MetLife 2005 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

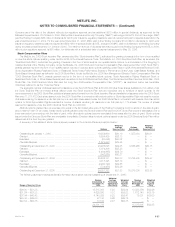

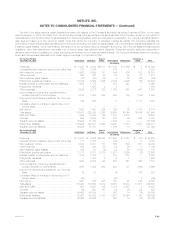

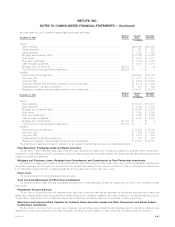

Amounts related to the Company’s financial instruments were as follows:

Notional Carrying Estimated

December 31, 2005 Amount Value Fair Value

(In millions)

Assets:

Fixed maturities************************************************************************ $230,050 $230,050

Trading securities ********************************************************************** $ 825 $ 825

Equity securities *********************************************************************** $ 3,338 $ 3,338

Mortgage and consumer loans *********************************************************** $ 37,190 $ 37,820

Policy loans*************************************************************************** $ 9,981 $ 9,981

Short-term investments ***************************************************************** $ 3,306 $ 3,306

Cash and cash equivalents************************************************************** $ 4,018 $ 4,018

Mortgage loan commitments************************************************************* $2,974 $ — $ (4)

Commitments to fund partnership investments ********************************************** $2,684 $ — $ —

Liabilities:

Policyholder account balances *********************************************************** $109,694 $107,083

Short-term debt *********************************************************************** $ 1,414 $ 1,414

Long-term debt************************************************************************ $ 9,888 $ 10,296

Junior subordinated debt securities underlying common equity units**************************** $ 2,134 $ 2,098

Shares subject to mandatory redemption ************************************************** $ 278 $ 362

Payables for collateral under securities loaned and other transactions*************************** $ 34,515 $ 34,515

Notional Carrying Estimated

December 31, 2004 Amount Value Fair Value

(In millions)

Assets:

Fixed maturities************************************************************************ $176,377 $176,377

Equity securities *********************************************************************** $ 2,188 $ 2,188

Mortgage and consumer loans *********************************************************** $ 32,406 $ 33,902

Policy loans*************************************************************************** $ 8,899 $ 8,899

Short-term investments ***************************************************************** $ 2,662 $ 2,662

Cash and cash equivalents************************************************************** $ 4,048 $ 4,048

Mortgage loan commitments************************************************************* $1,189 $ — $ 4

Commitments to fund partnership investments ********************************************** $1,324 $ — $ —

Liabilities:

Policyholder account balances *********************************************************** $ 70,739 $ 69,790

Short-term debt *********************************************************************** $ 1,445 $ 1,445

Long-term debt************************************************************************ $ 7,412 $ 7,835

Shares subject to mandatory redemption ************************************************** $ 278 $ 361

Payables for collateral under securities loaned and other transactions*************************** $ 28,678 $ 28,678

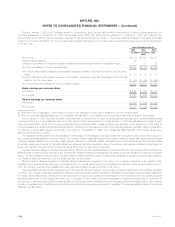

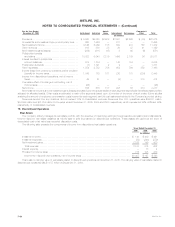

The methods and assumptions used to estimate the fair values of financial instruments are summarized as follows:

Fixed Maturities, Trading Securities and Equity Securities

The fair value of fixed maturities, trading securities and equity securities are based upon quotations published by applicable stock exchanges or

received from other reliable sources. For securities for which the market values were not readily available, fair values were estimated using quoted market

prices of comparable investments.

Mortgage and Consumer Loans, Mortgage Loan Commitments and Commitments to Fund Partnership Investments

Fair values for mortgage and consumer loans are estimated by discounting expected future cash flows, using current interest rates for similar loans

with similar credit risk. For mortgage loan commitments, the estimated fair value is the net premium or discount of the commitments. Commitments to

fund partnership investments have no stated interest rate and are assumed to have a fair value of zero.

Policy Loans

The carrying values for policy loans approximate fair value.

Cash and Cash Equivalents and Short-term Investments

The carrying values for cash and cash equivalents and short-term investments approximated fair values due to the short-term maturities of these

instruments.

Policyholder Account Balances

The fair value of policyholder account balances which have final contractual maturities are estimated by discounting expected future cash flows

based upon interest rates currently being offered for similar contracts with maturities consistent with those remaining for the agreements being valued.

The fair value of policyholder account balances without final contractual maturities are assumed to equal their current net surrender.

Short-term and Long-term Debt, Payables for Collateral Under Securities Loaned and Other Transactions and Shares Subject

to Mandatory Redemption

The fair values of short-term and long-term debt, payables under securities loaned transactions and shares subject to mandatory redemption are

determined by discounting expected future cash flows using risk rates currently available for debt with similar terms and remaining maturities.

MetLife, Inc. F-67