MetLife 2005 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

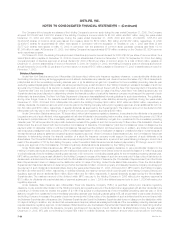

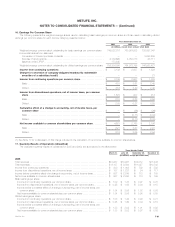

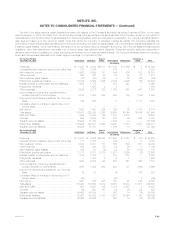

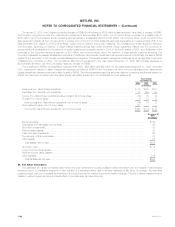

For the Year Ended Auto & Corporate &

December 31, 2003 Institutional Individual Home International Reinsurance Other Total

(In millions)

Premiums**************************************** $ 9,063 $4,363 $2,908 $1,631 $2,648 $ (38) $20,575

Universal life and investment-type product policy fees *** 660 1,564 — 271 — — 2,495

Net investment income***************************** 4,146 6,069 158 500 431 168 11,472

Other revenues *********************************** 618 380 33 80 47 41 1,199

Net investment gains (losses) *********************** (289) (311) (15) 8 62 (6) (551)

Policyholder benefits

and claims ************************************* 10,023 5,048 2,139 1,456 2,109 36 20,811

Interest credited to policyholder********************** .

account balances ******************************* 974 1,734 — 143 184 — 3,035

Policyholder dividends ***************************** (1) 1,721 2 9 — — 1,731

Other expenses*********************************** 1,854 2,783 756 652 764 359 7,168

Income (loss) from continuing operations before provision

(benefit) for income taxes ************************* 1,348 779 187 230 131 (230) 2,445

Income from discontinued operations, net of income

taxes****************************************** 49 51 — (5) — 319 414

Cumulative effect of a change in accounting, net of

income taxes *********************************** (26) — — — — — (26)

Net income ************************************** 886 570 157 208 86 310 2,217

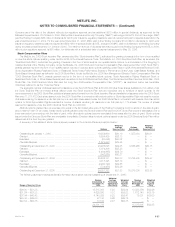

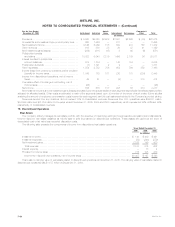

Net investment income and net investment gains (losses) are based upon the actual results of each segment’s specifically identifiable asset portfolio

adjusted for allocated capital. Other costs are allocated to each of the segments based upon: (i) a review of the nature of such costs; (ii) time studies

analyzing the amount of employee compensation costs incurred by each segment; and (iii) cost estimates included in the Company’s product pricing.

Revenues derived from any customer did not exceed 10% of consolidated revenues. Revenues from U.S. operations were $39,571 million,

$34,894 million and $31,759 million for the years ended December 31, 2005, 2004 and 2003, respectively, which represented 88%, 90% and 90%,

respectively, of consolidated revenues.

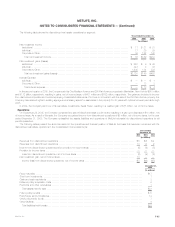

19. Discontinued Operations

Real Estate

The Company actively manages its real estate portfolio with the objective of maximizing earnings through selective acquisitions and dispositions.

Income related to real estate classified as held-for-sale or sold is presented in discontinued operations. These assets are carried at the lower of

depreciated cost or fair value less expected disposition costs.

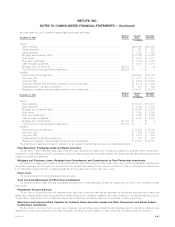

The following table presents the components of income from discontinued real estate operations:

Years Ended December 31,

2005 2004 2003

(In millions)

Investment income****************************************************************************** $ 140 $ 409 $ 491

Investment expense***************************************************************************** (82) (240) (279)

Net investment gains **************************************************************************** 2,125 146 420

Total revenues ******************************************************************************* 2,183 315 632

Interest expense******************************************************************************** —13 4

Provision for income taxes *********************************************************************** 776 105 230

Income from discontinued operations, net of income taxes ****************************************** $1,407 $ 197 $ 398

There was no carrying value of real estate related to discontinued operations at December 31, 2005. The carrying value of real estate related to

discontinued operations was $1,157 million at December 31, 2004.

MetLife, Inc.

F-64