MetLife 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

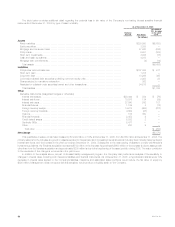

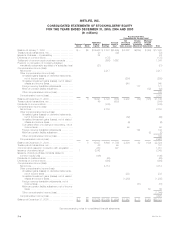

METLIFE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS — (Continued)

FOR THE YEARS ENDED DECEMBER 31, 2005, 2004 AND 2003

(Dollars in millions)

2005 2004 2003

Cash flows from financing activities

Policyholder account balances:

Deposits ******************************************************************************* $ 52,077 $ 39,506 $ 40,371

Withdrawals **************************************************************************** (47,827) (31,057) (31,135)

Net change in payables for collateral under securities loaned and other transactions****************** 4,138 1,595 9,221

Net change in short-term debt*************************************************************** (56) (2,178) 2,481

Long-term debt issued ********************************************************************* 3,940 1,822 926

Long-term debt repaid ********************************************************************* (1,430) (119) (763)

Preferred stock issued ********************************************************************* 2,100 — —

Dividends on preferred stock **************************************************************** (63) — —

Junior subordinated debt securities issued **************************************************** 2,134 — —

Treasury stock acquired ******************************************************************** — (1,000) (97)

Settlement of common stock purchase contracts *********************************************** — — 1,006

Proceeds from offering of common stock by subsidiary, net ************************************** — — 317

Dividends on common stock **************************************************************** (394) (343) (175)

Stock options exercised ******************************************************************** 72 51 1

Debt and equity issuance costs ************************************************************* (128) — —

Other, net******************************************************************************** (46) 3 8

Net cash provided by financing activities ******************************************************** 14,517 8,280 22,161

Change in cash and cash equivalents ********************************************************** (88) 373 1,410

Cash and cash equivalents, beginning of year *************************************************** 4,106 3,733 2,323

Cash and cash equivalents, end of year **************************************************** $ 4,018 $ 4,106 $ 3,733

Cash and cash equivalents, subsidiaries held-for-sale, beginning of year ***************************** $58$57$66

Cash and cash equivalents, subsidiaries held-for-sale, end of year ************************** $—$58$57

Cash and cash equivalents, from continuing operations, beginning of year **************************** $ 4,048 $ 3,676 $ 2,257

Cash and cash equivalents, from continuing operations, end of year************************* $ 4,018 $ 4,048 $ 3,676

Supplemental disclosures of cash flow information:

Net cash paid during the year for:

Interest ******************************************************************************** $ 579 $ 362 $ 468

Income taxes *************************************************************************** $ 1,391 $ 977 $ 702

Non-cash transactions during the year:

Business acquisitions:

Assets acquired*********************************************************************** $ 102,112 $ 20 $ 153

Less: liabilities assumed **************************************************************** 90,090 13 144

Net assets acquired ******************************************************************* 12,022 7 9

Less: cash paid*********************************************************************** 11,012 7 9

Business acquisition, common stock issued *********************************************** $ 1,010 $ — $ —

Business Dispositions:

Assets disposed ********************************************************************** $ 366 $ 923 $ 8

Less: liabilities disposed **************************************************************** 269 820 5

Net assets disposed******************************************************************* 97 103 3

Plus: equity securities received ********************************************************** 43 — —

Less: cash disposed ****************************************************************** 43 103 —

Business disposition, net of cash disposed************************************************ $97$—$ 3

Contribution of equity securities to MetLife Foundation******************************************* $1$50$—

Accrual for stock purchase contracts related to common equity units ****************************** $97$—$—

Purchase money mortgage on real estate sale ************************************************* $ — $ 2 $ 196

MetLife Capital Trust I transactions *********************************************************** $ — $ — $ 1,037

Real estate acquired in satisfaction of debt **************************************************** $ 1$7$14

Transfer from funds withheld at interest to fixed maturities **************************************** $—$606$—

See accompanying notes to consolidated financial statements.

MetLife, Inc.

F-6