MetLife 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

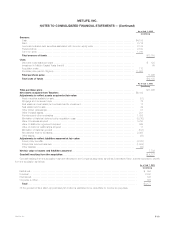

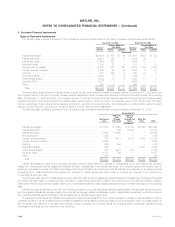

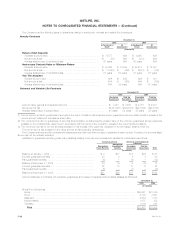

Mortgage and Consumer Loans

Mortgage and consumer loans were categorized as follows:

December 31,

2005 2004

Amount Percent Amount Percent

(In millions)

Commercial mortgage loans ********************************************************* $28,169 75% $25,139 77%

Agricultural mortgage loans ********************************************************** 7,711 21 5,914 18

Consumer loans ******************************************************************* 1,482 4 1,510 5

Total *************************************************************************** 37,362 100% 32,563 100%

Less: Valuation allowances ********************************************************** 172 157

Mortgage and consumer loans ******************************************************* $37,190 $32,406

Mortgage loans are collateralized by properties primarily located in the United States. At December 31, 2005, approximately 22%, 9% and 7% of the

properties were located in California, New York and Illinois, respectively. Generally, the Company (as the lender) requires that a minimum of one-fourth of

the purchase price of the underlying real estate be paid by the borrower.

Certain of the Company’s real estate joint ventures have mortgage loans with the Company. The carrying values of such mortgages were

$379 million and $641 million at December 31, 2005 and 2004, respectively.

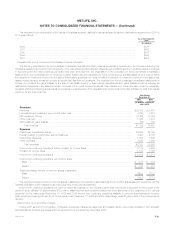

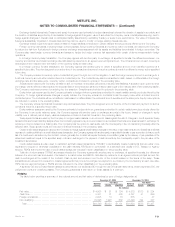

Changes in loan valuation allowances for mortgage and consumer loans were as follows:

Years Ended

December 31,

2005 2004 2003

(In millions)

Balance, beginning of year************************************************************************** $157 $129 $126

Additions **************************************************************************************** 64 57 52

Deductions*************************************************************************************** (49) (29) (49)

Balance, end of year******************************************************************************* $172 $157 $129

A portion of the Company’s mortgage and consumer loans was impaired and consisted of the following:

December 31,

2005 2004

(In millions)

Impaired loans with valuation allowances********************************************************************** $ 22 $185

Impaired loans without valuation allowances ******************************************************************* 116 133

Total ************************************************************************************************** 138 318

Less: Valuation allowances on impaired loans ***************************************************************** 441

Impaired loans ***************************************************************************************** $134 $277

The average investment in impaired loans was $187 million, $404 million and $652 million for the years ended December 31, 2005, 2004 and

2003, respectively. Interest income on impaired loans was $12 million, $29 million and $58 million for the years ended December 31, 2005, 2004 and

2003, respectively.

The investment in restructured loans was $37 million and $125 million at December 31, 2005 and 2004, respectively. Interest income of $2 million,

$9 million and $19 million was recognized on restructured loans for the years ended December 31, 2005, 2004 and 2003, respectively. Gross interest

income that would have been recorded in accordance with the original terms of such loans amounted to $3 million, $12 million and $24 million for the

years ended December 31, 2005, 2004 and 2003, respectively.

Mortgage and consumer loans with scheduled payments of 60 days (90 days for agricultural mortgages) or more past due or in foreclosure had an

amortized cost of $60 million and $58 million at December 31, 2005 and 2004, respectively.

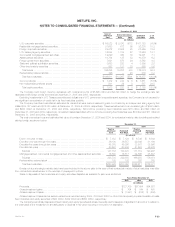

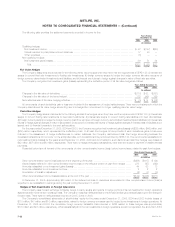

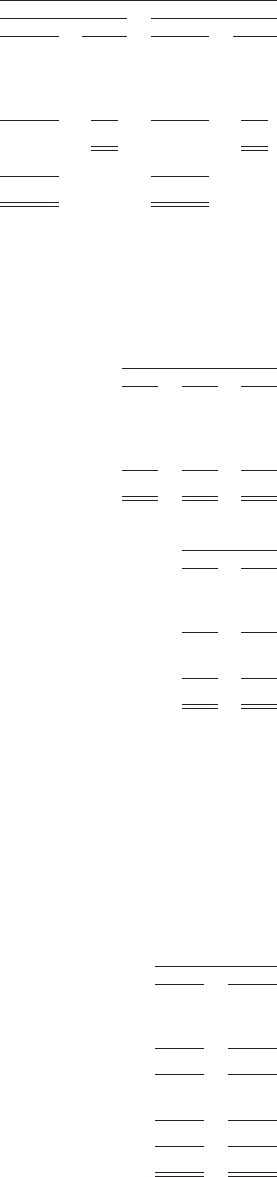

Real Estate and Real Estate Joint Ventures

Real estate and real estate joint ventures consisted of the following:

December 31,

2005 2004

(In millions)

Real estate and real estate joint ventures held-for-investment ************************************************* $4,783 $3,194

Impairments ****************************************************************************************** (118) (118)

Total ********************************************************************************************** 4,665 3,076

Real estate held-for-sale ******************************************************************************** — 1,173

Impairments ****************************************************************************************** — (16)

Total ********************************************************************************************** — 1,157

Real estate and real estate joint ventures ****************************************************************** $4,665 $4,233

MetLife, Inc.

F-26