MetLife 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

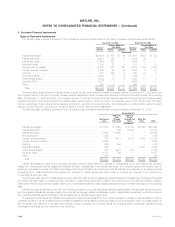

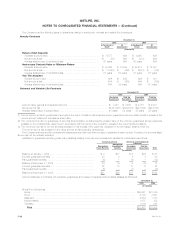

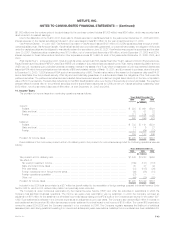

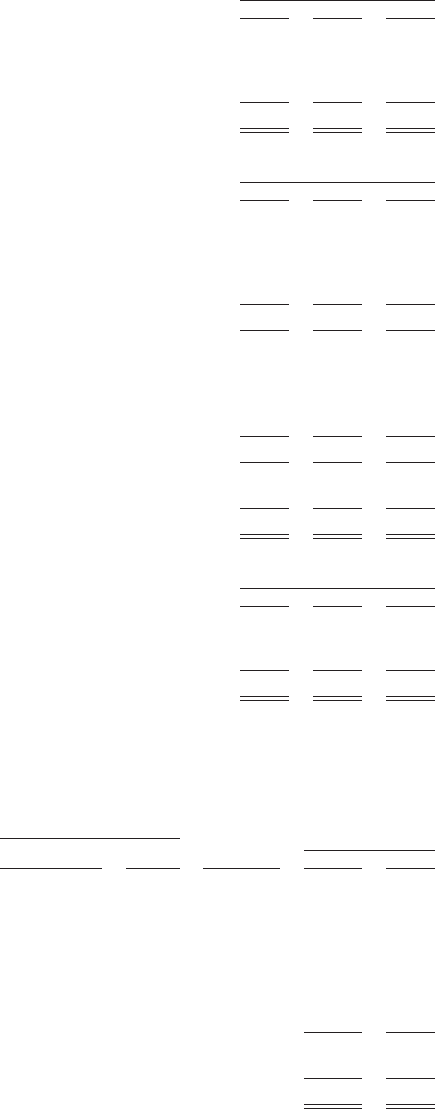

Information regarding the policyholder dividend obligation is as follows:

Years Ended December 31,

2005 2004 2003

(In millions)

Balance at beginning of year ******************************************************************* $2,243 $2,130 $1,882

Impact on revenues, net of expenses and income taxes ******************************************** (9) 124 —

Change in unrealized investment and derivative gains (losses) *************************************** (627) (11) 248

Balance at end of year ************************************************************************ $1,607 $2,243 $2,130

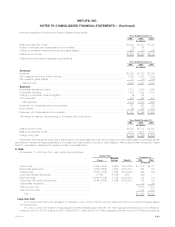

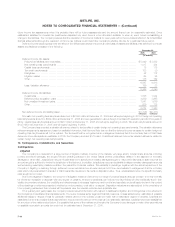

Closed block revenues and expenses were as follows:

Years Ended December 31,

2005 2004 2003

(In millions)

Revenues

Premiums *********************************************************************************** $3,062 $3,156 $3,365

Net investment income and other revenues******************************************************* 2,382 2,504 2,554

Net investment gains (losses) ****************************************************************** 10 (19) (128)

Total revenues ***************************************************************************** 5,454 5,641 5,791

Expenses

Policyholder benefits and claims **************************************************************** 3,478 3,480 3,660

Policyholder dividends************************************************************************* 1,465 1,458 1,509

Change in policyholder dividend obligation******************************************************** (9) 124 —

Other expenses ****************************************************************************** 263 275 297

Total expenses***************************************************************************** 5,197 5,337 5,466

Revenues, net of expenses before income taxes ************************************************** 257 304 325

Income taxes ******************************************************************************** 90 109 118

Revenues, net of expenses and income taxes **************************************************** $ 167 $ 195 $ 207

The change in maximum future earnings of the closed block is as follows:

Years Ended December 31,

2005 2004 2003

(In millions)

Balance at end of year ************************************************************************ $4,545 $4,712 $4,907

Balance at beginning of year ******************************************************************* 4,712 4,907 5,114

Change during year*************************************************************************** $ (167) $ (195) $ (207)

Metropolitan Life charges the closed block with federal income taxes, state and local premium taxes, and other additive state or local taxes, as well

as investment management expenses relating to the closed block as provided in the plan of demutualization. Metropolitan Life also charges the closed

block for expenses of maintaining the policies included in the closed block.

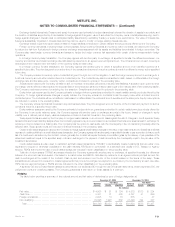

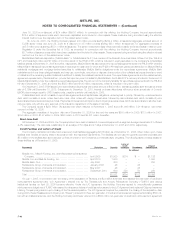

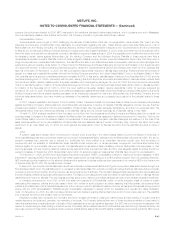

8. Debt

At December 31, 2005 and 2004, debt outstanding is as follows:

Interest Rates

December 31,

Weighted

Range Average Maturity 2005 2004

(In millions)

Senior notes*************************************************** 5.00%-7.25% 5.66% 2006-2035 $ 7,616 $6,017

Repurchase agreements***************************************** 2.18%-5.65% 3.99% 2006-2013 855 105

Surplus notes************************************************** 7.63%-7.88% 7.76% 2015-2025 696 946

Junior subordinated debentures ********************************** 6.75% 6.75% 2065 399 —

Fixed rate notes************************************************ 4.20%-10.50% 5.10% 2006-2010 104 110

Other notes with varying interest rates ***************************** 3.44%-5.89% 4.86% 2006-2012 145 168

Capital lease obligations ***************************************** ———7366

Total long-term debt ******************************************** 9,888 7,412

Total short-term debt******************************************** 1,414 1,445

Total ***************************************************** $11,302 $8,857

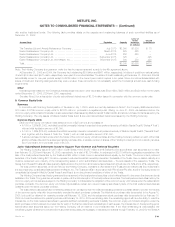

Long-term Debt

In connection with financing the acquisition of Travelers on July 1, 2005, which is more fully described in Note 2, the Holding Company issued

the following debt:

On June 23, 2005, the Holding Company issued in the United States public market $1,000 million aggregate principal amount of 5.00% senior

notes due June 15, 2015 at a discount of $2.7 million ($997.3 million) and $1,000 million aggregate principal amount of 5.70% senior notes due

MetLife, Inc. F-39