MetLife 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

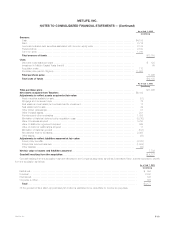

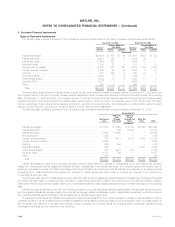

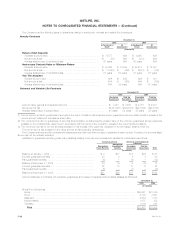

The changes in net unrealized investment gains (losses) were as follows:

Years Ended December 31,

2005 2004 2003

(In millions)

Balance, beginning of year ******************************************************************** $ 2,994 $2,972 $2,282

Unrealized investment gains (losses) during the year *********************************************** (3,372) 201 1,711

Unrealized investment gains of subsidiaries at the date of sale ************************************** 15 — —

Unrealized investment gains (losses) relating to:

Future policy benefit gains (losses) recognition ************************************************** 581 (509) (213)

Deferred policy acquisition costs ************************************************************* 462 133 (115)

Participating contracts ********************************************************************** — 183 (30)

Policyholder dividend obligation ************************************************************** 627 11 (248)

Deferred income taxes********************************************************************** 635 3 (415)

Balance, end of year ************************************************************************* $ 1,942 $2,994 $2,972

Net change in unrealized investment gains (losses) ************************************************ $(1,052) $ 22 $ 690

Trading Securities

Net investment income for the year ended December 31, 2005 includes $37 million of gains (losses) on securities classified as trading. Of this

amount, $42 million relates to net gains (losses) recognized on trading securities sold during the year ended December 31, 2005. The remaining

($5) million for the year ended December 31, 2005 relates to changes in fair value on trading securities held at December 31, 2005. The Company did

not have any trading securities during the years ended December 31, 2004 and 2003.

As part of the acquisition of Travelers on July 1, 2005, the Company acquired Travelers’ investment in Tribeca. Tribeca is a feeder fund investment

structure whereby the feeder fund invests substantially all of its assets in the master fund, Tribeca Global Convertible Instruments Ltd. The primary

investment objective of the master fund is to achieve enhanced risk-adjusted return by investing in domestic and foreign equities and equity-related

securities utilizing such strategies as convertible securities arbitrage. MetLife is the majority owner of the feeder fund and consolidates the fund within its

consolidated financial statements. Approximately $452 million of Tribeca’s investments are reported as trading securities in the accompanying consoli-

dated financial statements with changes in fair value recognized in net investment income.

Structured Investment Transactions

The Company invests in structured notes and similar type instruments, which generally provide equity-based returns on debt securities. The carrying

value of such investments was approximately $362 million and $666 million at December 31, 2005 and 2004, respectively. The related net investment

income recognized was $28 million, $45 million and $78 million for the years ended December 31, 2005, 2004 and 2003, respectively.

Variable Interest Entities

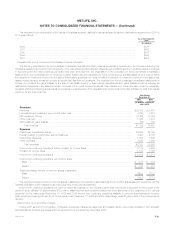

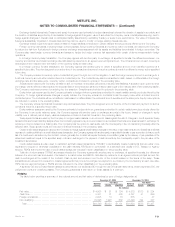

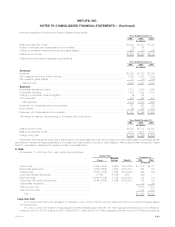

The following table presents the total assets of and maximum exposure to loss relating to VIEs for which the Company has concluded that (i) it is the

primary beneficiary and which are consolidated in the Company’s consolidated financial statements at December 31, 2005; and (ii) it holds significant

variable interests but it is not the primary beneficiary and which have not been consolidated:

December 31, 2005

Primary Beneficiary Not Primary Beneficiary

Maximum Maximum

Total Exposure to Total Exposure to

Assets(1) Loss(2) Assets(1) Loss(2)

(In millions)

Asset-backed securitizations and collateralized debt obligations ********************** $ — $ — $ 3,728 $ 463

Real estate joint ventures(3) **************************************************** 304 114 246 19

Other limited partnerships(4) **************************************************** 48 35 15,760 2,109

Other investments(5) ********************************************************** — — 3,722 242

Total************************************************************************ $352 $149 $23,456 $2,833

(1) The assets of the asset-backed securitizations and collateralized debt obligations are reflected at fair value at December 31, 2005. The assets of the

real estate joint ventures, other limited partnerships and other investments are reflected at the carrying amounts at which such assets would have

been reflected on the Company’s balance sheet had the Company consolidated the VIE from the date of its initial investment in the entity.

(2) The maximum exposure to loss of the asset-backed securitizations and collateralized debt obligations is equal to the carrying amounts of participation

or retained interests. In addition, the Company provides collateral management services for certain of these structures for which it collects a

management fee. The maximum exposure to loss relating to real estate joint ventures, other limited partnerships and other investments is equal to the

carrying amounts plus any unfunded commitments, reduced by amounts guaranteed by other partners.

(3) Real estate joint ventures include partnerships and other ventures which engage in the acquisition, development, management and disposal of real

estate investments.

(4) Other limited partnerships include partnerships established for the purpose of investing in real estate funds, public and private debt and equity

securities, as well as limited partnerships established for the purpose of investing in low-income housing that qualifies for federal tax credits.

(5) Other investments include securities that are not asset-backed securitizations or collateralized debt obligations.

MetLife, Inc. F-29