SunTrust 2007 Annual Report Download - page 48

Download and view the complete annual report

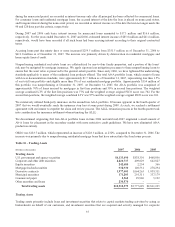

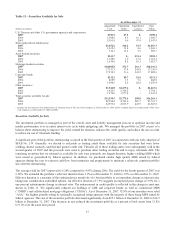

Please find page 48 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.balance sheet management purposes. Beginning in 2007, we utilized a more active trading portfolio as part of our asset/

liability management process, as evidenced by the purchase of approximately $23 billion of trading assets and sales or

maturities of $31.1 billion of trading assets for balance sheet management purposes. This activity along with the

reclassification of $16.0 billion of available for sale securities to trading upon electing fair value accounting for these

instruments under SFAS No. 159 (see the “Adoption of Fair Value Accounting Standards” discussion within MD&A)

resulted in a $7.7 billion, or 278.7%, increase in trading assets from December 31, 2006 to December 31, 2007.

The trading securities purchased during 2007 included Treasury Bills, U.S. agency notes, commercial paper, investment

grade corporate bonds, and ABS. Approximately $3.0 billion of the trading securities acquired during 2007 were ABS that

were purchased from certain affiliated money market funds and Three Pillars (see the “Introduction” to MD&A). The

following is a description of the circumstances causing the acquisition of these illiquid ABS:

• During the third quarter of 2007, we provided support for specific securities within an institutional private

placement fund (the “Private Fund”) and consolidated the Private Fund as of September 30, 2007, resulting in the

addition of approximately $967 million of trading securities. Based on market conditions in the fourth quarter, we

decided to close the Private Fund in a manner in which the Private Funds’ shareholders received their full principal

and interest due, and we began actively managing these trading securities. These trading securities consist of

approximately 80% residential MBS that were AAA-rated at the time they were purchased. Due to increased losses

within the underlying collateral, some of which is comprised of Alt-A or sub prime mortgages, as well as market

illiquidity, the value of these securities was reduced by approximately $132 million during 2007. As of

December 31, 2007, the remaining fair value of the securities was $743.3 million, and $106.7 million in principal

pay downs have been received since the securities were acquired.

• In December 2007, we purchased, through a combination of cash and notes, approximately $1.4 billion in SIV

securities from the STI Classic Prime Quality Money Market Fund and the STI Classic Institutional Cash

Management Money Market Fund (collectively, the “Funds”) at amortized cost plus accrued interest. Trusco, a

wholly owned subsidiary of SunTrust, is the investment adviser to the Funds. We took this action to protect

investors in the Funds from possible losses associated with these securities. The SIV assets were originally rated

A1/P1 and were Tier 1 eligible securities when purchased. The underlying collateral consists of a wide array of

assets including, mortgage backed securities, collateralized debt and loan obligations, and corporate bonds.

Approximately $688 million of the SIV securities are backed by high quality, liquid assets or sponsored by large,

well capitalized banks that have publicly announced that they are providing liquidity and support to these

programs. All of these higher quality or bank sponsored SIV securities mature by June 2008. The remaining SIV

securities have gone into a restructuring process, and the ultimate timing and form of repayment is not known at

this time. We recorded a pre-tax mark to market valuation loss of $250.5 million in the fourth quarter of 2007 as a

result of purchasing these securities.

• Also in December 2007, we purchased $725.0 million in ABS, at amortized cost plus accrued interest, from Three

Pillars in order to reduce the risk profile of the conduit. These securities consist of residential MBS and

collateralized debt obligations, with 83% of the bonds currently AAA-rated and the remainder AA-rated. During

the fourth quarter of 2007, the rapid deterioration in the performance of the underlying collateral, some of which is

comprised of sub-prime and Alt-A mortgages, as well as market illiquidity began to materially decrease the market

value of these securities; as a result, we recorded a market value loss of $144.8 million in the fourth quarter of

2007. See the “Off-Balance Sheet Arrangements,” section of MD&A for additional discussion of Three Pillars.

Due to the illiquid nature of these ABS and the market as a whole in the fourth quarter of 2007, the estimated market value of

these securities is based on market information, where available, along with significant, unobservable third-party data. As a

result of the high degree of judgment and estimates used to value these illiquid securities, the market values could vary

significantly during 2008. See the “Estimates of Fair Value” section within “Critical Accounting Policies” for further

discussion of these estimates. We did not have a contractual or implicit obligation to purchase these securities or provide

additional support to the Funds or Three Pillars. The assets of the Funds and Three Pillars have been restructured; therefore,

we do not anticipate similar valuation issues with the assets of the Funds or Three Pillars. The purchase of these securities

should not be considered a precedent for future actions or commitment by us to provide additional support.

36