SunTrust 2007 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The FDIC merged the Bank Insurance Fund (“BIF”) and the Savings Association Insurance Fund (“SAIF”) to form the

Deposit Insurance Fund (“DIF”) on March 31, 2006 in accordance with the Federal Deposit Insurance Reform Act of 2005.

The FDIC maintains the DIF by assessing depository institutions an insurance premium. The amount each institution is

assessed is based upon statutory factors that include the balance of insured deposits as well as the degree of risk the

institution poses to the insurance fund. The FDIC uses a risk-based premium system that assesses higher rates on those

institutions that pose greater risks to the DIF. The FDIC places each institution in one of four risk categories using a two-step

process based first on capital ratios (the capital group assignment) and then on other relevant information (the supervisory

group assignment).

The Company’s non-banking subsidiaries are regulated and supervised by various regulatory bodies. For example, SunTrust

Robinson Humphrey, Inc. is a broker-dealer and investment adviser registered with the Securities and Exchange Commission

(“SEC”), and the Financial Industry Regulatory Authority, Inc. (“FINRA”). SunTrust Investment Services, Inc. is also a

broker-dealer and investment adviser registered with the SEC and a member of the FINRA. Trusco Capital Management, Inc.

(“Trusco”) is an investment adviser registered with the SEC.

In addition, there have been a number of legislative and regulatory proposals that would have an impact on the operation of

bank/financial holding companies and their bank and non-bank subsidiaries. It is impossible to predict whether or in what

form these proposals may be adopted in the future and, if adopted, what their effect will be on us.

Competition

SunTrust operates in a highly competitive industry that could become even more competitive as a result of legislative,

regulatory and technological changes, and continued consolidation. The Company also faces aggressive competition from

other domestic and foreign lending institutions and from numerous other providers of financial services. The ability of

non-banking financial institutions to provide services previously limited to commercial banks has intensified competition.

Because non-banking financial institutions are not subject to the same regulatory restrictions as banks and bank holding

companies, they can often operate with greater flexibility and lower cost structures. Securities firms and insurance companies

that elect to become financial holding companies may acquire banks and other financial institutions. This may significantly

change the competitive environment in which the Company conducts business. Some of the Company’s competitors have

greater financial resources and/or face fewer regulatory constraints. As a result of these various sources of competition, the

Company could lose business to competitors or be forced to price products and services on less advantageous terms to retain

or attract clients, either of which would adversely affect the Company’s profitability.

The Company’s ability to expand into additional states remains subject to various federal and state laws. See “Government

Supervision and Regulation” for a more detailed discussion of interstate banking and branching legislation and certain state

legislation.

Employees

As of December 31, 2007, there were 32,323 full-time equivalent employees within SunTrust. None of the domestic

employees within the Company is subject to a collective bargaining agreement. Management considers its employee relations

to be good.

Additional Information

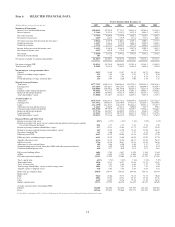

See also the following additional information which is incorporated herein by reference: Business Segments (under the

caption “Business Segments” in Item 7, the MD&A and in Note 22 to the Consolidated Financial Statements in Item 8,

Financial Statements and Supplementary Data (the “Notes”)); Net Interest Income (under the captions “Net Interest Income/

Margin” in the MD&A and “Selected Financial Data” in Item 6); Securities (under the caption “Securities Available for

Sale” in the MD&A and Note 5 of the Notes); Outstanding Loans and Leases (under the caption “Loans” in the MD&A and

Note 6 of the Notes); Deposits (under the caption “Deposits” in the MD&A); Short-Term Borrowings (under the caption

“Liquidity Risk” in the MD&A and Note 10 “Other Short-Term Borrowings and Contractual Commitments” of the Notes);

Trading Activities in the MD&A and Trading Assets (under the caption “Trading Assets” in the MD&A and Notes 4 and 20

of the Notes); Market Risk Management (under the caption “Market Risk Management” in the MD&A); Liquidity Risk

Management (under the caption “Liquidity Risk” in the MD&A); Operational Risk Management (under the caption

“Operational Risk Management” in the MD&A).

4