MetLife 2005 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

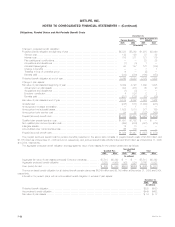

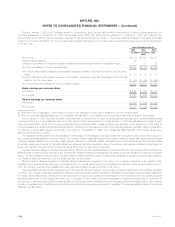

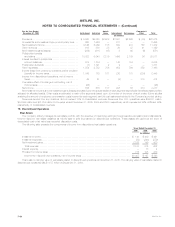

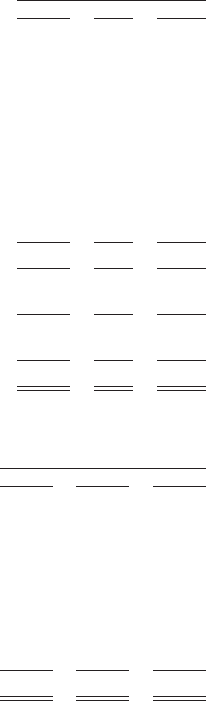

Other Comprehensive Income

The following table sets forth the reclassification adjustments required for the years ended December 31, 2005, 2004 and 2003 in other

comprehensive income (loss) that are included as part of net income for the current year that have been reported as a part of other comprehensive

income (loss) in the current or prior year:

Years Ended December 31,

2005 2004 2003

(In millions)

Holding gains (losses) on investments arising during the year***************************************** $(3,329) $ 513 $1,528

Income tax effect of holding (losses) gains ******************************************************** 1,253 74 (575)

Reclassification adjustments:

Recognized holding (gains) losses included in current year income ********************************** 156 (218) 351

Amortization of premiums and accretion of discounts associated with investments ********************* (199) (94) (168)

Income tax effect *************************************************************************** 16 (45) (68)

Allocation of holding gains (losses) on investments relating to other policyholder amounts ***************** 1,670 (182) (606)

Income tax effect of allocation of holding gains (losses) to other policyholder amounts ******************** (629) (26) 228

Unrealized investment gains of subsidiary at date of sale ******************************************** 15 — —

Deferred income taxes on unrealized investment gains of subsidiary at date of sale ********************** (5) — —

Net unrealized investment gains (losses) ********************************************************** (1,052) 22 690

Foreign currency translation adjustments arising during the year*************************************** (86) 144 177

Reclassification adjustment for sale of investment in foreign operation********************************** 5— —

Foreign currency translation adjustment *********************************************************** (81) 144 177

Minimum pension liability adjustment ************************************************************* 89 (2) (82)

Other comprehensive income (losses) ************************************************************ $(1,044) $ 164 $ 785

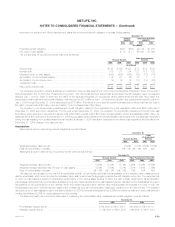

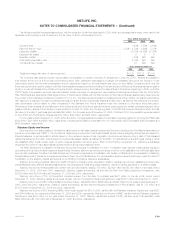

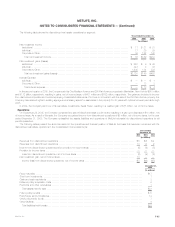

15. Other Expenses

Other expenses were comprised of the following:

Years Ended December 31,

2005 2004 2003

(In millions)

Compensation****************************************************************************** $ 3,163 $ 2,874 $ 2,707

Commissions ****************************************************************************** 3,266 2,876 2,473

Interest and debt issue costs ***************************************************************** 659 408 478

Amortization of DAC and VOBA *************************************************************** 2,451 1,908 1,820

Capitalization of DAC ************************************************************************ (3,604) (3,101) (2,792)

Rent, net of sublease income ***************************************************************** 296 264 254

Minority interest***************************************************************************** 154 152 110

Other ************************************************************************************* 2,882 2,432 2,118

Total other expenses ********************************************************************** $ 9,267 $ 7,813 $ 7,168

MetLife, Inc.

F-60