SunTrust 2007 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

offering will be used to pay substantially all of the losses incurred. In the event this initial public offering occurs, the

Company expects that the proceeds of the planned initial public offering (both cash consideration and restricted stock) would

more than offset any losses arising out of the Litigation. As a result of the indemnification provision in Section 2.05j of the

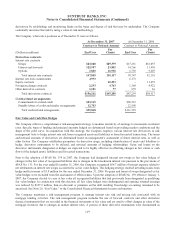

Visa By-Laws and/or the indemnification provided through the loss sharing agreement, the Company has recorded $76.9

million in other liabilities on the Consolidated Balance Sheet as of December 31, 2007, $50.0 million of which represents the

fair value of its guarantee obligation to Visa and $26.9 million of which represents a SFAS No. 5 liability associated with

Visa litigation within the scope of the indemnification provided. A high degree of subjectivity was used in estimating the fair

value of the guarantee obligation and the ultimate cost to the Company could be higher or lower than the liability recorded as

of December 31, 2007.

Letters of Credit

Letters of credit are conditional commitments issued by the Company generally to guarantee the performance of a client to a

third party in borrowing arrangements, such as commercial paper, bond financing and similar transactions. The credit risk

involved in issuing letters of credit is essentially the same as that involved in extending loan facilities to clients and may be

reduced by selling participations to third parties. The Company issues letters of credit that are classified as financial standby,

performance standby or commercial letters of credit. Commercial letters of credit are specifically excluded from the

disclosure and recognition requirements of FIN 45.

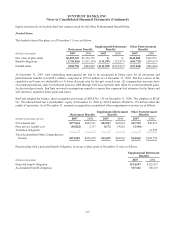

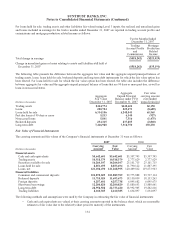

As of December 31, 2007 and December 31, 2006, the maximum potential amount of the Company’s obligation was $12.6

billion and $12.9 billion, respectively, for financial and performance standby letters of credit. The Company has recorded

$112.4 million and $104.8 million in other liabilities for unearned fees related to these letters of credit as of December 31,

2007 and December 31, 2006, respectively. The Company’s outstanding letters of credit generally have a term of less than

one year but may extend longer than one year. If a letter of credit is drawn upon, the Company may seek recourse through the

client’s underlying line of credit. If the client’s line of credit is also in default, the Company may take possession of the

collateral securing the line of credit, where applicable.

Loan Sales

SunTrust Mortgage, Inc. (“STM”), a consolidated subsidiary of SunTrust, originates and purchases consumer residential

mortgage loans, a portion of which are sold to outside investors in the normal course of business. When mortgage loans or

MSRs are sold, representations and warranties regarding certain attributes of the loans sold are made to the third party

purchaser. These representations and warranties may extend through the life of the mortgage loan, generally 25 to 30 years.

Subsequent to the sale, if inadvertent underwriting deficiencies or documentation defects are discovered in individual

mortgage loans, STM will be obligated to repurchase the respective mortgage loan, MSRs or absorb the loss if such

deficiencies or defects cannot be cured by STM within the specified period following discovery. STM maintains a liability

for estimated losses on mortgage loans and MSRs that may be repurchased due to breach of general representations and

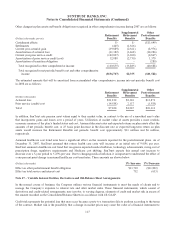

warranties or purchasers’ rights under early payment default provisions. As of December 31, 2007 and December 31, 2006,

$49.9 million and $13.0 million, respectively were accrued for these repurchases. The increase in the liability primarily

relates to loan and servicing right sales that occurred during 2007, an early payment default event, an increase in repurchase

activity and early payment default events, as well as adjustments based on recent experience to the estimated loss factors

used to calculate the liability.

Contingent Consideration

The Company has contingent payment obligations related to certain business combination transactions. Payments are

calculated using certain post-acquisition performance criteria. The potential liability associated with these arrangements was

approximately $37.7 million and $82.8 million as of December 31, 2007 and December 31, 2006, respectively. As contingent

consideration in a business combination is not subject to the recognition and measurement provisions of FIN 45, the

Company currently has no amounts recorded for these guarantees as of December 31, 2007. If required, these contingent

payments will be payable within the next five years.

124