MetLife 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Mortgage Loan Commitments

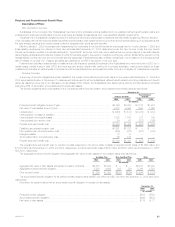

The Company commits to lend funds under mortgage loan commitments. The amounts of these mortgage loan commitments were $2,974 million

and $1,189 million at December 31, 2005 and 2004, respectively. The purpose of these loans is to enhance the Company’s total return on its

investment portfolio. There are no other obligations or liabilities arising from such arrangements that are reasonably likely to become material.

Lease Commitments

The Company, as lessee, has entered into various lease and sublease agreements for office space, data processing and other equipment. The

Company’s commitments under such lease agreements are included within the contractual obligations table. See ‘‘— Liquidity and Capital Resources —

The Company — Liquidity Uses.’’

Credit Facilities and Letters of Credit

The Company maintains committed and unsecured credit facilities and letters of credit with various financial institutions. See ‘‘— Liquidity and Capital

Resources — The Company — Liquidity Sources — Credit Facilities and — Letters of Credit’’ for further description of such arrangements.

Share-Based Arrangements

In connection with the issuance of the common equity units, the Holding Company has issued forward stock purchase contracts under which the

Company will issue, in 2008 and 2009, between 39.0 and 47.8 million shares, depending upon whether the share price is greater than $43.45 and less

than $53.10. See ‘‘— Liquidity and Capital Resources — The Holding Company — Liquidity Sources — Common Equity Units’’ for further description of

such arrangements.

Guarantees

In the course of its business, the Company has provided certain indemnities, guarantees and commitments to third parties pursuant to which it may

be required to make payments now or in the future. In the context of acquisition, disposition, investment and other transactions, the Company has

provided indemnities and guarantees, including those related to tax, environmental and other specific liabilities, and other indemnities and guarantees that

are triggered by, among other things, breaches of representations, warranties or covenants provided by the Company. In addition, in the normal course

of business, the Company provides indemnifications to counterparties in contracts with triggers similar to the foregoing, as well as for certain other

liabilities, such as third party lawsuits. These obligations are often subject to time limitations that vary in duration, including contractual limitations and

those that arise by operation of law, such as applicable statutes of limitation. In some cases, the maximum potential obligation under the indemnities and

guarantees is subject to a contractual limitation ranging from less than $1 million to $2 billion, with a cumulative maximum of $5.2 billion, while in other

cases such limitations are not specified or applicable. Since certain of these obligations are not subject to limitations, the Company does not believe that

it is possible to determine the maximum potential amount due under these guarantees in the future.

In addition, the Company indemnifies its directors and officers as provided in its charters and by-laws. Also, the Company indemnifies other of its

agents for liabilities incurred as a result of their representation of the Company’s interests. Since these indemnities are generally not subject to limitation

with respect to duration or amount, the Company does not believe that it is possible to determine the maximum potential amount due under these

indemnities in the future.

The Company has also guaranteed minimum investment returns on certain international retirement funds in accordance with local laws. Since these

guarantees are not subject to limitation with respect to duration or amount, the Company does not believe that it is possible to determine the maximum

potential amount due under these guarantees in the future.

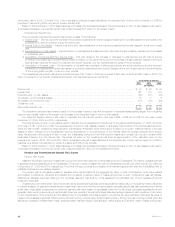

In the first quarter of 2005, the Company recorded a liability of $4 million with respect to indemnities provided in connection with a certain disposition.

The approximate term for this liability is 18 months. The maximum potential amount of future payments the Company could be required to pay under

these indemnities is approximately $500 million. Due to the uncertainty in assessing changes to the liability over the term, the liability on the Company’s

consolidated balance sheet will remain until either expiration or settlement of the guarantee unless evidence clearly indicates that the estimates should be

revised. In the third quarter of 2005, the Company released $6 million of a liability due to the expiration of indemnities provided in a prior year disposition.

The Company’s recorded liabilities at December 31, 2005 and 2004 for indemnities, guarantees and commitments were $9 million and $10 million,

respectively.

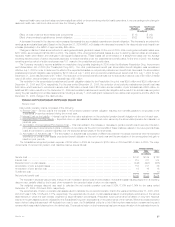

In connection with RSATs, the Company writes credit default swap obligations requiring payment of principal due in exchange for the reference credit

obligation, depending on the nature or occurrence of specified credit events for the referenced entities. In the event of a specified credit event, the

Company’s maximum amount at risk, assuming the value of the referenced credits becomes worthless, is $593 million at December 31, 2005. The

credit default swaps expire at various times during the next six years.

Other Commitments

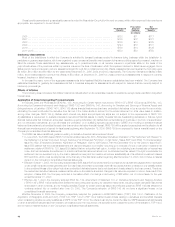

TIC is a member of the Federal Home Loan Bank of Boston (the ‘‘FHLB of Boston’’) and has entered into several funding agreements with the FHLB

of Boston whereby TIC has issued such funding agreements in exchange for cash and for which the FHLB of Boston has been granted a blanket lien on

TIC’s residential mortgages and mortgage-backed securities to collateralize TIC’s obligations under the funding agreements. TIC maintains control over

these pledged assets, and may use, commingle, encumber or dispose of any portion of the collateral as long as there is no event of default and the

remaining qualified collateral is sufficient to satisfy the collateral maintenance level. The funding agreements and the related security agreement

represented by this blanket lien, provide that upon any event of default by TIC, the FHLB of Boston’s recovery is limited to the amount of TIC’s liability

under the outstanding funding agreements. The amount of the Company’s liability for funding agreements with the Bank as of December 31, 2005 is

$1.1 billion, which is included in policyholder account balances.

Collateral for Securities Lending

The Company has noncash collateral for securities lending on deposits from customers, which cannot be sold or re-pledged, and which has not

been recorded on its consolidated balance sheets. The amount of this collateral was $207 million and $17 million at December 31, 2005 and 2004,

respectively.

MetLife, Inc.

34