MetLife 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Asset/Liability Management

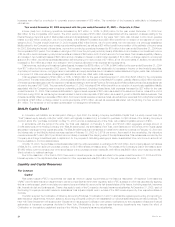

The Company actively manages its assets using an approach that balances quality, diversification, asset/liability matching, liquidity and investment

return. The goals of the investment process are to optimize, net of income taxes, risk-adjusted investment income and risk-adjusted total return while

ensuring that the assets and liabilities are managed on a cash flow and duration basis. The asset/liability management process is the shared responsibility

of the Portfolio Management Unit, the Business Finance Asset/Liability Management Unit, and the operating business segments under the supervision of

the various product line specific Asset/Liability Management Committees (‘‘ALM Committees’’). The ALM Committees’ duties include reviewing and

approving target portfolios on a periodic basis, establishing investment guidelines and limits and providing oversight of the asset/liability management

process. The portfolio managers and asset sector specialists, who have responsibility on a day-to-day basis for risk management of their respective

investing activities, implement the goals and objectives established by the ALM Committees.

The Company establishes target asset portfolios for each major insurance product, which represent the investment strategies used to profitably fund

its liabilities within acceptable levels of risk. These strategies include objectives for effective duration, yield curve sensitivity, convexity, liquidity, asset

sector concentration and credit quality. In executing these asset/liability matching strategies, management regularly reevaluates the estimates used in

determining the approximate amounts and timing of payments to or on behalf of policyholders for insurance liabilities. Many of these estimates are

inherently subjective and could impact the Company’s ability to achieve its asset/liability management goals and objectives.

Liquidity

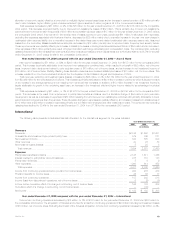

Liquidity refers to a company’s ability to generate adequate amounts of cash to meet its needs. The Company’s liquidity position (cash and cash

equivalents and short-term investments, excluding securities lending) was $6.7 billion and $5.4 billion at December 31, 2005 and 2004, respectively.

Liquidity needs are determined from a rolling 12-month forecast by portfolio and are monitored daily. Asset mix and maturities are adjusted based on

forecast. Cash flow testing and stress testing provide additional perspectives on liquidity. The Company believes that it has sufficient liquidity to fund its

cash needs under various scenarios that include the potential risk of early contractholder and policyholder withdrawal. The Company includes provisions

limiting withdrawal rights on many of its products, including general account institutional pension products (generally group annuities, including

guaranteed interest contracts (‘‘GICs’’), and certain deposit funds liabilities) sold to employee benefit plan sponsors. Certain of these provisions prevent

the customer from making withdrawals prior to the maturity date of the product.

In the event of significant unanticipated cash requirements beyond normal liquidity, the Company has multiple liquidity alternatives available based on

market conditions and the amount and timing of the liquidity need. These options include cash flow from operations, the sale of liquid assets, global

funding sources and various credit facilities.

The Company’s ability to sell investment assets could be limited by accounting rules including rules relating to the intent and ability to hold impaired

securities until the market value of those securities recovers.

In extreme circumstances, all general account assets within a statutory legal entity are available to fund any obligation of the general account within

that legal entity.

Liquidity Sources

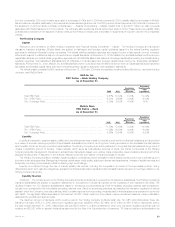

Cash Flow from Operations. The Company’s principal cash inflows from its insurance activities come from insurance premiums, annuity considera-

tions and deposit funds. A primary liquidity concern with respect to these cash inflows is the risk of early contractholder and policyholder withdrawal.

The Company’s principal cash inflows from its investment activities come from repayments of principal, proceeds from maturities and sales of

invested assets and investment income. The primary liquidity concerns with respect to these cash inflows are the risk of default by debtors and market

volatilities. The Company closely monitors and manages these risks through its credit risk management process.

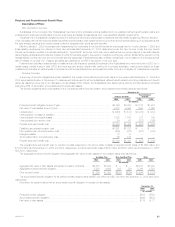

Liquid Assets. An integral part of the Company’s liquidity management is the amount of liquid assets it holds. Liquid assets include cash, cash

equivalents, short-term investments, marketable fixed maturity and equity securities. Liquid assets exclude assets relating to securities lending and dollar

roll activities. At December 31, 2005 and 2004, the Company had $179 billion and $136 billion in liquid assets, respectively.

Global Funding Sources. Liquidity is also provided by a variety of both short-term and long-term instruments, including repurchase agreements,

commercial paper, medium- and long-term debt, capital securities and stockholders’ equity. The diversification of the Company’s funding sources

enhances funding flexibility, limits dependence on any one source of funds and generally lowers the cost of funds.

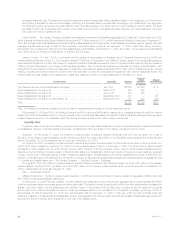

At December 31, 2005 and 2004, the Company had $1.4 billion in short-term debt outstanding, and $9.9 billion and $7.4 billion in long-term debt

outstanding, respectively.

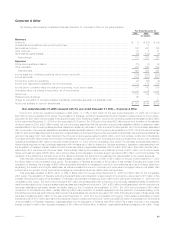

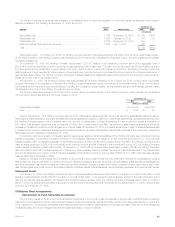

Debt Issuances. On June 23, 2005, the Holding Company issued in the United States public market $1,000 million aggregate principal amount of

5.00% senior notes due June 15, 2015 at a discount of $2.7 million ($997.3 million), and $1,000 million aggregate principal amount of 5.70% senior

notes due June 15, 2035 at a discount of $2.4 million ($997.6 million).

On June 29, 2005, the Holding Company issued 400 million pounds sterling ($729.2 million at issuance) aggregate principal amount of

5.25% senior notes due June 29, 2020 at a discount of 4.5 million pounds sterling ($8.1 million at issuance), for aggregate proceeds of 395.5 million

pounds sterling ($721.1 million at issuance). The senior notes were initially offered and sold outside the United States in reliance upon Regulation S under

the Securities Act of 1933, as amended.

On December 8, 2005, RGA issued junior subordinated debentures with a face amount of $400 million. Interest is payable semi-annually at a fixed

rate of 6.75% until December 15, 2015. Subsequent to December 15, 2015, interest on these debentures will accrue at an annual rate of 3-month

LIBOR plus a margin equal to 266.5 basis points, payable quarterly until maturity in 2065.

The Company repaid a $250 million, 7% surplus note which matured on November 1, 2005 and repaid a $1,006 million, 3.911% senior note which

matured on May 15, 2005.

MetLife Bank has entered into several repurchase agreements with the Federal Home Loan Bank of New York (the ‘‘FHLB of NY’’) whereby MetLife

Bank has issued such repurchase agreements in exchange for cash and for which the FHLB of NY has been granted a blanket lien on MetLife Bank’s

residential mortgages and mortgage-backed securities to collateralize MetLife Bank’s obligations under the repurchase agreements. The repurchase

agreements and the related security agreement represented by this blanket lien provide that upon any event of default by MetLife Bank, the FHLB of NY’s

recovery is limited to the amount of MetLife Bank’s liability under the outstanding repurchase agreements. During 2005, the Company increased its

MetLife, Inc. 25