SunTrust 2007 Annual Report Download - page 27

Download and view the complete annual report

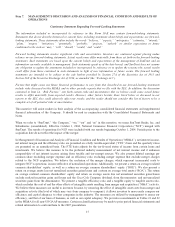

Please find page 27 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

Cautionary Statement Regarding Forward-Looking Statements

The information included or incorporated by reference in this Form 10-K may contain forward-looking statements.

Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-

looking statements. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,”

“plans,” “targets,” “initiatives,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future

conditional verbs such as “may,” “will,” “should,” “would,” and “could.”

Forward looking statements involve significant risks and uncertainties. Investors are cautioned against placing undue

reliance on our forward-looking statements. Actual results may differ materially from those set forth in the forward-looking

statements. Such statements are based upon the current beliefs and expectations of the management of SunTrust and on

information currently available to management. Such statements speak as of the date hereof, and SunTrust does not assume

any obligation to update the statements included or incorporated by reference or to update the reasons why actual results

could differ from those contained in such statements in light of new information or future events. The forward looking

statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Factors that might cause our future financial performance to vary from that described in our forward-looking statements

include risks discussed in this MD&A and in other periodic reports that we file with the SEC. In addition, the discussion

contained in Item 1A. “Risk Factors,” sets forth certain risks and uncertainties that we believe could cause actual future

results to differ materially from expected results. However, other factors besides those listed below or discussed in our

reports to the SEC also could adversely affect our results, and the reader should not consider this list of factors to be a

complete set of all potential risks or uncertainties.

This narrative will assist readers in their analysis of the accompanying consolidated financial statements and supplemental

financial information of the Company. It should be read in conjunction with the Consolidated Financial Statements and

Notes.

When we refer to “SunTrust,” “the Company,” “we,” “our” and “us” in this narrative, we mean SunTrust Banks, Inc. and

Subsidiaries (consolidated). Effective October 1, 2004, National Commerce Financial Corporation (“NCF”) merged with

SunTrust. The results of operations for NCF were included with our results beginning October 1, 2004. Periods prior to the

acquisition date do not reflect the impact of the merger.

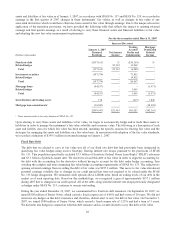

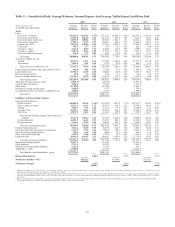

In Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”), net interest income,

net interest margin and the efficiency ratio are presented on a fully taxable-equivalent (“FTE”) basis and the quarterly ratios

are presented on an annualized basis. The FTE basis adjusts for the tax-favored status of income from certain loans and

investments. We believe this measure to be the preferred industry measurement of net interest income and it enhances

comparability of net interest income arising from taxable and tax-exempt sources. We also present diluted earnings per

common share excluding merger expense and an efficiency ratio excluding merger expense that exclude merger charges

related to the NCF acquisition. We believe the exclusion of the merger charges, which represent incremental costs to

integrate NCF’s operations, is more reflective of normalized operations. Additionally, we present a return on average realized

common shareholders’ equity, as well as a return on average common shareholders’ equity (“ROE”). We also present a

return on average assets less net unrealized securities gains/losses and a return on average total assets (“ROA”). The return

on average realized common shareholders’ equity and return on average assets less net unrealized securities gains/losses

exclude realized securities gains and losses and the Coca-Cola Company dividend, from the numerator, and net unrealized

securities gains from the denominator. We present a tangible efficiency ratio and a tangible equity to tangible assets ratio,

which excludes the cost of and the other effects of intangible assets resulting from merger and acquisition (“M&A”) activity.

We believe these measures are useful to investors because, by removing the effect of intangible asset costs from merger and

acquisition activity (the level of which may vary from company to company), it allows investors to more easily compare our

efficiency and capital adequacy to other companies in the industry. The measures are utilized by management to assess our

efficiency, and that of our lines of business, as well as our capital adequacy. We provide reconcilements in Tables 21 and 22

in the MD&A for all non-US GAAP measures. Certain reclassifications may be made to prior period financial statements and

related information to conform them to the 2007 presentation.

15