MetLife 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

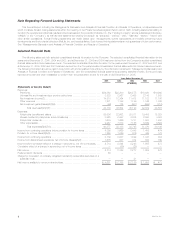

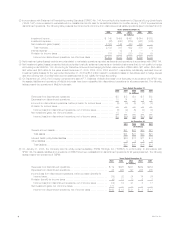

At December 31,

2005 2004 2003 2002 2001

(In millions)

Balance Sheet Data(1)

Assets:

General account assets******************************************** $353,776 $270,039 $251,085 $217,733 $194,256

Separate account assets******************************************* 127,869 86,769 75,756 59,693 62,714

Total assets(5)(6)************************************************ $481,645 $356,808 $326,841 $277,426 $256,970

Liabilities:

Life and health policyholder liabilities(9) ******************************* $258,881 $193,612 $177,947 $162,986 $148,598

Property and casualty policyholder liabilities**************************** 3,490 3,180 2,943 2,673 2,610

Short-term debt ************************************************** 1,414 1,445 3,642 1,161 355

Long-term debt*************************************************** 12,022 7,412 5,703 4,411 3,614

Other liabilities **************************************************** 48,868 41,566 39,701 27,852 21,761

Separate account liabilities ***************************************** 127,869 86,769 75,756 59,693 62,714

Total liabilities(5)(6)*********************************************** 452,544 333,984 305,692 258,776 239,652

Company-obligated mandatorily redeemable securities of subsidiary trusts** — — — 1,265 1,256

Stockholders’ Equity:

Preferred stock, at par value(10)************************************* 1————

Common stock, at par value(10) ************************************ 88888

Additional paid-in capital(10) **************************************** 17,274 15,037 14,991 14,968 14,966

Retained earnings(10)********************************************** 10,865 6,608 4,193 2,807 1,349

Treasury stock, at cost(10) ***************************************** (959) (1,785) (835) (2,405) (1,934)

Accumulated other comprehensive income(10) ************************ 1,912 2,956 2,792 2,007 1,673

Total stockholders’ equity***************************************** 29,101 22,824 21,149 17,385 16,062

Total liabilities and stockholders’ equity ***************************** $481,645 $356,808 $326,841 $277,426 $256,970

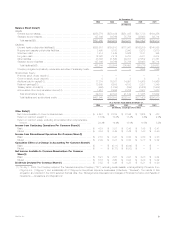

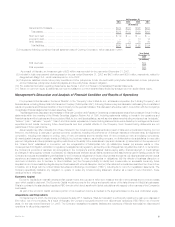

At or For the Years Ended December 31,

2005 2004 2003 2002 2001

(In millions, except per share data)

Other Data(1)

Net income available to common shareholders************************* $ 4,651 $ 2,758 $ 2,196 $ 1,605 $ 473

Return on common equity(11)*************************************** 18.5% 12.5% 11.4% 9.6% 2.9%

Return on common equity, excluding accumulated other comprehensive

income******************************************************** 20.4% 14.4% 13.0% 10.8% 3.2%

Income from Continuing Operations Per Common Share(1)

Basic *********************************************************** $ 4.19 $ 3.51 $ 2.45 $ 1.48 $ 0.41

Diluted ********************************************************** $ 4.16 $ 3.49 $ 2.42 $ 1.43 $ 0.40

Income from Discontinued Operations Per Common Share(1)

Basic *********************************************************** $ 2.10 $ 0.28 $ 0.56 $ 0.80 $ 0.23

Diluted ********************************************************** $ 2.09 $ 0.27 $ 0.55 $ 0.77 $ 0.22

Cumulative Effect of a Change in Accounting Per Common Share(1)

Basic *********************************************************** $ — $ (0.11) $ (0.04) $ — $ —

Diluted ********************************************************** $ — $ (0.11) $ (0.03) $ — $ —

Net Income Available to Common Shareholders Per Common

Share(1)

Basic *********************************************************** $ 6.21 $ 3.67 $ 2.97 $ 2.28 $ 0.64

Diluted ********************************************************** $ 6.16 $ 3.65 $ 2.94 $ 2.20 $ 0.62

Dividends Declared Per Common Share(1) ************************* $ 0.52 $ 0.46 $ 0.23 $ 0.21 $ 0.20

(1) On July 1, 2005, the Company acquired The Travelers Insurance Company (‘‘TIC’’), excluding certain assets, most significantly, Primerica, from

Citigroup Inc. (‘‘Citigroup’’), and substantially all of Citigroup’s international insurance businesses (collectively, ‘‘Travelers’’). The results of this

acquisition are reflected in the 2005 selected financial data. See ‘‘Management’s Discussion and Analysis of Financial Condition and Results of

Operations — Acquisitions and Dispositions.’’

MetLife, Inc. 3