SunTrust 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

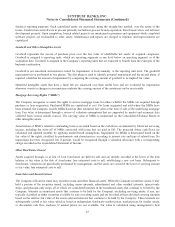

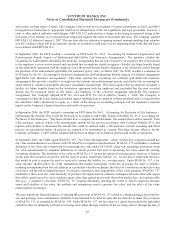

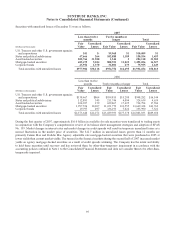

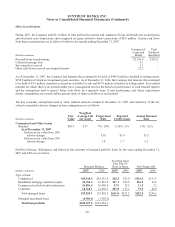

Securities with unrealized losses at December 31 were as follows:

2007

Less than twelve

months

Twelve months or

longer Total

(Dollars in thousands)

Fair

Value

Unrealized

Losses Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses

U.S. Treasury and other U.S. government agencies

and corporations $41 $- $9,968 $1 $10,009 $1

States and political subdivisions 47,666 264 102,888 1,189 150,554 1,453

Asset-backed securities 202,766 31,380 1,344 3 204,110 31,383

Mortgage-backed securities 683,475 5,104 808,551 11,223 1,492,026 16,327

Corporate bonds 43,954 1,370 32,001 279 75,955 1,649

Total securities with unrealized losses $977,902 $38,118 $954,752 $12,695 $1,932,654 $50,813

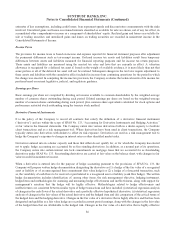

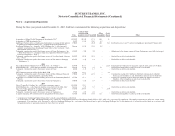

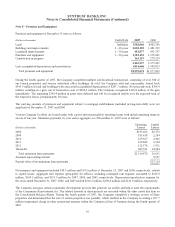

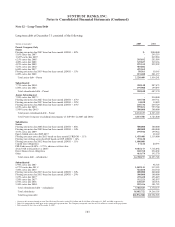

2006

Less than twelve

months Twelve months or longer Total

(Dollars in thousands)

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

U.S. Treasury and other U.S. government agencies

and corporations $138,467 $864 $859,815 $15,280 $998,282 $16,144

States and political subdivisions 112,893 545 211,746 4,094 324,639 4,639

Asset-backed securities 104,927 159 629,867 17,425 734,794 17,584

Mortgage-backed securities 1,997,556 10,207 11,651,772 233,555 13,649,328 243,762

Corporate bonds 19,797 497 336,193 7,024 355,990 7,521

Total securities with unrealized losses $2,373,640 $12,272 $13,689,393 $277,378 $16,063,033 $289,650

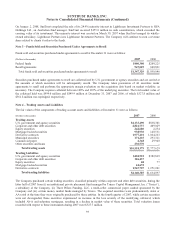

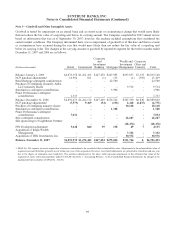

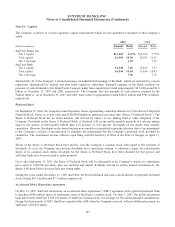

During the first quarter of 2007, approximately $16.0 billion in available for sale securities were transferred to trading assets

in conjunction with the Company’s comprehensive review of its balance sheet management strategies and adoption of SFAS

No. 159. Market changes in interest rates and market changes in credit spreads will result in temporary unrealized losses as a

normal fluctuation in the market price of securities. The $12.7 million in unrealized losses greater than 12 months are

primarily Fannie Mae and Freddie Mac Agency adjustable rate mortgage-backed securities that were purchased in 2005 at

lower yields than current market yields. The turmoil in the financial markets during the second half of 2007 increased market

yields on agency mortgage-backed securities as a result of credit spreads widening. The Company has the intent and ability

to hold these securities until recovery and has reviewed them for other-than-temporary impairment in accordance with the

accounting policies outlined in Note 1 to the Consolidated Financial Statements and does not consider them to be other-than-

temporarily impaired.

95