SunTrust 2007 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

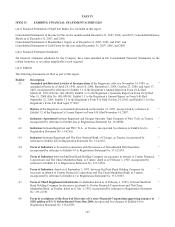

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

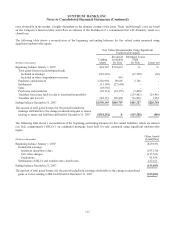

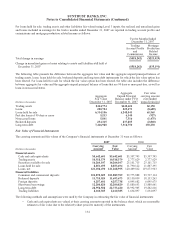

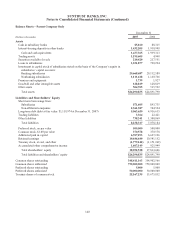

Note 23 – Accumulated Other Comprehensive Income

(Dollars in thousands)

Pre-tax

Amount

Income

Tax

(Expense)

Benefit

After-tax

Amount

Accumulated Other Comprehensive Income

Accumulated other comprehensive income, January 1, 2005 $1,964,539 ($687,589) $1,276,950

Unrealized net loss on securities (576,888) 219,217 (357,671)

Unrealized net loss on derivatives (24,253) 9,216 (15,037)

Change related to employee benefit plans 6,561 (2,493) 4,068

Reclassification adjustment for realized gains and losses on securities 41,109 (15,621) 25,488

Reclassification adjustment for realized gains and losses on derivatives 6,924 (2,631) 4,293

Accumulated other comprehensive income, December 31, 2005 1,417,992 (479,901) 938,091

Unrealized net gain on securities 474,003 (180,121) 293,882

Unrealized net gain on derivatives 52,674 (20,016) 32,658

Change related to employee benefit plans 9,482 (3,603) 5,879

Adoption of SFAS No. 158 (621,011) 235,984 (385,027)

Reclassification adjustment for realized gains and losses on securities 59,499 (22,610) 36,889

Reclassification adjustment for realized gains and losses on derivatives 5,770 (2,193) 3,577

Accumulated other comprehensive income, December 31, 2006 1,398,409 (472,460) 925,949

Unrealized net gain on securities 666,387 (253,227) 413,160

Unrealized net gain on derivatives 240,816 (91,510) 149,306

Change related to employee benefit plans 113,550 (43,149) 70,401

Adoption of SFAS No. 159 231,211 (83,837) 147,374

Pension plan changes and resulting remeasurement 128,560 (48,853) 79,707

Reclassification adjustment for realized gains and losses on securities (272,861) 103,687 (169,174)

Reclassification adjustment for realized gains and losses on derivatives (15,442) 5,868 (9,574)

Accumulated other comprehensive income, December 31, 2007 $2,490,630 ($883,481) $1,607,149

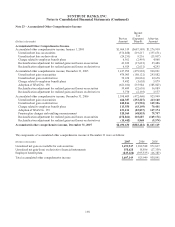

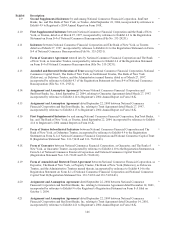

The components of accumulated other comprehensive income at December 31 were as follows:

(Dollars in thousands) 2007 2006 2005

Unrealized net gain on available for sale securities 1,693,947 1,302,588 971,817

Unrealized net gain/(loss) on derivative financial instruments 158,628 18,896 (17,339)

Employee benefit plans (245,426) (395,535) (16,387)

Total accumulated other comprehensive income 1,607,149 925,949 938,091

138