SunTrust 2007 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

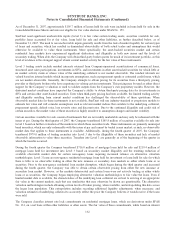

The Company elected to move these available for sale securities to trading securities in order to initially seed the trading

securities portfolio that the Company intended to actively manage in connection with the overall management of the

Company’s balance sheet. The transfer of securities to trading enabled the Company to more actively trade a more significant

portion of its investment portfolio and reduce the overall size of the available for sale portfolio. In determining the assets to

be sold, the Company considered economic factors, such as yield, collateral, interest terms, capital efficiency, and duration,

in relation to its balance sheet strategies. In evaluating its total available for sale portfolio of approximately $23 billion at

January 1, 2007, the Company determined that approximately $3 billion of securities were not available or were not

practicable to be fair valued and reclassified to trading under SFAS No. 159, as these securities had matured or been called

during the quarter, were subject to business restrictions, were privately placed or had nominal principal amounts.

Approximately $5 billion of securities aligned with the Company’s recent balance sheet strategy, due to the nature of the

assets (such as 30-year fixed rate mortgage backed securities (“MBS”), 10/1 adjustable rate mortgages (“ARMs”), floating

rate ABS and municipal bonds); therefore, the securities continued to be classified as available for sale. These securities

yielded over 5.6%, had a duration over 4.0%, and were in a $6.7 million net unrealized gain position as of January 1, 2007.

The remaining $15.4 billion of securities, which included hybrid ARMs, commercial MBS, collateralized mortgage

obligations (“CMO”) and MBS (excluding those classes of mortgage-backed securities that remained classified as securities

available for sale), yielded approximately 4.5% and had a duration under 3.0%. The approximate $600 million of securities

that were purchased in the first quarter and originally classified as available for sale were similar to the securities reclassified

to trading on January 1, 2007 upon adoption of SFAS No. 159; accordingly, the Company reclassified these securities to

trading pursuant to the provisions of SFAS No. 159.

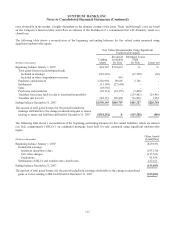

During the first quarter of 2007, in connection with the Company’s decision to early adopt SFAS No. 159, the Company

purchased approximately $1.7 billion of treasury bills, which were classified as trading securities, and approximately $3.2

billion of 30-year fixed rate MBS, which were classified as securities available for sale. The Company entered into

approximately $13.5 billion notional of interest rate derivatives to mitigate the fair value volatility of the available for sale

securities that had been reclassified to trading. Finally, as part of its asset/liability strategies, the Company executed an

additional $7.5 billion notional receive-fixed interest rate swaps that were designated as cash flow hedges under SFAS

No. 133 on floating rate commercial loans.

During the second quarter of 2007, the Company sold substantially all of the $16.0 billion in securities transferred to trading

at prices that, in the aggregate and including the hedging gains and losses, approximated the fair value of the securities at

March 31, 2007, and terminated the interest rate derivatives it had entered into as hedges of the fair value. The Company

replaced a portion of these securities with an additional $5.4 billion of treasury bills classified as trading and $1.8 billion of

30-year fixed rate MBS classified as available for sale. In addition, the Company reduced wholesale overnight funding by

approximately $4 billion. The 30-year fixed-rate MBS were a similar asset type to the securities that remained classified as

available for sale but were substantially different from the securities reclassified to trading as part of our adoption. These

securities yield over 5.5% and have an effective duration of approximately 5.7%.

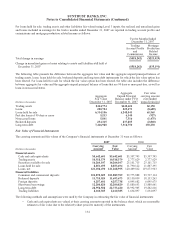

Subsequent to the transactions executed at the end of the first quarter and early second quarter, the Company continued to

maintain an active trading portfolio, as well as refine its trading securities strategies. As trading securities matured or sold,

the Company purchased additional trading securities that included longer dated agency debentures, commercial paper, ABS,

corporate bonds, etc. During the year ended December 31, 2007, the Company purchased approximately $23 billion of

trading securities for balance sheet management purposes. In addition, during 2007, the Company entered into $4.6 billion of

FHLB letters of credit that it elected to record at fair value and used these letters of credit to satisfy customer collateral and

deposit requirements.

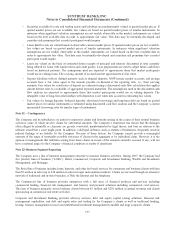

Mortgage Loans Held for Sale

In connection with the early adoption of SFAS No. 159, the Company evaluated the composition of the mortgage loan

portfolio including certain business restrictions on loans that are held by real estate investment trusts (“REITs”). As part of

its overall balance sheet management strategies during the second quarter of 2006, the Company decided to no longer retain

in its portfolio new originations of prime quality, mid-term adjustable rate, highly commoditized, conforming agency and

nonagency conforming residential mortgage portfolio loans in order to moderate the growth of earning assets, but had not

undertaken plans to sell or securitize any of these loans held in the loan portfolio. In connection with its recently formulated

128