SunTrust 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

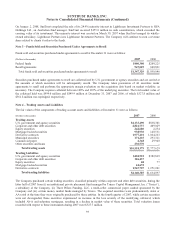

On January 2, 2008, SunTrust completed the sale of its 24.9% minority interest in Lighthouse Investment Partners to HFA

Holdings Ltd., an Australian fund manager. SunTrust received $155.0 million in cash consideration, which exceeded the

carrying value of its investment. This minority interest was created on March 30, 2007 when SunTrust merged its wholly-

owned subsidiary, Lighthouse Partners into Lighthouse Investment Partners. The Company will continue to earn a revenue

share related to clients it refers to the funds.

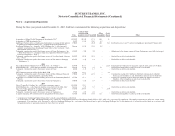

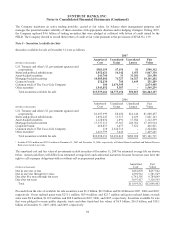

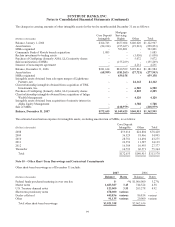

Note 3 – Funds Sold and Securities Purchased Under Agreements to Resell

Funds sold and securities purchased under agreements to resell at December 31 were as follows:

(Dollars in thousands) 2007 2006

Federal funds $400,300 $209,225

Resell agreements 947,029 840,821

Total funds sold and securities purchased under agreements to resell $1,347,329 $1,050,046

Securities purchased under agreements to resell are collateralized by U.S. government or agency securities and are carried at

the amounts at which securities will be subsequently resold. The Company takes possession of all securities under

agreements to resell and performs the appropriate margin evaluation on the acquisition date based on market volatility, as

necessary. The Company requires collateral between 100% and 105% of the underlying securities. The total market value of

the collateral held was $999.0 million and $849.9 million at December 31, 2007 and 2006, of which $527.8 million and

$561.8 million was repledged, respectively.

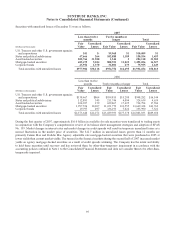

Note 4 – Trading Assets and Liabilities

The fair values of the components of trading account assets and liabilities at December 31 were as follows:

(Dollars in thousands) 2007 2006

Trading Assets

U.S. government and agency securities $4,133,490 $838,301

Corporate and other debt securities 2,821,737 409,029

Equity securities 242,680 2,254

Mortgage-backed securities 938,930 140,531

Derivative contracts 1,977,401 1,064,263

Municipal securities 171,203 293,311

Commercial paper 2,368 29,940

Other securities and loans 230,570 -

Total trading assets $10,518,379 $2,777,629

Trading Liabilities

U.S. government and agency securities $404,501 $382,819

Corporate and other debt securities 126,437 -

Equity securities 68 77

Mortgage-backed securities 61,672 -

Derivative contracts 1,567,707 1,251,201

Total trading liabilities $2,160,385 $1,634,097

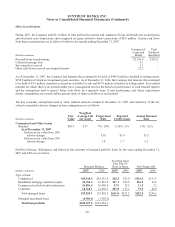

The Company purchased certain trading securities, classified primarily within corporate and other debt securities, during the

latter half of 2007 from (i) an institutional private placement fund managed by Trusco Capital Management, Inc. (“Trusco”),

a subsidiary of the Company, (ii) Three Pillars Funding, LLC, a multi-seller commercial paper conduit sponsored by the

Company and (iii) certain money market funds managed by Trusco. The acquired securities were predominantly AAA or

AA-rated at the time they were originally purchased by these entities. In the fourth quarter of 2007, while certain securities

were not downgraded, these securities experienced an increase in the loss severity of the underlying collateral, which

included Alt-A and subprime mortgages, resulting in a decline in market value of these securities. Total valuation losses

recorded with respect to these instruments during 2007 were $527.7 million.

93