MetLife 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

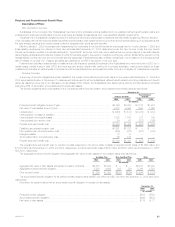

Pensions and Postretirement Benefit Plans

Description of Plans

Plan Description Overview

Subsidiaries of the Company (the ‘‘Subsidiaries’’) sponsor and/or administer various qualified and non-qualified defined benefit pension plans and

postretirement employee benefit plans covering employees and sales representatives who meet specified eligibility requirements.

Virtually all of the Subsidiaries’ obligations under the defined benefit pension plans relate to traditional defined benefit obligations. Effective January 1,

1994, the basic plan benefit under the traditional defined benefit pension plan was amended to provide an annual benefit based upon a participant’s final

five year average earnings and credited years of service integrated with social security benefits.

Effective January 1, 2003 the pension plan was amended to incorporate a new benefit formula for employees hired on or after January 1, 2002 and

those existing employees who elected to have new accruals after December 31, 2002 determined under the new formula. Under the new benefit

formula, amounts are credited to individual participants’ ‘‘hypothetical’’ accounts. Such plan accumulations are commonly referred to as cash balance

plans. Eligible participants accounts are credited monthly for benefits equal to five percent of eligible monthly pay, and an additional five percent on the

excess eligible monthly pay over the current social security wage base. Participants are also credited interest each month based on the average annual

rate of interest on 30-year U.S. Treasury securities as published by the IRS in November of the prior year.

Postretirement benefits consist primarily of healthcare and life insurance benefits. Employees of the Subsidiaries who were hired prior to 2003 (or, in

certain cases, rehired during or after 2003) and meet age and service criteria while working for a covered subsidiary, may become eligible for these

postretirement benefits, at various levels, in accordance with the applicable plans. Employees hired after 2003 are not eligible for postretirement benefits.

Financial Summary

A summary of the plan obligations and plan assets for the pension and postretirement benefit plans for the years ended December 31, 2005 and

2004 are presented below. A December 31 measurement date is used for all the Subsidiaries’ defined benefit pension and other postretirement benefit

plans. As described more fully in the discussion of plan assets which follows, the Subsidiaries have issued group annuity and life insurance contracts

supporting 98% of all pension and postretirement benefit plan assets.

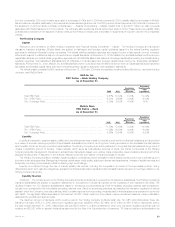

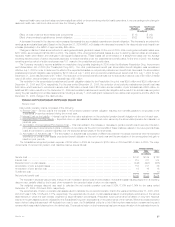

The benefit obligations and funded status of the Company’s defined benefit pension and postretirement benefit plans are as follows:

December 31,

Postretirement

Pension Benefits Benefits

2005 2004 2005 2004

(In millions)

Projected benefit obligation at end of year ******************************************* $5,766 $5,523 $ 2,176 $1,975

Fair value of plan assets at end of year********************************************** 5,518 5,392 1,093 1,062

Underfunded******************************************************************** $ (248) $ (131) $(1,083) $ (913)

Unrecognized net asset at transition ************************************************ —1 1—

Unrecognized net actuarial losses ************************************************** 1,528 1,510 377 199

Unrecognized prior service cost **************************************************** 54 67 (122) (165)

Prepaid (accrued) benefit cost ***************************************************** $1,334 $1,447 $ (827) $ (879)

Qualified plan prepaid pension cost************************************************* $1,691 $1,782 $ — $ —

Non-qualified plan accrued pension cost ******************************************** (435) (478) (827) (879)

Intangible assets***************************************************************** 12 13 — —

Accumulated other comprehensive loss ********************************************* 66 130 — —

Prepaid (accrued) benefit cost ***************************************************** $1,334 $1,447 $ (827) $ (879)

The prepaid (accrued) benefit cost for pension benefits presented in the above table consists of prepaid benefit costs of $1,696 million and

$1,785 million as of December 31, 2005 and 2004, respectively, and accrued benefit costs of $362 million and $338 million as of December 31, 2005

and 2004, respectively.

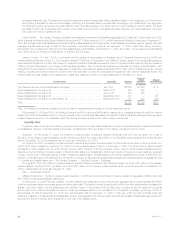

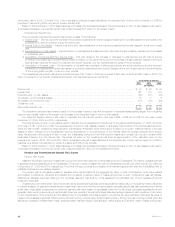

The aggregate projected benefit obligation and aggregate fair value of plan assets for the pension plans were as follows:

Qualified Plan Non-Qualified Plan Total

2005 2004 2005 2004 2005 2004

(In millions)

Aggregate fair value of plan assets (principally Company contracts) ***** $5,518 $5,392 $ — $ — $5,518 $5,392

Aggregate projected benefit obligation ***************************** 5,258 4,999 508 524 5,766 5,523

Over (under) funded ******************************************** $ 260 $ 393 $(508) $(524) $ (248) $ (131)

The accumulated benefit obligation for all defined benefit pension plans was $5,349 million and $5,149 million at December 31, 2005 and 2004,

respectively.

Information for pension plans with an accumulated benefit obligation in excess of plan assets:

December 31,

2005 2004

(In millions)

Projected benefit obligation ******************************************************************************** $538 $550

Accumulated benefit obligation ***************************************************************************** $449 $482

Fair value of plan assets ********************************************************************************** $19 $17

MetLife, Inc. 35