SunTrust 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Net securities gains of $243.1 million were realized during 2007, primarily due to a $234.8 million gain from the sale in the

second quarter of 2007 of 4.5 million shares of our holdings of the common stock of The Coca-Cola Company. Net securities

losses realized for the year ended December 31, 2006 were $50.5 million, and $7.2 million for the year ended December 31,

2005.

The carrying value of the available for sale investment portfolio reflected $2.7 billion in net unrealized gains at December 31,

2007, substantially all of which related to unrealized gains on our investment in common stock of The Coca-Cola Company.

The net unrealized gain on the remaining portion of our holdings of this equity investment increased $349.6 million

compared to December 31, 2006 in addition to the $234.8 million gain realized on the sale discussed above. The net

unrealized gain on the remainder of the portfolio was $50.3 million, an improvement of $271.7 million compared to

December 31, 2006. These changes in market value did not affect our net income, but were included in other comprehensive

income. We review all of our securities with unrealized losses for other-than-temporary impairment at least quarterly. As a

result of these reviews in the fourth quarter of 2007, we determined that no impairment charges related to securities owned

with unrealized losses were deemed other than temporarily impaired this quarter since we have the present intent and ability

to retain these securities until recovery.

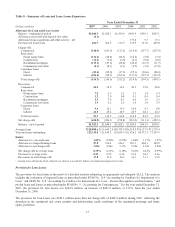

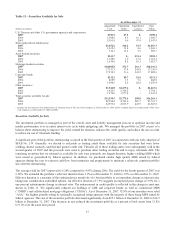

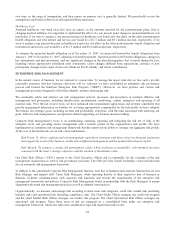

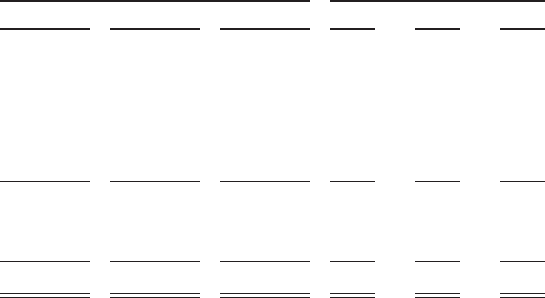

Table 12 – Composition of Average Deposits

Year Ended December 31 Percent of Total

(Dollars in millions) 2007 2006 2005 2007 2006 2005

Noninterest-bearing $21,677.2 $23,312.3 $24,315.0 18.1% 18.9% 22.0%

NOW accounts 20,042.8 17,214.4 17,213.7 16.7 13.9 15.6

Money market accounts 22,676.7 24,507.9 25,589.2 18.9 19.8 23.2

Savings 4,608.7 5,371.1 6,320.0 3.8 4.3 5.7

Consumer time 16,941.3 15,622.7 12,526.4 14.2 12.7 11.4

Other time 12,073.5 11,146.9 7,390.7 10.1 9.0 6.7

Total consumer and commercial deposits 98,020.2 97,175.3 93,355.0 81.8 78.6 84.6

Brokered deposits 16,091.9 17,425.7 10,182.2 13.4 14.1 9.2

Foreign deposits 5,764.5 9,064.5 6,869.3 4.8 7.3 6.2

Total deposits $119,876.6 $123,665.5 $110,406.5 100.0% 100.0% 100.0%

Deposits

Average consumer and commercial deposits increased during 2007 by $0.8 billion, or 0.9%, compared to 2006. The growth

was exclusively in higher cost NOW, consumer time and other time deposits, which increased $5.1 billion, or 11.5%, and

were offset by declines in money market, savings, and noninterest bearing DDA account balances. Money market accounts

declined $1.8 billion, or 7.5%, savings accounts declined $0.8 billion, or 14.2%, and noninterest bearing DDA account

balances declined $1.6 billion, or 7.0%. The decline in these products was the result of deposit migration to higher cost time

deposits as well as customers moving balances to alternative investments such as repurchase agreements or money market

mutual funds to take advantage of higher interest rates in response to the interest environment that prevailed during 2007.

Average brokered and foreign deposits decreased by $4.6 billion, or 17.5%, during 2007 compared to 2006. The decrease

was due to our efforts to reduce our reliance upon wholesale funding sources through balance sheet restructuring actions.

Consumer and commercial deposit growth is one of our key initiatives, as we focus on deposit gathering opportunities across

all lines business throughout the geographic footprint. We have instituted a number of initiatives to attract deposits including

the “My Cause” campaign which provides enrollment incentives to depositors, the modification of incentive plans to place

greater emphasis on deposit and package account sales, enhancing online banking products and partnering with other well

known brands in deposit oriented promotions. As of December 31, 2007 these efforts were successful in generating new

accounts and households, specifically, the “My Cause” campaign generated over 402,000 checking accounts. However, the

new accounts had not translated into higher overall deposit balances. As of December 31, 2007, securities pledged as

collateral for deposits totaled $6.9 billion.

38