MetLife 2005 Annual Report Download - page 25

Download and view the complete annual report

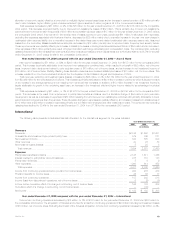

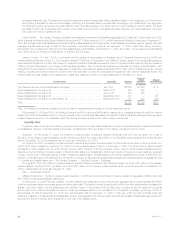

Please find page 25 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Total expenses increased by $553 million, or 14%, to $4,417 million for the year ended December 31, 2005 from $3,864 million for the comparable

2004 period. This increase is commensurate with growth in revenues and is primarily attributable to an increase of $520 million in policyholder benefits

and claims and interest credited to policyholder account balances, primarily associated with RGA’s growth in insurance in force of approximately

$270 billion, the aforementioned unfavorable mortality experience in the U.S. and U.K. during the first six months of the year, and strengthening of

reserves of $33 million for the Argentine pension business. The comparable 2004 period included a negotiated claim settlement in RGA’s accident and

health business of $24 million and $18 million in policy benefits and claims as a result of the Indian Ocean tsunami on December 26, 2004 and claims

development associated with the reinsurance of the Argentine pension business. Other expenses increased by $34 million, or 4%, primarily due to an

increase in the amortization of DAC. Changes in DAC, included in other expenses, can vary from period to period primarily due to changes in the mixture

of the business being reinsured. Additionally, $46 million of the total expense increase is attributable to foreign currency exchange rate movements.

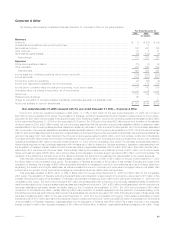

Year ended December 31, 2004 compared with the year ended December 31, 2003 — Reinsurance

Net income increased by $5 million, or 6%, to $91 million for the year ended December 31, 2004 from $86 million for the comparable 2003 period.

This increase is attributable to a 26% increase in revenues, primarily due to strong premium growth across all of RGA’s geographical segments, which

includes the effect of the Allianz Life transaction. The growth in income from continuing operations is partially offset by higher minority interest expense as

the Company’s ownership in RGA decreased from 59% to 52% in the comparable periods and a negotiated claim settlement in RGA’s accident and

health business, which is currently in run-off, of $8 million for the third quarter of 2004, net of income taxes and minority interest.

Total revenues, excluding net investment gains (losses), increased by $816 million, or 26%, to $3,942 million for the year ended December 31,

2004 from $3,126 million for the comparable 2003 period due primarily to a $700 million increase in premiums. The premium increase during the year

ended December 31, 2004 is partially the result of RGA’s coinsurance agreement with Allianz Life under which RGA assumed 100% of Allianz Life’s

United States traditional life reinsurance business. This transaction closed during 2003, with six months of reinsurance activity recorded in 2003, as

compared to twelve months in 2004. New premiums from facultative and automatic treaties and renewal premiums on existing blocks of business in the

United States and certain international operations also contributed to the premium growth. Premium levels are significantly influenced by large

transactions, such as the Allianz Life transaction, and reporting practices of ceding companies, and as a result, can fluctuate from period to period. Net

investment income also contributed to revenue growth, increasing $107 million, or 25%, to $538 million in 2004 from $431 million in 2003. The growth in

net investment income is the result of the growth in RGA’s operations and invested asset base, as well as the conversion of a large reinsurance treaty

from a funds withheld to coinsurance basis which resulted in an increase of $12 million in net investment income. Additionally, a component of the total

revenue increase is attributable to foreign currency exchange rate movements contributing an estimated $99 million.

Total expenses increased by $807 million, or 26%, to $3,864 million for the year ended December 31, 2004 from $3,057 million for the comparable

2003 period. This increase is commensurate with the growth in revenues and is primarily attributable to an increase of $613 million in policyholder

benefits and claims and interest credited to policyholder account balances, primarily associated with RGA’s growth in insurance in force of approximately

$200 billion, a negotiated claim settlement in RGA’s accident and health business of $24 million, and the inclusion of only six months of results from the

Allianz Life transaction in the prior year. The growth in interest credited is associated with an increase in the account balances of market value adjusted

annuity products and is generally offset by corresponding change in investment income. Also, during the fourth quarter of 2004, RGA recorded

approximately $18 million in policy benefits and claims as a result of the Indian Ocean tsunami on December 26, 2004 and claims development

associated with its reinsurance of Argentine pension business. Other expenses increased primarily due to an increase of $106 million in allowances and

related expenses on assumed reinsurance associated with RGA’s growth in premiums and insurance in force and $15 million in additional amortization of

DAC from the conversion of a large reinsurance treaty from a funds withheld to coinsurance basis. The balance of the growth in other expenses is

primarily due to additional costs in the U.S. associated with the Allianz Life transaction, start-up costs in various international markets, and the

aforementioned increase in minority interest expense from $114 million in 2003 to $161 million in 2004. Additionally, $95 million of the total expense

increase is attributable to foreign currency exchange rate movements.

MetLife, Inc.

22