SunTrust 2007 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

Other

In the normal course of business, the Company enters into indemnification agreements and provides standard representations

and warranties in connection with numerous transactions. These transactions include those arising from underwriting

agreements, merger and acquisition agreements, loan sales, contractual commitments, payment processing sponsorship

agreements, and various other business transactions or arrangements. The extent of the Company’s obligations under these

indemnification agreements depends upon the occurrence of future events; therefore, the Company’s potential future liability

under these arrangements is not determinable.

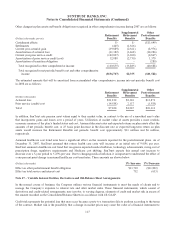

Prior to December 21, 2007, third party investors held Series B Preferred Stock in STB Real Estate Holdings (Atlanta), Inc.

(“STBREH”), a subsidiary of SunTrust. The contract between STBREH and the third party investors contained an automatic

exchange clause which, under certain circumstances, required the Series B preferred shares to be automatically exchanged

for guaranteed preferred beneficial interest in debentures of the Company. The guaranteed preferred beneficial interest in

debentures was guaranteed to have a liquidation value equal to the sum of the issue price, $350.0 million, and an approximate

yield of 8.5% per annum subject to reduction for any cash or property dividends paid to date. This exchange agreement

remained in effect as long as any shares of Series B Preferred Stock were owned by the third party investors, not to exceed

30 years from the February 25, 2002 date of issuance. On December 21, 2007, SunTrust purchased the stock from the third

party investors. As a result, the guarantee is not in effect as of December 31, 2007. As of December 31, 2007 liabilities for

accrued principal and interest had been extinguished and as of December 31, 2006, $538.7 million was accrued in other

liabilities for the principal and interest.

SunTrust Investments Services, Inc., (“STIS”) and SunTrust Robinson Humphrey, Inc. (“STRH”), broker-dealer affiliates of

SunTrust, use a common third party clearing broker to clear and execute their customers’ securities transactions and to hold

customer accounts. Under their respective agreements, STIS and STRH agree to indemnify the clearing broker for losses that

result from a customer’s failure to fulfill its contractual obligations. As the clearing broker’s rights to charge STIS and STRH

have no maximum amount, the Company believes that the maximum potential obligation cannot be estimated. However, to

mitigate exposure, the affiliate may seek recourse from the customer through cash or securities held in the defaulting

customers’ account. For the year ended December 31, 2007 and December 31, 2006, STIS and STRH experienced minimal

net losses as a result of the indemnity. The clearing agreements expire in May 2010 for both STIS and STRH.

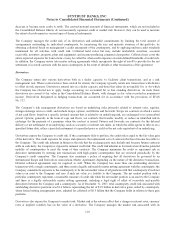

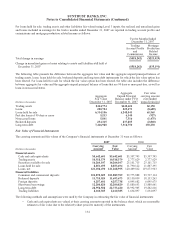

The Company has guarantees associated with credit derivatives, an agreement in which the buyer of protection pays a

premium to the seller of the credit derivatives for protection against an event of default. Events constituting default under

such agreements that would result in the Company making a guaranteed payment to a counterparty may include (i) default of

the referenced asset; (ii) bankruptcy of the client; or (iii) restructuring or reorganization by the client. The maximum

guarantee outstanding as of December 31, 2007 and December 31, 2006 was $331.7 million and $345.6 million, respectively.

As of December 31, 2007, the maximum guarantee amounts expire as follows: $87.0 million in 2008, $37.4 million in 2009,

$76.5 million in 2010, $46.2 million in 2011, $23.2 million in 2012 and $61.4 million thereafter. In the event of default under

the contract, the Company would make a cash payment to the holder of credit protection and would take delivery of the

referenced asset from which the Company may recover a portion of the credit loss. There were no cash payments made

during 2006 or 2007. In addition, there are certain purchased credit derivative contracts that mitigate a portion of the

Company’s exposure on written contracts. Such contracts are not included in this disclosure since they represent benefits to,

rather than obligations of, the Company. The Company records purchased and written credit derivative contracts at fair

value.

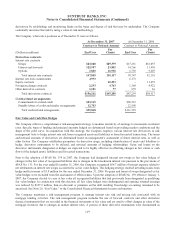

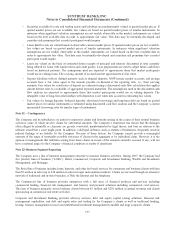

SunTrust CDC, LLC (“CDC”), a SunTrust subsidiary, obtains state and federal tax credits through the construction and

development of affordable housing properties. CDC or its subsidiaries are limited and/or general partners in various

partnerships established for the properties. If the partnerships generate tax credits, those credits may be sold to outside

investors. As of December 31, 2007, the CDC had completed six tax credit sales containing guarantee provisions stating that

the CDC will make payment to the outside investors if the tax credits become ineligible. The CDC also guarantees that the

general partner under the transaction will perform on the delivery of the credits. The guarantees are expected to expire within

a ten year period. As of December 31, 2007, the maximum potential amount that the CDC could be obligated to pay under

these guarantees is $38.6 million; however, the CDC can seek recourse against the general partner. Additionally, the CDC

can seek reimbursement from cash flow and residual values of the underlying affordable housing properties provided that the

125