MetLife 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

For the year ended December 31, 2005, MetLife recorded restructuring costs, including severance, relocation and outplacement services of

Travelers’ employees, as liabilities assumed in the purchase business combination. Management currently estimates total restructuring costs associated

with such actions to approximate $48 million. Estimated restructuring expenses may change as management continues to execute the approved plan.

Decreases to these estimates are recorded as an adjustment to goodwill. Increases to these estimates are recorded as an adjustment to goodwill during

the purchase price allocation period (generally within one year of the acquisition date) and will be recorded as operating expenses thereafter. The

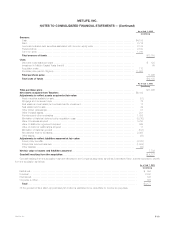

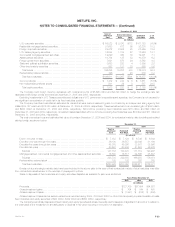

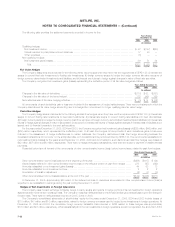

restructuring costs associated with the Travelers acquisition are as follows:

Cash Payments for

Accrued Year Ended Accrued Total Costs

Restructuring at December 31, Restructuring at Incurred at

July 1, 2005 2005 December 31, 2005 December 31, 2005

(In millions)

Total restructuring costs ********************************* $49 $(20) $28 $48

The liability for restructuring costs was reduced by $1 million due to a reduction in the estimate of severance benefits to be paid to Travelers

employees. The adjustment was recorded against the acquisition costs included in the determination of the purchase price.

Additional Acquisitions and Dispositions

On September 1, 2005, the Company completed the acquisition of CitiStreet Associates, a division of CitiStreet LLC, that is primarily involved in the

distribution of annuity products and retirement plans to the education, healthcare, and not-for-profit markets, for approximately $56 million, of which

$2 million was allocated to goodwill and $54 million to other identifiable intangibles, specifically the value of customer relationships acquired, which has a

weighted average amortization period of 16 years. CitiStreet Associates will be integrated with MetLife Resources, a division of MetLife dedicated to

providing retirement plans and financial services to the same markets.

In 2003, a subsidiary of MetLife, Inc., Reinsurance Group of America, Incorporated (‘‘RGA’’), entered into a coinsurance agreement under which it

assumed the traditional U.S. life reinsurance business of Allianz Life Insurance Company of North America (‘‘Allianz Life’’). The transaction added

approximately $278 billion of life reinsurance in-force, $246 million of premiums and $11 million of income before income tax expense, excluding minority

interest expense, in 2003. The effects of such transaction are included within the Reinsurance segment.

In 2002, the Company acquired Aseguradora Hidalgo S.A. (‘‘Hidalgo’’), an insurance company based in Mexico with approximately $2.5 billion in

assets as of the date of acquisition (June 20, 2002). During the second quarter of 2003, as a part of its acquisition and integration strategy, the

International segment completed the legal merger of Hidalgo into its original Mexican subsidiary, Seguro Genesis, S.A., forming MetLife Mexico, S.A. As a

result of the merger of these companies, the Company recorded $62 million of earnings, net of income taxes, from the merger and a reduction in

policyholder liabilities resulting from a change in methodology in determining the liability for future policy benefits. Such benefit was recorded in the

second quarter of 2003 in the International segment.

See Note 19 for information on the disposition of P.T. Sejahtera (‘‘MetLife Indonesia’’) and SSRM Holdings, Inc. (‘‘SSRM’’).

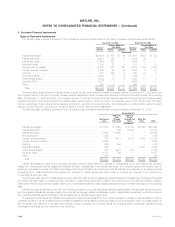

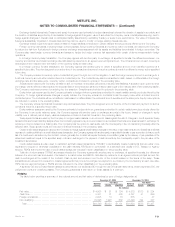

3. Investments

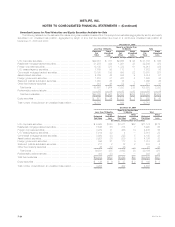

Fixed Maturities by Sector and Equity Securities Available-for-Sale

The following tables set forth the cost or amortized cost, gross unrealized gain and loss, and estimated fair value of the Company’s fixed maturities

by sector and equity securities, the percentage of the total fixed maturities holdings that each sector represents and the percentage of the total equity

securities at:

December 31, 2005

Cost or Gross Unrealized

Amortized Estimated % of

Cost Gain Loss Fair Value Total

(In millions)

U.S. corporate securities************************************************* $ 72,339 $2,814 $ 835 $ 74,318 32.3%

Residential mortgage-backed securities************************************* 47,365 353 472 47,246 20.5

Foreign corporate securities ********************************************** 33,578 1,842 439 34,981 15.2

U.S. treasury/agency securities ******************************************* 25,643 1,401 86 26,958 11.7

Commercial mortgage-backed securities************************************ 17,682 223 207 17,698 7.7

Asset-backed securities ************************************************* 11,533 91 51 11,573 5.0

Foreign government securities ******************************************** 10,080 1,401 35 11,446 5.0

State and political subdivision securities ************************************ 4,601 185 36 4,750 2.1

Other fixed maturity securities ********************************************* 912 17 41 888 0.4

Total bonds ********************************************************** 223,733 8,327 2,202 229,858 99.9

Redeemable preferred stocks********************************************* 193 2 3 192 0.1

Total fixed maturities*************************************************** $223,926 $8,329 $2,205 $230,050 100.0%

Common stocks******************************************************** $ 2,004 $ 250 $ 30 $ 2,224 66.6%

Non-redeemable preferred stocks ***************************************** 1,080 45 11 1,114 33.4

Total equity securities************************************************** $ 3,084 $ 295 $ 41 $ 3,338 100.0%

MetLife, Inc.

F-22