MetLife 2005 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

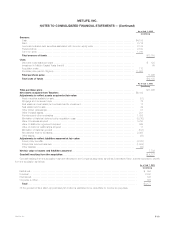

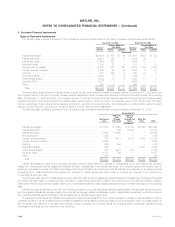

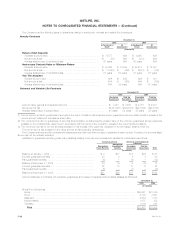

Net Investment Income

The components of net investment income were as follows:

Years Ended December 31,

2005 2004 2003

(In millions)

Fixed maturities *************************************************************************** $11,414 $ 9,397 $ 8,789

Equity securities ************************************************************************** 65 80 31

Mortgage and consumer loans ************************************************************** 2,302 1,963 1,903

Real estate and real estate joint ventures ***************************************************** 804 680 606

Policy loans ****************************************************************************** 572 541 554

Other limited partnership interests************************************************************ 709 324 80

Cash, cash equivalents and short-term investments ******************************************** 400 167 171

Other *********************************************************************************** 472 219 224

Total ********************************************************************************** 16,738 13,371 12,358

Less: Investment expenses ***************************************************************** 1,828 1,007 886

Net investment income ****************************************************************** $14,910 $12,364 $11,472

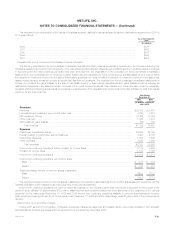

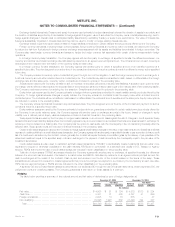

Net Investment Gains (Losses)

Net investment gains (losses) were as follows:

Years Ended December 31,

2005 2004 2003

(In millions)

Fixed maturities********************************************************************************** $(868) $ 71 $(398)

Equity securities ********************************************************************************* 117 155 41

Mortgage and consumer loans ********************************************************************* 17 (47) (56)

Real estate and real estate joint ventures ************************************************************ 14 16 19

Other limited partnership interests ****************************************************************** 42 53 (84)

Sales of businesses****************************************************************************** 823—

Derivatives ************************************************************************************** 381 (255) (103)

Other ****************************************************************************************** 196 159 30

Net investment gains (losses) ******************************************************************** $ (93) $ 175 $(551)

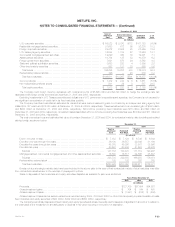

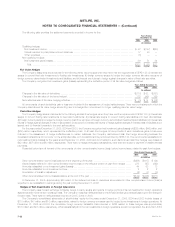

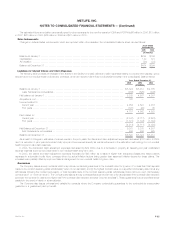

Net Unrealized Investment Gains (Losses)

The components of net unrealized investment gains (losses), included in accumulated other comprehensive income, were as follows:

Years Ended December 31,

2005 2004 2003

(In millions)

Fixed maturities***************************************************************************** $ 6,132 $ 9,602 $ 9,204

Equity securities **************************************************************************** 247 287 376

Derivatives ********************************************************************************* (142) (503) (427)

Minority interest***************************************************************************** (171) (104) (51)

Other ************************************************************************************* (102) 39 18

Total ************************************************************************************ 5,964 9,321 9,120

Amounts allocated from:

Future policy benefit loss recognition ********************************************************* (1,410) (1,991) (1,482)

DAC and VOBA ************************************************************************** (79) (541) (674)

Participating contracts ********************************************************************* — — (183)

Policyholder dividend obligation *************************************************************** (1,492) (2,119) (2,130)

Total ************************************************************************************ (2,981) (4,651) (4,469)

Deferred income taxes*********************************************************************** (1,041) (1,676) (1,679)

Total ************************************************************************************ (4,022) (6,327) (6,148)

Net unrealized investment gains (losses) **************************************************** $ 1,942 $ 2,994 $ 2,972

MetLife, Inc.

F-28