MetLife 2005 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chairman’s Letter

To MetLife’s Shareholders:

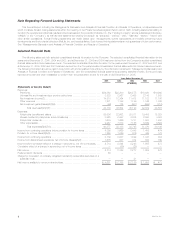

In 1998, MetLife announced that it would create a new financial services holding company and raise

capital through an initial public offering of common stock. Through this IPO, we fueled the company’s

growth and created an enterprise that, today, addresses shifting demographics in the United States and

abroad through MetLife’s best-in-class products and services. The tasks and requirements associated

with such a successful transformation were certainly very challenging but, now more than five years after

becoming a public company, the results of our efforts are evident: since 2000, total assets have

increased 90%; premiums, fees and other revenues are up 55%; life insurance in-force is up 65%; and

MetLife’s market capitalization is now more than three times what it was in April 2000.

In 2005 alone, MetLife’s achievements and growth were equally impressive. Not only did we announce, close and integrate our

acquisition of Travelers Life & Annuity, substantially all of Citigroup Inc.’s international insurance businesses and CitiStreet Associates

(collectively, Travelers) in ten months, we once again generated record financial results. It is with great pride that, in my last letter to you

as chairman of the board, I can report to you, our shareholders, that 2005 marked MetLife’s fourth consecutive year of record net

income growth. In 2005, MetLife earned $6.16 per diluted common share in net income available to common shareholders, a 69%

increase over 2004’s results. Amid modest equity market performance and rising interest rates, MetLife’s premiums, fees and other

revenues reached $30 billion, a 14% increase over 2004. In addition, total assets grew 35%, in large part due to the Travelers

acquisition, to reach $482 billion.

Meeting our business objectives and closing and integrating the Travelers acquisition were aggressive, but equally crucial goals.

However, the results of our efforts are clear: record financial results, a seamless integration of the Travelers businesses and—perhaps

most important—the demonstration that MetLife is a company that delivers on its promises.

HRecord Business Performance

During the year, our diversified businesses performed extremely well, both financially and operationally, as they achieved record net

income and contributed to MetLife’s growth and expansion.

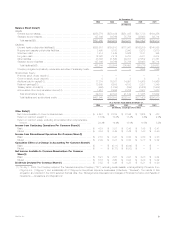

Institutional Business continued to demonstrate and reinforce its market leadership as it grew net income by 23% over 2004’s results.

MetLife remains a leader in the group product area and, according to LIMRA and MetLife Market Research, continues to hold the number

one ranking in sales of group life, auto and home, long-term care and disability products, as well as institutional annuities and structured

settlements.

While generating record sales growth in multiple product lines, Institutional also introduced a new long-term care product and

improved efficiencies by holding expenses at 2004 levels. All of this was accomplished while integrating the Travelers retirement

business, which increased MetLife’s retirement and savings general account assets by 62%. Institutional also continues to focus on both

growing and maintaining its market share. It has reorganized its product groups to better align with customers’ needs and placed a

renewed emphasis on service, which both our customers and distributors identify as an important differentiator in our business.

On the retail side, Individual Business (IB) net income increased 70% as the segment grew life sales faster than the industry, retained

agents at record levels and improved distribution profitability by more than 20%.

During the year, IB’s distribution network continued to diversify and grow, particularly in independent distribution channels. While

managing Travelers integration work, IB reorganized its independent distribution channels to better serve client needs; redesigned the life

and annuity product portfolio; restructured the operations platform for the independent channel and realigned its affiliated distribution

network and offered new products. These new product offerings included new living benefits for MetLife’s variable annuities, including

the Guaranteed Minimum Accumulation Benefit rider and an enhancement to the Guaranteed Minimum Income Benefit rider, as well as a

new suite of universal life insurance products. In addition to ensuring that MetLife is taking advantage of shifting demographics and

growing multicultural markets, IB continues to further its retail growth strategy of focusing on the needs of both clients and distributors in

order to drive profitability.

Auto & Home net income was up 8% in 2005 over the prior year. Despite the impact of some of the most destructive hurricanes in

history and other catastrophes, new business sales grew 16% over 2004, customer retention grew and the non-catastrophe combined

ratio improved from 90.4% in 2004 to 86.7% in 2005. During 2005, Auto & Home launched a new product, GrandProtect, a comprehen-

sive ‘‘package’’ policy that provides personal insurance protection for consumers with complex insurance needs. In addition, MetLife

Auto & Home was ranked one of the top companies for delivering customer satisfaction to homeowners in J.D. Power and Associates’

annual 2005 National Homeowners Insurance Satisfaction Study.

Adding to our growth in the marketplace was MetLife Bank, which grew deposits by 61% to reach $4.3 billion at the end of 2005. In

addition, MetLife Bank introduced residential mortgages as it took steps towards becoming an increasingly important contributor to

MetLife’s overall success.

In International, net income increased 18% over the prior year, driven in large part by the acquisition of Travelers’ international

businesses. This acquisition significantly increased MetLife’s presence in markets outside of the United States and gave us access to

new countries, including Australia, Belgium, Japan, Poland and the United Kingdom. Today, MetLife has access to 71% of the world’s life

insurance markets, up from 36% in 2004. At the same time, the transaction increased MetLife’s number of customers outside of the

U.S. from 9 million to 15 million and also added new distribution capabilities. In addition to the U.S., MetLife now holds leading market