MetLife 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

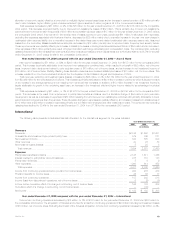

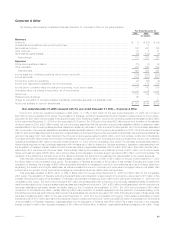

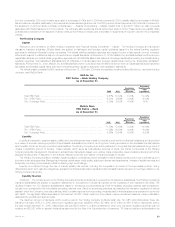

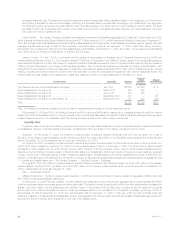

The following table summarizes the Company’s major contractual obligations as of December 31, 2005:

Less Than Three to More than

Contractual Obligations Total Three Years Five Years Five Years

(In millions)

Other long-term liabilities(1)(2) ****************************************************** $106,522 $19,089 $ 8,026 $79,407

Payables for collateral under securities loaned and other transactions ********************* 34,515 34,515 — —

Long-term debt(3) **************************************************************** 19,506 2,836 1,376 15,294

Mortgage commitments *********************************************************** 2,974 2,030 296 648

Partnership investments(4) ********************************************************* 2,684 2,684 — —

Junior subordinated debt securities underlying common equity units(5)******************** 2,433 1,359 1,074 —

Operating leases***************************************************************** 1,338 579 235 524

Shares subject to mandatory redemption(3) ****************************************** 350 — — 350

Capital leases ******************************************************************* 73 38 9 26

Contracts to purchase real estate*************************************************** 36 36 — —

Total *************************************************************************** $170,431 $63,166 $11,016 $96,249

(1) Other long-term liabilities include various investment-type products with contractually scheduled maturities, including guaranteed interest contracts,

structured settlements, pension closeouts, certain annuity policies and certain indemnities.

(2) Other long-term liabilities include benefit and claim liabilities for which the Company believes the amount and timing of the payment is essentially fixed

and determinable. Such amounts generally relate to (i) policies or contracts where the Company is currently making payments and will continue to do

so until the occurrence of a specific event, such as death; and (ii) life insurance and property and casualty incurred and reported claims. Liabilities for

future policy benefits of $82.4 billion and policyholder account balances of $113.4 billion, both at December 31, 2005, have been excluded from this

table. Amounts excluded from the table are generally comprised of policies or contracts where (i) the Company is not currently making payments and

will not make payments in the future until the occurrence of an insurable event, such as death or disability, or (ii) the occurrence of a payment

triggering event, such as a surrender of a policy or contract, is outside the control of the Company. The determination of these liability amounts and

the timing of payment are not reasonably fixed and determinable since the insurable event or payment triggering event has not yet occurred. Such

excluded liabilities primarily represent future policy benefits of approximately $63.4 billion relating to traditional life, health and disability insurance

products and policyholder account balances of approximately $41.7 billion relating to deferred annuities, $27.3 billion for group and universal life

products and approximately $27.0 billion for funding agreements without fixed maturity dates. Significant uncertainties relating to these liabilities

include mortality, morbidity, expenses, persistency, investment returns, inflation and the timing of payments. See ‘‘— The Company — Asset/Liability

Management.’’

Amounts included in other long-term liabilities reflect estimated cash payments to be made to policyholders. Such cash outflows reflect adjustments

for the estimated timing of mortality, retirement, and other appropriate factors, but are undiscounted with respect to interest. The amount shown in the

More than Five Years column represents the sum of cash flows, also adjusted for the estimated timing of mortality, retirement and other appropriate

factors and undiscounted with respect to interest, extending for more than 100 years from the present date. As a result, the sum of the cash outflows

shown for all years in the table of $104.4 billion exceeds the corresponding liability amounts of $51.4 billion included in the consolidated financial

statements at December 31, 2005. The liability amount in the consolidated financial statements reflects the discounting for interest, as well as

adjustments for the timing of other factors as described above.

(3) Amounts differ from the balances presented on the consolidated balance sheets. The amounts above do not include any fair value adjustments,

related premiums and discounts or capital leases which are presented separately. Amounts include interest to be paid on fixed-rate debt only.

(4) The Company anticipates that these amounts could be invested in these partnerships any time over the next five years, but are presented in the

current period, as the timing of the fulfillment of the obligation cannot be predicted.

(5) Amounts include interest paid on junior subordinated debt.

As of December 31, 2005, and relative to its liquidity program, the Company had no material (individually or in the aggregate) purchase obligations or

material (individually or in the aggregate) unfunded pension or other postretirement benefit obligations due within one year.

Support Agreements. Metropolitan Life entered into a net worth maintenance agreement with New England Life Insurance Company (‘‘NELICO’’) at

the time Metropolitan Life merged with New England Mutual Life Insurance Company. Under the agreement, Metropolitan Life agreed, without limitation

as to the amount, to cause NELICO to have a minimum capital and surplus of $10 million, total adjusted capital at a level not less than the company

action level RBC (or not less than 125% of the company action level RBC, if NELICO has a negative trend), as defined by state insurance statutes, and

liquidity necessary to enable it to meet its current obligations on a timely basis. At December 31, 2005, the capital and surplus of NELICO was in excess

of the minimum capital and surplus amount referenced above, and its total adjusted capital was in excess of the most recently referenced RBC-based

amount calculated at December 31, 2005.

In connection with the Company’s acquisition of the parent of General American Life Insurance Company (‘‘General American’’), Metropolitan Life

entered into a net worth maintenance agreement with General American. Under the agreement, as subsequently amended, Metropolitan Life agreed,

without limitation as to amount, to cause General American to have a minimum capital and surplus of $10 million, total adjusted capital at a level not less

than 250% of the company action level RBC, as defined by state insurance statutes, and liquidity necessary to enable it to meet its current obligations on

a timely basis. At December 31, 2005, the capital and surplus of General American was in excess of the minimum capital and surplus amount referenced

above, and its total adjusted capital was in excess of the most recent referenced RBC-based amount calculated at December 31, 2005.

Metropolitan Life has also entered into arrangements for the benefit of some of its other subsidiaries and affiliates to assist such subsidiaries and

affiliates in meeting various jurisdictions’ regulatory requirements regarding capital and surplus and security deposits. In addition, Metropolitan Life has

entered into a support arrangement with respect to a subsidiary under which Metropolitan Life may become responsible, in the event that the subsidiary

becomes the subject of insolvency proceedings, for the payment of certain reinsurance recoverables due from the subsidiary to one or more of its

cedents in accordance with the terms and conditions of the applicable reinsurance agreements.

General American has agreed to guarantee the contractual obligations of its subsidiary, Paragon Life Insurance Company, and certain contractual

obligations of its former subsidiaries, MetLife Investors Insurance Company (‘‘MetLife Investors’’), First MetLife Investors Insurance Company and MetLife

MetLife, Inc. 27