SunTrust 2007 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

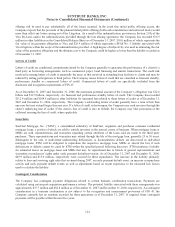

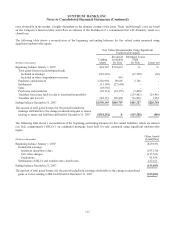

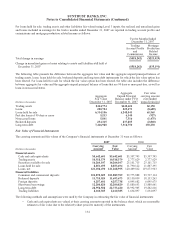

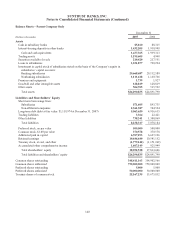

For loans held for sale, trading assets and other liabilities fair-valued using Level 3 inputs, the realized and unrealized gains

and losses included in earnings for the twelve months ended December 31, 2007 are reported in trading account profits and

commissions and mortgage production related income as follows:

Twelve Months Ended

December 31, 2007

Trading

Account Profits

and

Commissions

Mortgage

Production

Related

Income

Total change in earnings ($518,242) ($223,029)

Change in unrealized gains or losses relating to assets and liabilities still held at

December 31, 2007 ($518,242) ($35,191)

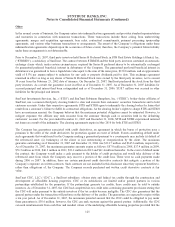

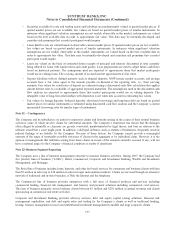

The following table presents the difference between the aggregate fair value and the aggregate unpaid principal balance of

trading assets, loans, loans held for sale, brokered deposits and long term debt instruments for which the fair value option has

been elected. For loans held for sale for which the fair value option has been elected, the table also includes the difference

between aggregate fair value and the aggregate unpaid principal balance of loans that are 90 days or more past due, as well as

loans in nonaccrual status.

(Dollars in thousands)

Aggregate

Fair Value

December 31, 2007

Aggregate

Unpaid Principal

Balance under FVO

December 31, 2007

Fair value

carrying amount

over/(under)

unpaid principal

Trading assets $444,774 $442,624 $2,150

Loans 220,784 229,473 (8,689)

Loans held for sale 6,314,106 6,248,541 65,565

Past due loans of 90 days or more 5,213 6,140 (927)

Nonaccrual loans 5,841 7,316 (1,475)

Brokered deposits 234,345 237,205 (2,860)

Long-term debt 7,446,980 7,316,750 130,230

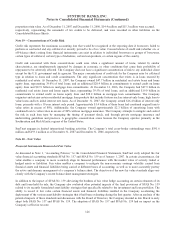

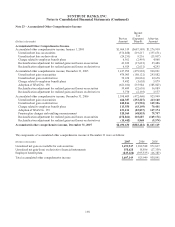

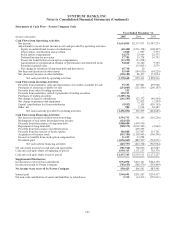

Fair Value of Financial Instruments

The carrying amounts and fair values of the Company’s financial instruments at December 31 were as follows:

2007 2006

(Dollars in thousands)

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Financial assets

Cash and cash equivalents $5,642,601 $5,642,601 $5,307,745 $5,307,745

Trading assets 10,518,379 10,518,379 2,777,629 2,777,629

Securities available for sale 16,264,107 16,264,107 25,101,715 25,101,715

Loans held for sale 8,851,695 8,853,694 11,790,122 11,807,395

Loans, net 121,036,490 121,268,955 120,409,812 119,673,963

Financial liabilities

Consumer and commercial deposits 101,870,025 101,889,709 99,775,888 99,737,114

Brokered deposits 11,715,024 11,693,673 18,150,059 18,153,263

Foreign deposits 4,257,601 4,257,738 6,095,682 6,095,675

Short-term borrowings 12,200,820 12,200,820 13,880,653 13,880,661

Long-term debt 22,956,508 22,733,420 18,992,905 19,202,616

Trading liabilities 2,160,385 2,160,385 1,634,097 1,634,097

The following methods and assumptions were used by the Company in estimating the fair value of financial instruments:

• Cash and cash equivalents are valued at their carrying amounts reported in the balance sheet, which are reasonable

estimates of fair value due to the relatively short period to maturity of the instruments.

134