MetLife 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

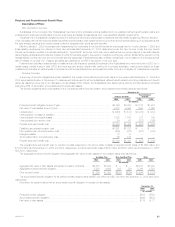

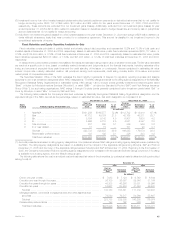

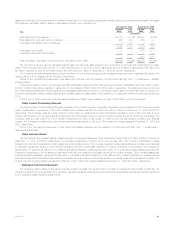

Composition of Portfolio and Investment Results

The following table illustrates the net investment income and annualized yields on average assets for each of the components of the Company’s

investment portfolio for the years ended December 31, 2005, 2004 and 2003.

December 31,

2005 2004 2003

(In millions)

FIXED MATURITIES

Yield(2) **************************************************************************** 6.02% 6.53% 6.91%

Investment income(3)***************************************************************** $ 10,424 $ 9,015 $ 8,480

Net investment gains (losses) ********************************************************** $ (868) $ 71 $ (398)

Ending assets(3)********************************************************************* $230,875 $176,377 $167,382

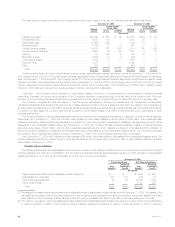

MORTGAGE AND CONSUMER LOANS

Yield(2) **************************************************************************** 6.81% 6.99% 7.49%

Investment income(4)***************************************************************** $ 2,236 $ 1,951 $ 1,902

Net investment gains (losses) ********************************************************** $ 17 $ (47) $ (56)

Ending assets*********************************************************************** $ 37,190 $ 32,406 $ 26,249

REAL ESTATE AND REAL ESTATE JOINT VENTURES(5)

Yield(2) **************************************************************************** 10.59% 11.69% 10.88%

Investment income******************************************************************* $ 467 $ 515 $ 513

Net investment gains (losses) ********************************************************** $ 2,139 $ 162 $ 440

Ending assets*********************************************************************** $ 4,665 $ 4,233 $ 4,677

POLICY LOANS

Yield(2) **************************************************************************** 6.00% 6.15% 6.40%

Investment income******************************************************************* $ 572 $ 541 $ 554

Ending assets*********************************************************************** $ 9,981 $ 8,899 $ 8,750

EQUITY SECURITIES AND OTHER LIMITED PARTNERSHIP INTERESTS

Yield(2) **************************************************************************** 12.44% 9.96% 3.03%

Investment income******************************************************************* $ 774 $ 404 $ 111

Net investment gains (losses) ********************************************************** $ 159 $ 208 $ (43)

Ending assets*********************************************************************** $ 7,614 $ 5,095 $ 4,183

CASH AND SHORT-TERM INVESTMENTS

Yield(2) **************************************************************************** 3.66% 3.00% 2.45%

Investment income******************************************************************* $ 362 $ 153 $ 160

Net investment gains (losses) ********************************************************** $(2)$(1)$ 1

Ending assets*********************************************************************** $ 7,324 $ 6,710 $ 5,483

OTHER INVESTED ASSETS(6)

Yield(2) **************************************************************************** 8.96% 6.55% 9.65%

Investment income******************************************************************* $ 570 $ 290 $ 324

Net investment gains (losses)(7)******************************************************** $ 502 $ (149) $ (159)

Ending assets*********************************************************************** $ 8,078 $ 5,295 $ 4,998

TOTAL INVESTMENTS

Gross investment income yield(2) ****************************************************** 6.35% 6.69% 6.88%

Investment fees and expenses yield **************************************************** (0.14)% (0.14)% (0.16)%

NET INVESTMENT INCOME YIELD ************************************************* 6.21% 6.55% 6.72%

Gross investment income ************************************************************* $ 15,405 $ 12,869 $ 12,044

Investment fees and expenses********************************************************* $ (339) $ (260) $ (276)

NET INVESTMENT INCOME(1)(5)(6)(7)*********************************************** $ 15,066 $ 12,609 $ 11,768

Ending assets(1)********************************************************************* $305,727 $239,015 $221,722

Net investment gains (losses)(1)(5)(6)(7) ************************************************* $ 1,947 $ 244 $ (215)

(1) Included in ending assets, investment income and investment gains (losses) is $7,102 million, $213 million and $8 million, respectively, related to the

consolidation of separate accounts under SOP 03-1 for the year ended December 31, 2005. Included in ending assets, investment income and

investment gains (losses) is $2,139 million, $86 million and $25 million, respectively, related to the consolidation of separate accounts under SOP

03-1 for the year ended December 31, 2004.

(2) Yields are based on quarterly average asset carrying values, excluding recognized and unrealized investment gains (losses), and for yield calculation

purposes, average assets exclude collateral associated with the Company’s securities lending program.

(3) Fixed maturities include $825 million in ending assets and $14 million in investment income relating to trading securities for the year ended

December 31, 2005. The annualized yield on trading securities was 2.74% for the year ended December 31, 2005. The Company did not have any

trading securities during the years ended December 31, 2004 and 2003.

(4) Investment income from mortgage and consumer loans includes prepayment fees.

(5) Real estate and real estate joint venture income includes amounts classified as discontinued operations of $58 million, $169 million and $212 million

for the years ended December 31, 2005, 2004 and 2003, respectively. Net investment gains (losses) include $2,125 million, $146 million and

$420 million of gains classified as discontinued operations for the years ended December 31, 2005, 2004 and 2003, respectively.

MetLife, Inc.

44