MetLife 2005 Annual Report Download - page 56

Download and view the complete annual report

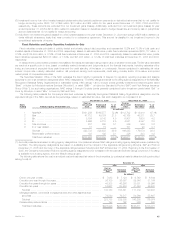

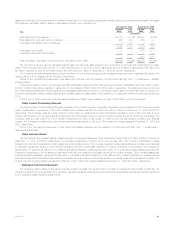

Please find page 56 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management fee. The maximum exposure to loss relating to real estate joint ventures, other limited partnerships and other investments is equal to the

carrying amounts plus any unfunded commitments, reduced by amounts guaranteed by other partners.

(3) Real estate joint ventures include partnerships and other ventures which engage in the acquisition, development, management and disposal of real

estate investments.

(4) Other limited partnerships include partnerships established for the purpose of investing in real estate funds, public and private debt and equity

securities, as well as limited partnerships established for the purpose of investing in low-income housing that qualifies for federal tax credits.

(5) Other investments include securities that are not asset-backed securitizations or collateralized debt obligations.

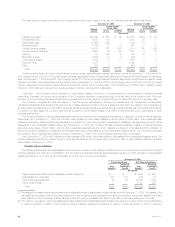

Securities Lending

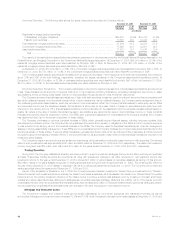

The Company participates in a securities lending program whereby blocks of securities, which are included in fixed maturity securities, are loaned to

third parties, primarily major brokerage firms. The Company requires a minimum of 102% of the fair value of the loaned securities to be separately

maintained as collateral for the loans. Securities with a cost or amortized cost of $32,068 million and $26,564 million and an estimated fair value of

$32,954 million and $27,974 million were on loan under the program at December 31, 2005 and 2004, respectively. Securities loaned under such

transactions may be sold or repledged by the transferee. The Company was liable for cash collateral under its control of $33,893 million and

$28,678 million at December 31, 2005 and 2004, respectively. Securities loaned transactions are accounted for as financing arrangements on the

Company’s consolidated balance sheets and consolidated statements of cash flows and the income and expenses associated with the program are

reported in net investment income as investment income and investment expenses, respectively. Security collateral of $207 million and $17 million,

respectively, at December 31, 2005 and 2004 on deposit from customers in connection with the securities lending transactions may not be sold or

repledged and is not reflected in the consolidated financial statements.

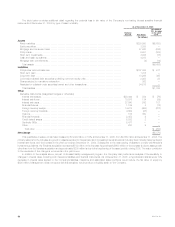

Separate Accounts

The Company had $127.9 billion and $86.8 billion held in its separate accounts, for which the Company generally does not bear investment risk, as

of December 31, 2005 and 2004, respectively. The Company manages each separate account’s assets in accordance with the prescribed investment

policy that applies to that specific separate account. The Company establishes separate accounts on a single client and multi-client commingled basis in

compliance with insurance laws. Effective with the adoption of SOP 03-1, on January 1, 2004, the Company reports separately, as assets and liabilities,

investments held in separate accounts and liabilities of the separate accounts if (i) such separate accounts are legally recognized; (ii) assets supporting

the contract liabilities are legally insulated from the Company’s general account liabilities; (iii) investments are directed by the contractholder; and (iv) all

investment performance, net of contract fees and assessments, is passed through to the contractholder. The Company reports separate account assets

meeting such criteria at their fair value. Investment performance (including investment income, net investment gains (losses) and changes in unrealized

gains (losses)) and the corresponding amounts credited to contractholders of such separate accounts are offset within the same line in the consolidated

statements of income.

The Company’s revenues reflect fees charged to the separate accounts, including mortality charges, risk charges, policy administration fees,

investment management fees and surrender charges. Separate accounts not meeting the above criteria are combined on a line-by-line basis with the

Company’s general account assets, liabilities, revenues and expenses.

Quantitative and Qualitative Disclosures About Market Risk.

The Company must effectively manage, measure and monitor the market risk associated with its invested assets and interest rate sensitive

insurance contracts. It has developed an integrated process for managing risk, which it conducts through its Corporate Risk Management Department,

Asset/Liability Management Committees (‘‘ALM Committees’’) and additional specialists at the business segment level. The Company has established

and implemented comprehensive policies and procedures at both the corporate and business segment level to minimize the effects of potential market

volatility.

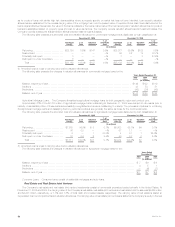

The Company regularly analyzes its exposure to interest rate, equity market and foreign currency exchange risk. As a result of that analysis, the

Company has determined that the fair value of its interest rate sensitive invested assets is materially exposed to changes in interest rates. The equity and

foreign currency portfolios do not expose the Company to material market risk.

The Company analyzes interest rate risk using various models including multi-scenario cash flow projection models that forecast cash flows of the

liabilities and their supporting investments, including derivative instruments. The Company uses a variety of strategies to manage interest rate, equity

market, and foreign currency exchange risk, including the use of derivative instruments.

The Travelers acquisition has increased the Company’s exposure to market risk. The Travelers acquisition has not changed management’s

processes for measuring, managing and monitoring market risk; however, some of those processes are utilizing interim manual reporting and estimation

techniques while the Company integrates the operations acquired. During the second half of 2005, management restructured the portfolio of assets that

were acquired, generally reducing the amount of market risk associated with the acquired block, in line with the Company’s overall investment strategy.

The acquisition also changed the profile of the Company’s foreign currency exchange rate risk, although management still deems the aggregate

sensitivity to foreign currency exchange rate risk to be immaterial.

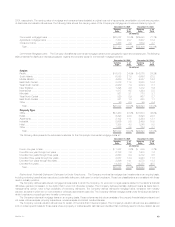

Market Risk Exposures

The Company has exposure to market risk through its insurance operations and investment activities. For purposes of this disclosure, ‘‘market risk’’

is defined as the risk of loss resulting from changes in interest rates, equity market prices and foreign currency exchange rates.

Interest rates. The Company’s exposure to interest rate changes results from its significant holdings of fixed maturities, as well as its interest rate

sensitive liabilities. The fixed maturities include U.S. and foreign government bonds, securities issued by government agencies, corporate bonds and

mortgage-backed securities, all of which are mainly exposed to changes in medium- and long-term treasury rates. The interest rate sensitive liabilities for

purposes of this disclosure include guaranteed interest contracts and fixed annuities, which have the same type of interest rate exposure (medium- and

long-term treasury rates) as the fixed maturities. The Company employs product design, pricing and asset/liability management strategies to reduce the

adverse effects of interest rate movements. Product design and pricing strategies include the use of surrender charges or restrictions on withdrawals in

some products. Asset/liability management strategies include the use of derivatives, the purchase of securities structured to protect against prepay-

MetLife, Inc. 53