MetLife 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

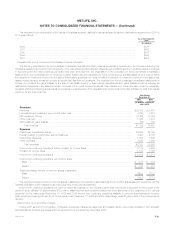

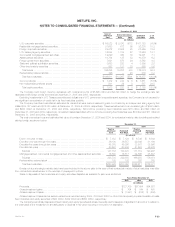

The estimated future amortization of the values of business acquired, distribution agreements and customer relationships acquired from 2006 to

2010 is as follows:

As of December 31,

2005

(In millions)

2006************************************************************************************************ $376

2007************************************************************************************************ $363

2008************************************************************************************************ $347

2009************************************************************************************************ $330

2010************************************************************************************************ $307

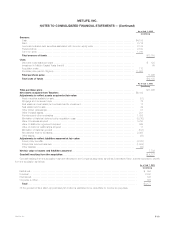

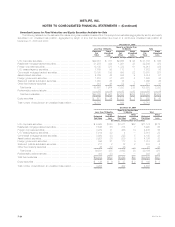

Unaudited Pro Forma Condensed Consolidated Financial Information

The following unaudited pro forma condensed consolidated financial information presents the results of operations for the Company assuming the

Travelers acquisition had occurred at the beginning of the respective periods presented. Discontinued operations and the cumulative effects of changes

in accounting and the related earnings per share have been excluded from the presentation of the unaudited pro forma condensed consolidated

statements of income as these are non-recurring in nature. Additionally, the unaudited pro forma condensed consolidated statements of income reflect

the reduction in investment income from the sale of fixed maturity securities, but does not reflect a reduction of investment income from the sale of real

estate property as such investment income is reported as discontinued operations. The unaudited pro forma condensed consolidated statements of

income do not reflect the gains (losses) on the sale of real estate property or fixed maturity securities as such gains (losses) would be reported as

discontinued operations or are sales that would not be part of the normal course of business. This unaudited pro forma information does not necessarily

represent what the Company’s actual results of operations would have been if the acquisition had occurred as of the date indicated or what such results

would be for any future periods.

Year Ended

December 31,

2005 2004

(In millions, except per

share data)

Revenues

Premiums ****************************************************************************************** $25,339 $23,514

Universal life and investment-type product policy fees ***************************************************** 4,255 3,612

Net investment income******************************************************************************* 16,405 14,864

Other revenues ************************************************************************************* 1,435 1,276

Net investment gains (losses) ************************************************************************* (52) 189

Total revenues ********************************************************************************** 47,382 43,455

Expenses

Policyholder benefits and claims *********************************************************************** 26,099 24,155

Interest credited to policyholder account balances ******************************************************** 4,495 4,156

Policyholder dividends ******************************************************************************* 1,679 1,666

Other expenses************************************************************************************* 9,920 8,953

Total expenses ********************************************************************************* 42,193 38,930

Income from continuing operations before provision for income taxes **************************************** 5,189 4,525

Provision for income taxes **************************************************************************** 1,510 1,308

Income from continuing operations ********************************************************************* $ 3,679 $ 3,217

Income from continuing operations per common share

Basic ******************************************************************************************* $ 4.84 $ 4.16

Diluted ****************************************************************************************** $ 4.80 $ 4.14

Weighted average number of common shares outstanding

Basic ******************************************************************************************* 760.2 773.3

Diluted ****************************************************************************************** 766.5 777.4

The weighted average number of common shares outstanding in the preceding table assumes the 22.4 million shares issued in connection with the

Travelers acquisition were outstanding as of the beginning of the periods presented.

Income from continuing operations per common share as presented in the preceding table does not include a deduction for the impact of the

preferred stock dividend of approximately $123 million, assuming that such preferred shares had been issued as of the beginning of the periods

presented, for the years ended December 31, 2005 and 2004. Income from continuing operations available to common shareholders per common

share would have been $4.68 and $4.00 for the years ended December 31, 2005 and 2004, respectively, deducting the impact of the preferred stock

dividend.

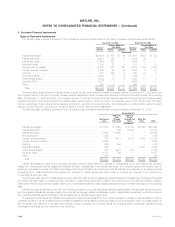

Restructuring Costs and Other Charges

During 2005, as part of the integration of Travelers’ operations, management approved and initiated plans to reduce approximately 1,000 domestic

and international Travelers employees which is expected to be completed by December 2006.

MetLife, Inc. F-21