MetLife 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

acquisition by the Holding Company and may not make dividend payments for a two-year period following the date of acquisition without regulatory

approval. MPC paid $400 million in special dividends, as approved by the Rhode Island Superintendent of Insurance, during the year ended

December 31, 2005. MTL paid $54 million in ordinary dividends for which prior insurance regulatory approval was not required and $873 million in

special dividends as approved by the Delaware Superintendent of Insurance during the year ended December 31, 2005. MetLife Mexico, S.A. paid

dividends to the Holding Company of $276 million during the year ended December 31, 2005. In addition, various subsidiaries paid $19 million in total to

the Holding Company for the year ended December 31, 2005. The maximum amount of dividends which Metropolitan Life, TIC, MPC and MTL may pay

to the Holding Company in 2006 without prior regulatory approval is $863 million, $0 million, $178 million, and $85 million, respectively. If paid before a

specified date in 2006, some or all of an otherwise ordinary dividend may be deemed special by the relevant regulatory authority and require approval.

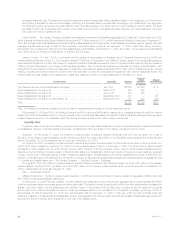

Liquid Assets. An integral part of the Holding Company’s liquidity management is the amount of liquid assets it holds. Liquid assets include cash,

cash equivalents, short-term investments and marketable fixed maturity securities. At December 31, 2005 and 2004, the Holding Company had

$668 million and $2.1 billion in liquid assets, respectively.

Global Funding Sources. Liquidity is also provided by a variety of both short-term and long-term instruments, commercial paper, medium- and

long-term debt, capital securities and stockholders’ equity. The diversity of the Holding Company’s funding sources enhances funding flexibility and limits

dependence on any one source of funds and generally lowers the cost of funds. Other sources of the Holding Company’s liquidity include programs for

short- and long-term borrowing, as needed.

At December 31, 2005 and 2004, the Holding Company had $961 million and $0 million in short-term debt outstanding, respectively. At

December 31, 2005 and 2004, the Holding Company had $7.3 billion and $5.7 billion of unaffiliated long-term debt outstanding, respectively. On

December 30, 2005, the Holding Company issued $286 million of affiliated long-term debt with an interest rate of 5.24% maturing in 2015.

On April 27, 2005, the Holding Company filed a shelf registration statement (the ‘‘2005 Registration Statement’’) with the U.S. Securities and

Exchange Commission (‘‘SEC’’), covering $11 billion of securities. On May 27, 2005, the 2005 Registration Statement became effective, permitting the

offer and sale, from time to time, of a wide range of debt and equity securities. In addition to the $11 billion of securities registered on the 2005

Registration Statement, approximately $3.9 billion of registered but unissued securities remained available for issuance by the Holding Company as of

such date, from the $5.0 billion shelf registration statement filed with the SEC during the first quarter of 2004, permitting the Holding Company to issue an

aggregate of $14.9 billion of registered securities. The terms of any offering will be established at the time of the offering.

During June 2005, in connection with the Company’s acquisition of Travelers, the Holding Company issued $2.0 billion of senior notes, $2.07 billion

of common equity units and $2.1 billion of preferred stock under the 2005 Registration Statement. In addition, $0.7 billion of senior notes were sold

outside the United States in reliance upon Regulation S under the Securities Act of 1933, as amended, a portion of which may be resold in the United

States under the 2005 Registration Statement. Remaining capacity under the 2005 Registration Statement after such issuances is $6.6 billion.

Debt Issuances. On June 23, 2005, the Holding Company issued in the United States public market $1,000 million aggregate principal

amount of 5.00% senior notes due June 15, 2015 at a discount of $2.7 million ($997.3 million), and $1,000 million aggregate principal amount of

5.70% senior notes due June 15, 2035 at a discount of $2.4 million ($997.6 million).

On June 29, 2005, the Holding Company issued 400 million pounds sterling ($729.2 million at issuance) aggregate principal amount of

5.25% senior notes due June 29, 2020 at a discount of 4.5 million pounds sterling ($8.1 million at issuance), for aggregate proceeds of

395.5 million pounds sterling ($721.1 million at issuance). The senior notes were initially offered and sold outside the United States in reliance upon

Regulation S under the Securities Act of 1933, as amended.

On December 30, 2005, the Holding Company issued $286 million of affiliated long-term debt with an interest rate of 5.24% maturing in 2015.

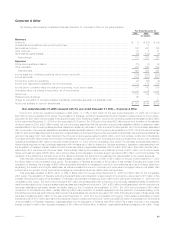

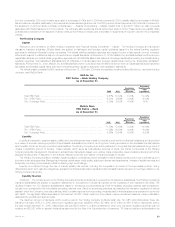

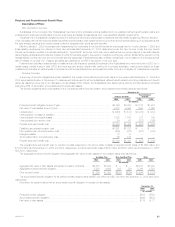

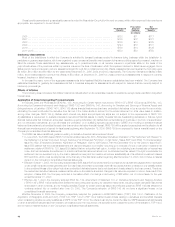

The following table summarizes the Holding Company’s outstanding senior notes issuances:

Interest

Issue Date Principal(3) Rate Maturity

(In millions)

June 2005 *********************************************************************** $1,000 5.00% 2015

June 2005 *********************************************************************** $1,000 5.70% 2035

June 2005(1) ********************************************************************* $ 688 5.25% 2020

December 2004(1) **************************************************************** $ 602 5.38% 2024

June 2004(2) ********************************************************************* $ 350 5.50% 2014

June 2004(2) ********************************************************************* $ 750 6.38% 2034

November 2003 ****************************************************************** $ 500 5.00% 2013

November 2003 ****************************************************************** $ 200 5.88% 2033

December 2002 ****************************************************************** $ 400 5.38% 2012

December 2002 ****************************************************************** $ 600 6.50% 2032

November 2001 ****************************************************************** $ 500 5.25% 2006

November 2001 ****************************************************************** $ 750 6.13% 2011

(1) This amount represents the translation of pounds sterling into U.S. Dollars using the noon buying rate on December 30, 2005 of $1.7188 as

announced by the Federal Reserve Bank of New York.

(2) On July 23, 2004, the Holding Company reopened its June 3, 2004 senior notes offering and increased the principal outstanding on the

5.50% notes due June 2014, from $200 million to $350 million and on the 6.38% notes due June 2034, from $400 million to $750 million.

(3) This table excludes any premium or discount on the senior notes issuances.

See also ‘‘— Liquidity and Capital Resources — The Holding Company — Liquidity Sources — Common Equity Units’’ for junior subordinated

debt securities of $2,134 million issued in connection with issuance of common equity units.

Debt Repayments. The Holding Company repaid a $1,006 million, 3.911% senior note which matured on May 15, 2005.

MetLife, Inc.

30