SunTrust 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to identify, assess, control, quantify, monitor, and report on operational risks company wide. These efforts support our goals

in seeking to minimize operational losses and strengthen our performance by optimizing operational capital allocation.

Operational Risk Management is overseen by our Chief Operational Risk Officer, who reports directly to the Chief Risk

Officer. The corporate governance structure also includes a risk manager and support staff embedded within each line of

business and corporate function. These risk managers, while reporting directly to their respective line or function, also report

indirectly to the Chief Risk Officer and are responsible for execution of the Operational Risk Management program within

their areas.

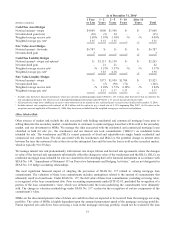

Market Risk Management

Market risk refers to potential losses arising from changes in interest rates, foreign exchange rates, equity prices, commodity

prices and other relevant market rates or prices. Interest rate risk, defined as the exposure of net interest income and

Economic Value of Equity (“EVE”) to adverse movements in interest rates, is our primary market risk, and mainly arises

from the structure of the balance sheet. We are also exposed to market risk in our trading activities, MSRs, loan warehouse

and pipeline, debt carried at fair value and equity holdings of The Coca-Cola Company common stock. The ALCO meets

regularly and is responsible for reviewing our open positions and establishing policies to monitor and limit exposure to

market risk. The policies established by ALCO are reviewed and approved by our Board of Directors.

Market Risk from Non-Trading Activities

The primary goal of interest rate risk management is to control exposure to interest rate risk, both within policy limits

approved by the Board and within narrower guidelines established by ALCO. These limits and guidelines reflect our

tolerance for interest rate risk over both short-term and long-term horizons.

The major sources of our non-trading interest rate risk are timing differences in the maturity and repricing characteristics of

assets and liabilities, changes in the shape of the yield curve, and the potential exercise of explicit or embedded options. We

measure these risks and their impact by identifying and quantifying exposures through the use of sophisticated simulation

and valuation models, as well as repricing gap analysis.

One of the primary methods that we use to quantify and manage interest rate risk is simulation analysis, which is used to

model net interest income from assets, liabilities, and derivative positions over a specified time period under various interest

rate scenarios and balance sheet structures. This analysis measures the sensitivity of net interest income over a two year time

horizon. Key assumptions in the simulation analysis (and in the valuation analysis discussed below) relate to the behavior of

interest rates and spreads, the changes in product balances and the behavior of loan and deposit customers in different rate

environments. This analysis incorporates several assumptions, the most material of which relate to the repricing

characteristics and balance fluctuations of deposits with indeterminate or non-contractual maturities.

As the future path of interest rates cannot be known in advance, we use simulation analysis to project net interest income

under various interest rate scenarios including implied forward and deliberately extreme and perhaps unlikely scenarios. The

analyses may include rapid and gradual ramping of interest rates, rate shocks, spread narrowing and widening, and yield

curve twists. Each analysis incorporates what management believes to be the most appropriate assumptions about customer

behavior in an interest rate scenario. Specific strategies are also analyzed to determine their impact on net interest income

levels and sensitivities.

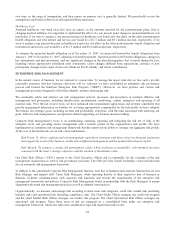

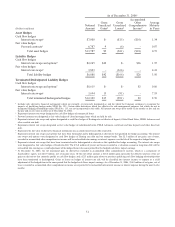

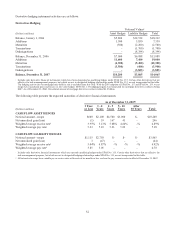

In 2007, we updated our deposit repricing assumptions and the base case yield curve from which sensitivity analysis is

derived (now the implied forward curve). Further, the sensitivity is now measured as a percentage change in net interest

income due to an instantaneous 100 basis point move instead of a gradual 100 basis point move. We believe instantaneous

shifts are more robust and better illustrate sensitivities. Estimated changes set forth below are dependent upon material

assumptions such as those previously discussed. The net interest income profile is relatively flat with respect to instantaneous

100 bp changes in rates.

Economic Perspective

Rate Change

(Basis Points)

Estimated % Change in

Net Interest Income Over 12 Months

December 31, 2007 December 31, 2006

+100 (1.0%) (0.9%)

-100 0.3% 1.0%

46