SunTrust 2007 Annual Report Download - page 41

Download and view the complete annual report

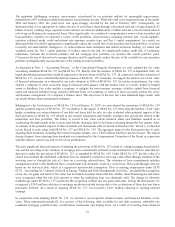

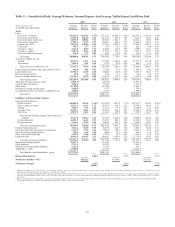

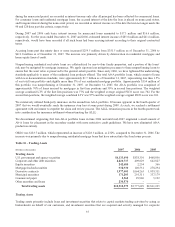

Please find page 41 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Total personnel expense increased $44.8 million, or 1.6%, due to our fair value election for certain mortgage loans held for

sale during 2007 under SFAS No. 159. As a result of recording these loans at fair value, we recognized compensation

expense related to origination activities that previously would have been deferred and recognized as part of gain/loss on the

sale of these loans as a part of mortgage production income. The impact of this adoption for the full year 2007 was

approximately $78 million. Offsetting this increase was a $30.7 million, or 6.5%, decrease in employee benefits due to

reduced headcount. The number of employees decreased from 33,599 full-time equivalent positions at December 31, 2006 to

32,323 at December 31, 2007.

Other staff expense increased $40.0 million, or 43.2%, compared to 2006 due to the implementation of E2. In the first quarter

of 2007, we initiated E2in an effort to reduce overall expense growth as well as enhance how we conduct business with our

customers. For the year ended December 31, 2007, we recognized approximately $45 million in severance expense related to

this program, which was recorded in other staff expense. We anticipate the run-rate of total cost savings of approximately

$530 million will be achieved during 2009 through initiatives identified in corporate real estate, supplier management,

offshoring, and process/organizational reviews. Through 2007, we have realized approximately $215 million in run-rate cost

savings. These estimated cost savings do not include the cost of incremental investments or the benefit of non-recurring gains

associated with the E2initiatives.

Marketing and customer development expense increased $21.8 million, or 12.6%, driven by our marketing campaigns

focused on various deposit growth initiatives, including the “My Cause” marketing initiative. Outside processing and

software increased $17.3 million, or 4.4%, compared to 2006, due to higher processing costs associated with higher

transaction volumes and higher software amortization costs.

Other real estate expense increased $15.6 million compared to 2006 due to greater losses on loan-related properties as a

result of deteriorating conditions in the housing market. Other expense increased $29.8 million, or 8.6%, compared to 2006

primarily due to write-downs related to Affordable Housing properties in 2007, offset by a $33.6 million reduction of the

accrued liability and corresponding non-deductible other expense associated with a capital instrument we redeemed in the

fourth quarter of 2007.

Provision for Income Taxes

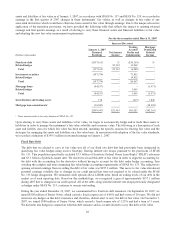

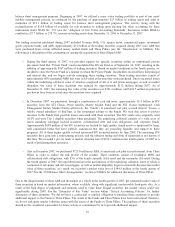

The provision for income taxes includes both federal and state income taxes. In 2007, the provision was $615.5 million,

compared to $869.0 million in 2006. The provision represents an effective tax rate of 27.4% for 2007 compared to 29.1% for

2006. The decrease in the effective tax rate was primarily attributable to the lower level of earnings and a higher level of

tax-exempt income for the year ended 2007.

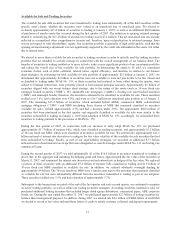

We adopted FIN 48, “Accounting for Uncertainty in Income Taxes,” an interpretation of SFAS No. 109 “Accounting for

Income Taxes,” effective January 1, 2007. The cumulative effect adjustment recorded upon adoption resulted in an increase

to unrecognized tax benefits of $55.0 million ($46.0 million on an after-tax basis), with offsetting adjustments to equity and

goodwill. We classify interest and penalties related to our tax positions as a component of income tax expense. As of

December 31, 2007, our cumulative unrecognized tax benefits amounted to $405.4 million ($316.2 million on an after-tax

basis). Of this amount, $351.5 million ($277.5 million on an after-tax basis) would affect our effective tax rate, if recognized.

The remaining $53.9 million ($38.7 million on an after-tax basis) is expected to impact goodwill, if recognized. After-tax

interest expense related to unrecognized tax benefits was $18.0 million for the year ended December 31, 2007. Cumulative

unrecognized tax benefits included interest of $80.0 million ($52.0 million on an after-tax basis) as of December 31, 2007.

We continually evaluate the unrecognized tax benefits associated with our uncertain tax positions. It is reasonably possible

that unrecognized tax benefits as of December 31, 2007 could decrease by an estimated $40.0 million ($26.0 million on an

after-tax basis) by December 31, 2008, as a result of the expiration of statutes of limitations and potential settlements with

federal and state taxing authorities. It is also reasonably possible that this decrease could be substantially offset by new

matters arising during the same period. We file consolidated and separate income tax returns in the United States Federal

jurisdiction and in various state jurisdictions. Our Federal returns through 1998 have been examined by the Internal Revenue

Services (“IRS”) and issues for tax years 1997 and 1998 are still in dispute. We have paid the amounts assessed by the IRS in

full and have filed refund claims with the IRS related to the disputed issues. Our 1999 through 2004 Federal income tax

returns are currently under examination by the IRS. Generally, the state jurisdictions in which we file income tax returns are

subject to examination for a period from three to seven years after returns are filed. The Corporation’s current estimate of the

resolution of these various examinations is reflected in accrued income taxes; however, final settlement of the examinations

or changes in the Corporation’s estimate may result in future income tax expense or benefit. In the opinion of management,

29