MetLife 2005 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

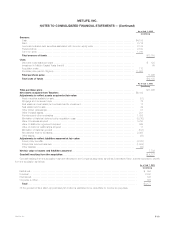

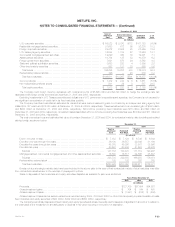

Condensed Statement of Net Assets Acquired

The condensed statement of net assets acquired reflects the fair value of Travelers net assets as of July 1, 2005 as follows:

As of

July 1,

2005

(In millions)

Assets:

Fixed maturities available-for-sale***************************************************************************** $44,346

Trading securities ****************************************************************************************** 555

Equity securities available-for-sale **************************************************************************** 641

Mortgage and consumer loans ****************************************************************************** 2,365

Policy loans ********************************************************************************************** 884

Real estate and real estate joint ventures held-for-investment ***************************************************** 77

Real estate held-for-sale ************************************************************************************ 49

Other limited partnership interests **************************************************************************** 1,124

Short-term investments ************************************************************************************* 2,801

Other invested assets ************************************************************************************** 1,686

Total investments **************************************************************************************** 54,528

Cash and cash equivalents ********************************************************************************* 844

Accrued investment income ********************************************************************************* 539

Premiums and other receivables ***************************************************************************** 4,886

Value of business acquired ********************************************************************************* 3,780

Goodwill ************************************************************************************************* 4,177

Other intangible assets ************************************************************************************* 662

Deferred tax assets **************************************************************************************** 1,087

Other assets ********************************************************************************************* 737

Separate account assets *********************************************************************************** 30,799

Total assets acquired ************************************************************************************ 102,039

Liabilities:

Future policy benefits ************************************************************************************** 18,501

Policyholder account balances******************************************************************************* 36,633

Other policyholder funds************************************************************************************ 324

Short-term debt ******************************************************************************************* 25

Current income taxes payable ******************************************************************************* 66

Other liabilities ******************************************************************************************** 3,725

Separate account liabilities ********************************************************************************** 30,799

Total liabilities assumed*********************************************************************************** 90,073

Net assets acquired ************************************************************************************* $11,966

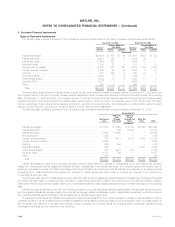

Other Intangible Assets

VOBA reflects the estimated fair value of in-force contracts acquired and represents the portion of the purchase price that is allocated to the value of

the right to receive future cash flows from the life insurance and annuity contracts in force at the acquisition date. VOBA is based on actuarially

determined projections, by each block of business, of future policy and contract charges, premiums, mortality and morbidity, separate account

performance, surrenders, operating expenses, investment returns and other factors. Actual experience on the purchased business may vary from these

projections. If estimated gross profits or premiums differ from expectations, the amortization of VOBA is adjusted to reflect actual experience.

The value of the other identifiable intangibles reflects the estimated fair value of Citigroup/Travelers distribution agreement and customer relationships

acquired at July 1, 2005 and will be amortized in relation to the expected economic benefits of the agreement. If actual experience under the distribution

agreements or with customer relationships differs from expectations, the amortization of these intangibles will be adjusted to reflect actual experience.

The use of discount rates was necessary to establish the fair value of VOBA, as well as the other identifiable intangible assets. In selecting the

appropriate discount rates, management considered its weighted average cost of capital as well as the weighted average cost of capital required by

market participants. A discount rate of 11.5% was used to value these intangible assets.

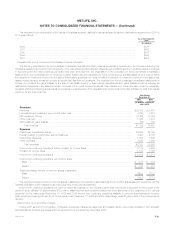

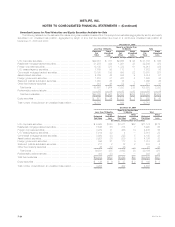

The fair values of business acquired, distribution agreements and customer relationships acquired are as follows:

As of

July 1, Weighted Average

2005 Amortization Period

(In millions) (In years)

Value of business acquired ******************************************************************* $3,780 16

Value of distribution agreements and customer relationships acquired****************************** 662 16

Total value of amortizable intangible assets acquired ****************************************** 4,442

Non-amortizable intangible assets acquired**************************************************** —

Total value of intangible assets acquired, excluding goodwill************************************ $4,442 16

MetLife, Inc.

F-20