607)

Less federal Medicare drug subsidy ----3,300 3,100

Benefit obligation, end of year $1,726,566 $1,812,130 $114,587 $122,837 $200,723 $209,617

The accumulated benefit obligation for the Retirement Benefits both at the end of 2007 and 2006 was $1.6 billion. For the

Supplemental Retirement Benefits, the accumulated benefit obligation at the end of 2007 and 2006 was $107.2 million and

$108.6 million, respectively.

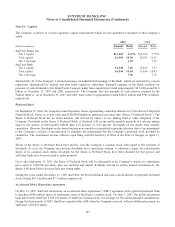

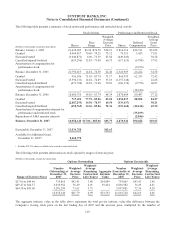

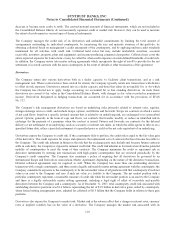

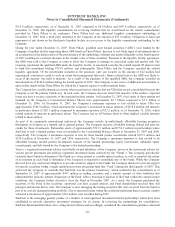

Retirement

Benefits

Supplemental

Retirement

Benefits

Other Post-

retirement

Benefits

(Weighted average assumptions used to

determine benefit obligations, end of year) 2007 2006 2007 2006 2007 2006

Discount rate 6.29% 5.94% 6.11% 5.84% 5.95% 5.75%

Rate of compensation increase 4.5014.50 4.50 4.50 N/A N/A

1At year-end 2007, total salaries were assumed to increase at 4.50% while base salaries were assumed to increase at 4.00%.

113