SunTrust 2007 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

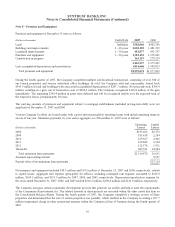

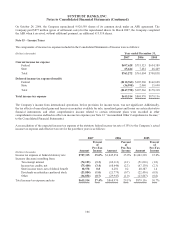

The average balances of short-term borrowings for the years ended December 31, 2007, 2006, and 2005 were $2.5 billion,

$1.5 billion, and $2.6 billion, respectively, while the maximum amounts outstanding at any month-end during the years

ended December 31, 2007, 2006, and 2005 were $3.8 billion, $2.4 billion, and $3.5 billion, respectively.

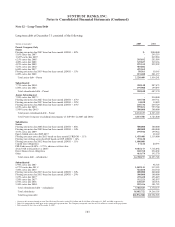

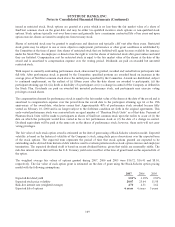

In the normal course of business, the Company enters into certain contractual obligations. Such obligations include

obligations to make future payments on debt and lease arrangements, contractual commitments for capital expenditures, and

service contracts. As of December 31, 2007 the Company had $251.4 million in unconditional purchase obligations.

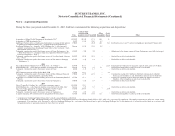

As of December 31, 2007

(Dollars in thousands)

1 year

or less

1-3

years

3-5

years

After

5 years Total

Purchase obligations1$88,893 $135,486 $23,990 $3,008 $251,377

1Includes contracts with a minimum annual payment of $5 million.

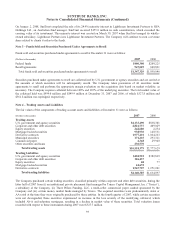

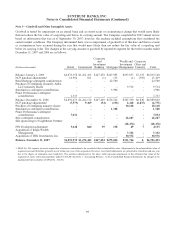

Note 11 – Securitization Activity and MSRs

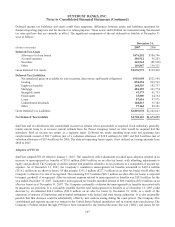

The Company sells and securitizes residential mortgage loans, student loans, commercial loans, including commercial

mortgage loans, as well as debt securities. Interests that continue to be held by the Company (“interests held”) in securitized

assets, including debt securities, are recorded as securities available for sale or trading assets at their allocated carrying

amounts based on the relative fair value at time of securitization. Interests held are subsequently carried at fair value. For

subordinated and other residual interests for which there is no quoted market price, fair value is generally estimated based on

the present value of expected cash flows, calculated using management’s best estimates of key assumptions, including credit

losses, loan repayment speeds and discount rates commensurate with the risks involved. Gains or losses upon securitization

as well as servicing fees and collateral management fees are recorded in noninterest income.

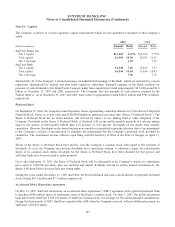

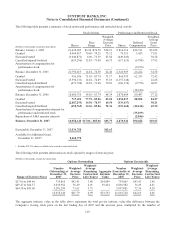

Mortgage-related Securitizations

During 2007, SunTrust sold $2.5 billion of mortgage loans in securitization transactions in exchange for net proceeds of $2.3

billion and interests that continue to be held by the Company in the form of securities. As of December 31, 2007, the interests

that continue to be held by the Company that are classified as trading securities have a fair value of $16.9 million, $12.6

million of which are investment grade securities. Investment grade securities are considered to be those of high or medium

credit quality. As of December 31, 2007, the interests that continue to be held by the Company that are classified as securities

available for sale have a fair value of $302.5 million, $300.3 million of which are investment grade securities. The fair values

of these interests are based on dealer prices and prices of similar assets. The Company recognized net losses, excluding the

impact of any related hedges, of $19.7 million related to the securitization of these assets. As of December 31, 2006, the

Company had interests that continued to be held of $1.1 million classified as securities available for sale. Certain cash flows

from the mortgage-related securitizations are as follows for the twelve months ending December 31, 2007:

(Dollars in millions)

Residential

Mortgage Loans

Commercial

Mortgage Loans

Proceeds from securitizations $1,892.8 $416.3

Servicing fees received 3.0 0.2

100