MetLife 2005 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Separate Accounts

Separate account assets and liabilities include two categories of account types: pass-through separate accounts totaling $111,155 million and

$71,623 million at December 31, 2005 and 2004, respectively, for which the policyholder assumes all investment risk, and separate accounts with a

minimum return or account value for which the Company contractually guarantees either a minimum return or account value to the policyholder which

totaled $16,714 million and $15,146 million at December 31, 2005 and 2004, respectively. The latter category consisted primarily of Met Managed

Guaranteed Interest Contracts and participating close-out contracts. The average interest rates credited on these contracts were 5.1% and 4.7% at

December 31, 2005 and 2004, respectively.

Fees charged to the separate accounts by the Company (including mortality charges, policy administration fees and surrender charges) are reflected

in the Company’s revenues as universal life and investment-type product policy fees and totaled $1,720 million, $1,333 million and $1,082 million for the

years ended December 31, 2005, 2004 and 2003, respectively.

At December 31, 2005, fixed maturities, equity securities, and cash and cash equivalents reported on the consolidated balance sheet include

$29 million, $34 million and $6 million, respectively, of the Company’s proportional interest in separate accounts. At December 31, 2004, fixed maturities,

equity securities, and cash and cash equivalents reported on the consolidated balance sheet include $47 million, $20 million and $2 million, respectively,

of the Company’s proportional interest in separate accounts.

For both the years ended December 31, 2005 and 2004, there were no investment gains (losses) on transfers of assets from the general account to

the separate accounts.

6. Reinsurance

The Company’s life insurance operations participate in reinsurance activities in order to limit losses, minimize exposure to large risks, and provide

additional capacity for future growth. The Company has historically reinsured the mortality risk on new life insurance policies primarily on an excess of

retention basis or a quota share basis. Until 2005, the Company reinsured up to 90% of the mortality risk for all new individual life insurance policies that it

wrote through its various franchises. This practice was initiated by the different franchises for different products starting at various points in time between

1992 and 2000. During 2005, the Company changed its retention practices for individual life insurance. Amounts reinsured in prior years remain

reinsured under the original reinsurance; however, under the new retention guidelines, the Company reinsures up to 90% of the mortality risk in excess of

$1 million for most new life insurance policies that it writes through its various franchises and for certain individual life policies the retention limits remained

unchanged. On a case by case basis, the Company may retain up to $25 million per life on single life policies and $30 million per life on survivorship

policies and reinsure 100% of amounts in excess of the Company’s retention limits. The Company evaluates its reinsurance programs routinely and may

increase or decrease its retention at any time. In addition, the Company reinsures a significant portion of the mortality risk on its universal life policies

issued since 1983. Placement of reinsurance is done primarily on an automatic basis and also on a facultative basis for risks with specific characteristics.

In addition to reinsuring mortality risk, the Company reinsures other risks and specific coverages. The Company routinely reinsures certain classes of

risks in order to limit its exposure to particular travel, avocation and lifestyle hazards. The Company has exposure to catastrophes, which are an inherent

risk of the property and casualty business and could contribute to significant fluctuations in the Company’s results of operations. The Company uses

excess of loss and quota share reinsurance arrangements to limit its maximum loss, provide greater diversification of risk and minimize exposure to larger

risks.

The Company had also protected itself through the purchase of combination risk coverage. This reinsurance coverage pooled risks from several

lines of business and included individual and group life claims in excess of $2 million per policy, as well as excess property and casualty losses, among

others. This combination risk coverage was commuted during 2005.

The Company reinsures its business through a diversified group of reinsurers. No single unaffiliated reinsurer has a material obligation to the

Company nor is the Company’s business substantially dependent upon any reinsurance contracts. The Company is contingently liable with respect to

ceded reinsurance should any reinsurer be unable to meet its obligations under these agreements.

In the Reinsurance Segment, RGA retains a maximum of $6 million of coverage per individual life with respect to its assumed reinsurance business.

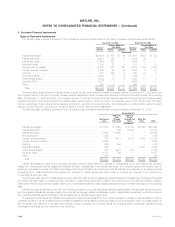

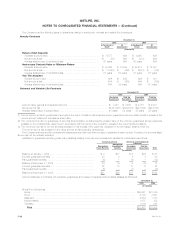

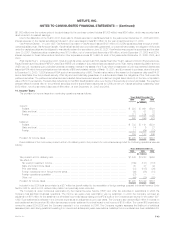

The amounts in the consolidated statements of income are presented net of reinsurance ceded. The effects of reinsurance were as follows:

Years Ended December 31,

2005 2004 2003

(In millions)

Direct premiums ************************************************************************** $22,232 $20,126 $19,300

Reinsurance assumed ********************************************************************* 5,316 4,488 3,702

Reinsurance ceded *********************************************************************** (2,688) (2,414) (2,427)

Net premiums **************************************************************************** $24,860 $22,200 $20,575

Reinsurance recoveries netted against policyholder benefits and claims **************************** $ 2,255 $ 1,850 $ 2,292

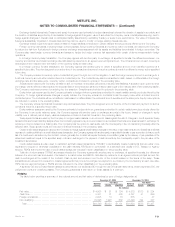

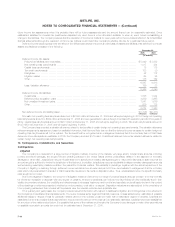

Reinsurance recoverables, included in premiums and other receivables, were $8,602 million and $4,104 million at December 31, 2005 and 2004,

respectively, including $1,261 million and $1,302 million, respectively, relating to reinsurance of long-term guaranteed interest contracts and structured

settlement lump sum contracts accounted for as a financing transaction; $2,772 million at December 31, 2005 relating to reinsurance on the runoff of

long-term care business written by Travelers; and $1,356 million at December 31, 2005 relating to reinsurance on the runoff of workers compensation

business written by Travelers. Reinsurance and ceded commissions payables, included in other liabilities, were $319 million and $110 million at

December 31, 2005 and 2004, respectively.

For the years ended December 31, 2005, 2004 and 2003, reinsurance ceded and assumed include affiliated transactions of $670 million,

$570 million, and $559 million, respectively.

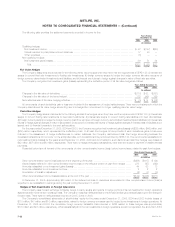

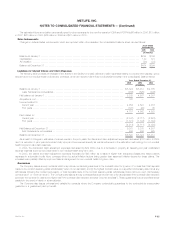

7. Closed Block

On April 7, 2000 (the ‘‘date of demutualization’’), Metropolitan Life established a closed block for the benefit of holders of certain individual life

insurance policies of Metropolitan Life. Assets have been allocated to the closed block in an amount that has been determined to produce cash flows

which, together with anticipated revenues from the policies included in the closed block, are reasonably expected to be sufficient to support obligations

MetLife, Inc. F-37