MetLife 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

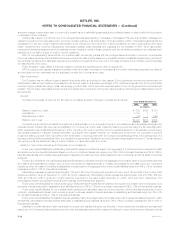

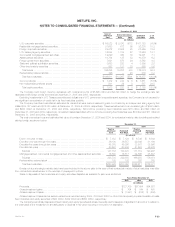

As of July 1, 2005

(In millions)

Sources:

Cash ********************************************************************************************* $4,198

Debt ********************************************************************************************* 2,716

Junior subordinated debt securities associated with common equity units *********************************** 2,134

Preferred stock ************************************************************************************ 2,100

Common stock ************************************************************************************ 1,010

Total sources of funds**************************************************************************** $12,158

Uses:

Debt and equity issuance costs ********************************************************************** $ 128

Investment in MetLife Capital Trusts II and III ************************************************************ 64

Acquisition costs *********************************************************************************** 113

Purchase price paid to Citigroup ********************************************************************** 11,853

Total purchase price****************************************************************************** 11,966

Total uses of funds ******************************************************************************* $12,158

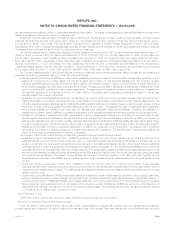

As of July 1, 2005

(In millions)

Total purchase price******************************************************************************** $11,966

Net assets acquired from Travelers ***************************************************************** $9,412

Adjustments to reflect assets acquired at fair value:

Fixed maturities available-for-sale********************************************************************** (31)

Mortgage and consumer loans *********************************************************************** 72

Real estate and real estate joint ventures held-for-investment ********************************************** 17

Real estate held-for-sale***************************************************************************** 22

Other limited partnerships**************************************************************************** 51

Other invested assets ******************************************************************************* 201

Premiums and other receivables ********************************************************************** 1,008

Elimination of historical deferred policy acquisition costs ************************************************** (3,210)

Value of business acquired ************************************************************************** 3,780

Value of distribution agreement acquired *************************************************************** 645

Value of customer relationships acquired *************************************************************** 17

Elimination of historical goodwill *********************************************************************** (197)

Net deferred income tax assets*********************************************************************** 2,098

Other assets ************************************************************************************** (88)

Adjustments to reflect liabilities assumed at fair value:

Future policy benefits ******************************************************************************* (4,070)

Policyholder account balances *********************************************************************** (1,904)

Other liabilities ************************************************************************************* (34)

Net fair value of assets and liabilities assumed ****************************************************** 7,789

Goodwill resulting from the acquisition ************************************************************** $ 4,177

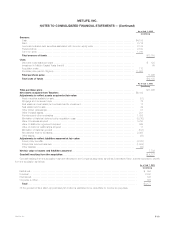

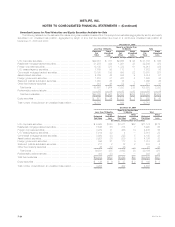

Goodwill resulting from the acquisition has been allocated to the Company’s segments, as well as Corporate & Other, that are expected to benefit

from the acquisition as follows:

As of July 1, 2005

(In millions)

Institutional********************************************************************************************* $ 894

Individual ********************************************************************************************** 2,702

International ******************************************************************************************** 193

Corporate & Other ************************************************************************************** 388

Total *********************************************************************************************** $4,177

Of the goodwill of $4.2 billion, approximately $1.5 billion is estimated to be deductible for income tax purposes.

MetLife, Inc. F-19