MetLife 2005 Annual Report Download - page 18

Download and view the complete annual report

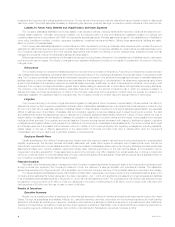

Please find page 18 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.base, interest on economic capital, corporate and real estate joint venture income and income from securities lending activities are the primary drivers of

the year over year increase. Interest margins in group life were relatively flat with a decrease of $1 million. The interest margins in the retirement & savings

and the group life businesses include the impact of a reduction in interest spreads compared to the prior year period. Interest spreads are generally the

percentage point difference between the yield earned on invested assets and the interest rate the Company uses to credit on certain liabilities. Therefore,

given a constant value of assets and liabilities, an increase in interest rate spreads would result in higher income to the Company. Interest rate spreads for

the year ended December 31, 2005 increased to 3.38% from 3.06% in the prior year period for the non-medical health & other business. Interest rate

spreads for the year ended December 31, 2005 decreased to 1.81% and 2.04% from 1.83% and 2.19%, in the prior year period for the retirement and

savings and group life businesses, respectively. Management generally expects these spreads to be in the range of 1.30% to 1.60%, 1.20% to 1.35%,

and 1.60% to 1.80% for the non-medical health & other, retirement & savings, and the group life businesses, respectively. Earnings from interest rate

spreads are influenced by several factors, including business growth, movement in interest rates, and certain investment and investment-related

transactions, such as corporate joint venture income and bond and commercial mortgage prepayment fees for which the timing and amount are generally

unpredictable. As a result, income from these investment transactions may fluctuate from period to period. The increase in interest margins is partially

offset by a decrease of $57 million, net of income taxes, in net investment gains (losses), which is partially offset by a decrease of $10 million, net of

income taxes, in policyholder benefits and claims related to net investment gains (losses). Also contributing to the decline in income from continuing

operations is a $14 million charge, net of income taxes, related to an adjustment recorded on DAC associated with certain long-term care products in

2005 and a reduction of a premium tax liability of $31 million, net of income taxes, recorded in 2004. Underwriting results decreased by $7 million, net of

income taxes, compared to the prior year. This decline is primarily due to less favorable results of $27 million, net of income taxes, in retirement & savings

and a $24 million, net of income taxes, decrease in non-medical health & other. These unfavorable results were partially offset by an improvement of

$44 million, net of income taxes, in group life’s underwriting results, primarily due to favorable claim experience. Underwriting results are generally the

difference between the portion of premium and fee income intended to cover mortality, morbidity or other insurance costs less claims incurred and the

change in insurance-related liabilities. Underwriting results are significantly influenced by mortality, morbidity, or other insurance-related experience trends

and the reinsurance activity related to certain blocks of business and, as a result, can fluctuate from period to period. In addition, increases in operating

expenses, which include higher expenses related to the Travelers integration, have more than offset the remaining growth in premiums, fees and other

revenues.

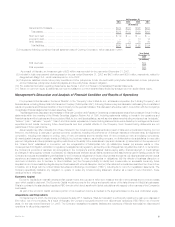

Total revenues, excluding net investment gains (losses), increased by $2,790 million, or 17%, to $18,774 million for the year ended December 31,

2005 from $15,984 million for the comparable 2004 period. The acquisition of Travelers accounted for $855 million of this increase. Excluding the impact

of the Travelers acquisition, total revenues, excluding net investment gains (losses), increased by $1,935 million, or 12%, from the comparable 2004

period. This increase is comprised of growth in premiums, fees and other revenues of $1,266 million and higher net investment income of $669 million.

The increase of $1,266 million in premiums, fees, and other revenues is largely due to an increase in non-medical health & other of $520 million, primarily

due to growth in the disability, dental and accidental death and dismemberment (‘‘AD&D’’) products of $360 million. In addition, continued growth in the

long-term care business contributed $138 million, of which $25 million is related to the 2004 acquisition of TIAA/CREF’s long-term care business. Group

life insurance premiums, fees and other revenues increased by $481 million, which management primarily attributes to improved sales and favorable

persistency, as well as a significant increase in premiums from two large customers. Retirement & savings’ premiums, fees and other revenues increased

by $265 million, which is largely due to growth in premiums, resulting primarily from an increase of $166 million in structured settlement sales and

$107 million in pension close-outs. Premiums, fees and other revenues from retirement & savings products are significantly influenced by large

transactions, and as a result, can fluctuate from period to period. In addition, net investment income increased by $669 million primarily due to higher

income from growth in the asset base driven by sales, particularly in guaranteed interest contracts and the structured settlement business. In addition,

increases in corporate and real estate joint venture income, interest on economic capital, and income from securities lending activities across the majority

of the businesses, and higher short-term interest rates contributed to the growth compared to the prior year.

Total expenses increased by $2,497 million, or 18%, to $16,658 million for the year ended December 31, 2005 from $14,161 million for the

comparable 2004 period. The acquisition of Travelers accounted for $658 million of this increase. Excluding the impact of the acquisition of Travelers,

total expenses increased by $1,839 million, or 13%, from the comparable 2004 period. This increase is comprised of higher policyholder benefits and

claims of $1,278 million, an increase in interest credited to policyholder account balances of $334 million and an increase in other expenses of

$227 million. The increase in policyholder benefits and claims of $1,278 million is attributable to a $482 million, a $452 million, and a $344 million

increase in the non-medical health & other, group life, and retirement & savings businesses, respectively. These increases are predominantly attributable

to the business growth referenced in the revenue discussion above. The increase in policyholder benefits and claims in the non-medical health & other

business include the impact of the acquisition of TIAA/CREF of $43 million. These increases include $2 million and $18 million of policyholder benefits

and claims related to Hurricane Katrina in the group life and non-medical health & other business, respectively. The increase in interest credited to

policyholder account balances of $334 million is primarily the result of the impact of growth in guaranteed interest contracts within the retirement &

savings business. In addition, the impact of higher short-term interest rates in the current year, also contributed to the increase. The rise in other

expenses of $227 million is primarily due to higher non-deferrable volume-related expenses of $61 million, which are largely associated with business

growth, an increase of $39 million in corporate support expenses, and $43 million of Travelers-related integration costs, principally incentive accruals. In

addition, expenses increased as a result of the impact of a $49 million benefit recorded in the second quarter of 2004, which is related to a reduction in a

premium tax liability. Expenses also increased by $22 million related to an adjustment of DAC for certain long-term care products in 2005.

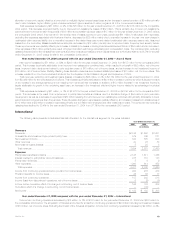

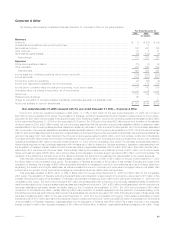

Year ended December 31, 2004 compared with the year ended December 31, 2003 — Institutional

Income from continuing operations increased by $445 million, or 52%, to $1,308 million for the year ended December 31, 2004 from $863 million

for the comparable 2003 period. An improvement of $287 million, net of income taxes, in net investment gains (losses), which is partially offset by an

increase of $63 million, net of income taxes, in policyholder benefits and claims related to net investment gains (losses), is a significant component of the

increase. In addition, favorable interest rate spreads contributed $219 million, net of income taxes, to the increase compared to the prior year period, with

the retirement & savings products generating $182 million, net of income taxes, of this increase. Higher investment yields, growth in the asset base and

lower average crediting rates are the primary drivers of the year over year increase in interest rate spreads. These spreads are generally the percentage

point difference between the yield earned on invested assets and the interest rate the Company uses to credit on certain liabilities. Therefore, given a

constant value of assets and liabilities, an increase in interest rate spreads would result in higher income to the Company. Interest rate spreads for the

year ended December 31, 2004 increased to 2.06%, 1.66% and 1.88% for group life, retirement & savings and the non-medical health & other

businesses, respectively, from 2.04%, 1.40% and 1.51% for the group life, retirement & savings, and the non-medical health & other businesses,

respectively, in the comparable prior year period. Management generally expects these spreads to be in the range of 1.60% to 1.80%, 1.30% to 1.45%,

MetLife, Inc. 15