MetLife 2005 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

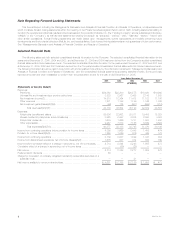

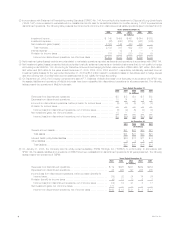

At December 31,

2004 2003 2002 2001

(In millions)

General account assets****************************************************** $379 $183 $198 $203

Total assets ************************************************************** $379 $183 $198 $203

Short-term debt ************************************************************ $19$—$—$—

Long-term debt************************************************************* — — 14 14

Other liabilities************************************************************** 221 70 78 80

Total liabilities************************************************************* $240 $ 70 $ 92 $ 94

(7) Includes the following combined financial statement data of Conning Corporation, which was sold in 2001:

Year Ended

December 31,

2001

(In millions)

Total revenues ********************************************************************************* $32

Total expenses********************************************************************************* $33

As a result of this sale, an investment gain of $25 million was recorded for the year ended December 31, 2001.

(8) Included in total revenues and total expenses for the year ended December 31, 2002 are $421 million and $358 million, respectively, related to

Aseguradora Hidalgo S.A., which was acquired in June 2002.

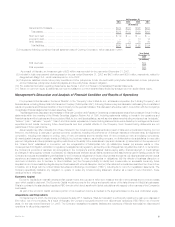

(9) Policyholder liabilities include future policy benefits and other policyholder funds. Life and health policyholder liabilities also include policyholder

account balances, policyholder dividends payable and the policyholder dividend obligation.

(10) For additional information regarding these items, see Notes 1 and 14 of Notes to Consolidated Financial Statements.

(11) Return on common equity is defined as net income available to common shareholders divided by average common stockholders’ equity.

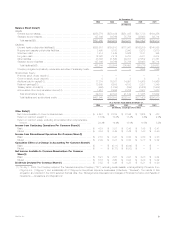

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For purposes of this discussion, the terms ‘‘MetLife’’ or the ‘‘Company’’ refer to MetLife, Inc., a Delaware corporation (the ‘‘Holding Company’’), and

its subsidiaries, including Metropolitan Life Insurance Company (‘‘Metropolitan Life’’). Following this summary is a discussion addressing the consolidated

results of operations and financial condition of the Company for the periods indicated. This discussion should be read in conjunction with the Company’s

consolidated financial statements included elsewhere herein.

This Management’s Discussion and Analysis of Financial Condition and Results of Operations contains statements which constitute forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to trends in the operations and

financial results and the business and the products of MetLife, Inc. and its subsidiaries, as well as other statements including words such as ‘‘anticipate,’’

‘‘believe,’’ ‘‘plan,’’ ‘‘estimate,’’ ‘‘expect,’’ ‘‘intend’’ and other similar expressions. Forward-looking statements are made based upon management’s current

expectations and beliefs concerning future developments and their potential effects on the Company. Such forward-looking statements are not

guarantees of future performance.

Actual results may differ materially from those included in the forward-looking statements as a result of risks and uncertainties including, but not

limited to, the following: (i) changes in general economic conditions, including the performance of financial markets and interest rates; (ii) heightened

competition, including with respect to pricing, entry of new competitors and the development of new products by new and existing competitors;

(iii) unanticipated changes in industry trends; (iv) MetLife, Inc.’s primary reliance, as a holding company, on dividends from its subsidiaries to meet debt

payment obligations and the applicable regulatory restrictions on the ability of the subsidiaries to pay such dividends; (v) deterioration in the experience of

the ‘‘closed block’’ established in connection with the reorganization of Metropolitan Life; (vi) catastrophe losses; (vii) adverse results or other

consequences from litigation, arbitration or regulatory investigations; (viii) regulatory, accounting or tax changes that may affect the cost of, or demand for,

the Company’s products or services; (ix) downgrades in the Company’s and its affiliates’ claims paying ability, financial strength or credit ratings;

(x) changes in rating agency policies or practices; (xi) discrepancies between actual claims experience and assumptions used in setting prices for the

Company’s products and establishing the liabilities for the Company’s obligations for future policy benefits and claims; (xii) discrepancies between actual

experience and assumptions used in establishing liabilities related to other contingencies or obligations; (xiii) the effects of business disruption or

economic contraction due to terrorism or other hostilities; (xiv) the Company’s ability to identify and consummate on successful terms any future

acquisitions, and to successfully integrate acquired businesses with minimal disruption; and (xv) other risks and uncertainties described from time to time

in MetLife, Inc.’s filings with the United States Securities and Exchange Commission (‘‘SEC’’), including its S-1 and S-3 registration statements. The

Company specifically disclaims any obligation to update or revise any forward-looking statement, whether as a result of new information, future

developments or otherwise.

Economic Capital

Economic Capital is an internally developed risk capital model, the purpose of which is to measure the risk in the business and to provide a basis

upon which capital is deployed. The Economic Capital model accounts for the unique and specific nature of the risks inherent in MetLife’s businesses.

This is in contrast to the standardized regulatory RBC formula, which is not as refined in its risk calculations with respect to the nuances of the Company’s

businesses.

As part of the economic capital process a portion of net investment income is credited to the segments based on the level of allocated equity.

Acquisitions and Dispositions

On September 29, 2005, the Company completed the sale of P.T. Sejahtera (‘‘MetLife Indonesia’’) to a third party resulting in a gain upon disposal of

$10 million, net of income taxes. As a result of this sale, the Company recognized income from discontinued operations of $5 million, net of income

taxes, for the year ended December 31, 2005. The Company reclassified the assets, liabilities and operations of MetLife Indonesia into discontinued

operations for all periods presented.

MetLife, Inc. 5