MetLife 2005 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

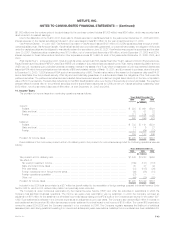

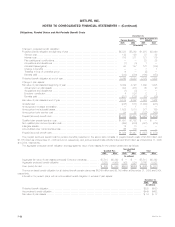

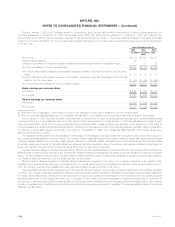

Information for pension and other postretirement plans with a projected benefit obligation in excess of plan assets:

December 31,

Pension Other Postretirement

Benefits Benefits

2005 2004 2005 2004

(In millions)

Projected benefit obligation*************************************************************** $538 $550 $2,176 $1,975

Fair value of plan assets ***************************************************************** $ 19 $ 17 $1,093 $1,062

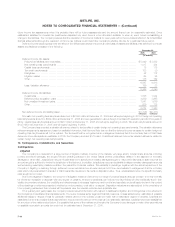

The components of net periodic benefit cost were as follows:

Other Postretirement

Pension Benefits Benefits

2005 2004 2003 2005 2004 2003

(In millions)

Service cost **************************************************************** $ 142 $ 129 $ 123 $ 37 $ 32 $ 39

Interest cost **************************************************************** 318 311 314 121 119 123

Expected return on plan assets ************************************************ (446) (428) (335) (79) (77) (72)

Amortization of prior actuarial losses ******************************************** 116 101 86 15 7 8

Amortization of prior service cost *********************************************** 16 16 16 (17) (19) (20)

Curtailment cost************************************************************* — — 10 — — 3

Net periodic benefit cost****************************************************** $ 146 $ 129 $ 214 $ 77 $ 62 $ 81

The Company expects to receive subsidies on prescription drug benefits beginning in 2006 under the Medicare Prescription Drug, Improvement

and Modernization Act of 2003 (the ‘‘Prescription Drug Act’’). The other postretirement benefit plan accumulated benefit obligation were remeasured

effective July 1, 2004 in order to determine the effect of the expected subsidies on net periodic other postretirement benefit cost. As a result, the

accumulated other postretirement benefit obligation was reduced by $213 million at July 1, 2004 and net periodic other postretirement benefit cost from

July 1, 2004 through December 31, 2004 was reduced by $17 million. The reduction of net periodic benefit cost was due to reductions in service cost of

$3 million, interest cost of $6 million, and amortization of prior actuarial loss of $8 million.

The reduction in the accumulated postretirement benefit obligation related to the Prescription Drug Act was $298 million and $230 million as of

December 31, 2005 and 2004, respectively. For the year ended December 31, 2005, the reduction of net periodic postretirement benefit cost was

$45 million, which was due to reductions in service cost of $6 million, interest cost of $16 million and amortization of prior actuarial loss of $23 million. An

additional $23 million reduction in the December 31, 2005 accumulated other postretirement benefit obligation is the result of an actuarial loss recognized

during the year resulting from updated assumptions including a January 1, 2005 participant census and new claims cost experience and the effect of a

December 31, 2005 change in the discount rate.

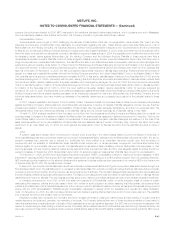

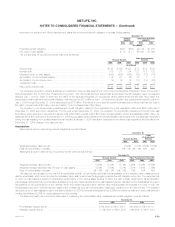

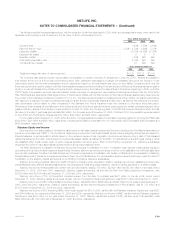

Assumptions

Assumptions used in determining benefit obligations were as follows:

December 31,

Other

Postretirement

Pension Benefits Benefits

2005 2004 2005 2004

Weighted average discount rate ************************************************************ 5.82% 5.87% 5.82% 5.88%

Rate of compensation increase************************************************************* 3% – 8% 3% – 8% N/A N/A

Assumptions used in determining net periodic benefit cost were as follows:

December 31,

Pension Benefits Other Postretirement Benefits

2005 2004 2003 2005 2004 2003

Weighted average discount rate *********************************** 5.83% 6.10% 6.74% 5.98% 6.20% 6.82%

Weighted average expected rate of return on plan assets ************* 8.50% 8.50% 8.51% 7.51% 7.91% 7.79%

Rate of compensation increase *********************************** 3% – 8% 3% – 8% 3% – 8% N/A N/A N/A

The discount rate is based on the yield of a hypothetical portfolio of high-quality debt instruments available on the valuation date, measured on a

yield to worst basis, which would provide the necessary future cash flows to pay the aggregate projected benefit obligation when due. The expected rate

of return on plan assets is based on anticipated performance of the various asset sectors in which the plan invests, weighted by target allocation

percentages. Anticipated future performance is based on long-term historical returns of the plan assets by sector, adjusted for the Subsidiaries’ long-term

expectations on the performance of the markets. While the precise expected return derived using this approach will fluctuate from year to year, the

Subsidiaries’ policy is to hold this long-term assumption constant as long as it remains within reasonable tolerance from the derived rate. The weighted

expected return on plan assets for use in that plan’s valuation in 2006 is currently anticipated to be 8.25% for pension benefits and other postretirement

medical benefits and 6.25% for other postretirement life benefits.

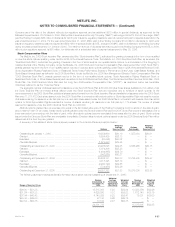

The assumed health care cost trend rates used in measuring the accumulated other postretirement benefit obligation were as follows:

December 31,

2005 2004

Pre-Medicare eligible claims ******************************************* 9.5% down to 5% in 2014 8% down to 5% in 2010

Medicare eligible claims *********************************************** 11.5% down to 5% in 2018 10% down to 5% in 2014

MetLife, Inc. F-53