MetLife 2005 Annual Report Download - page 111

Download and view the complete annual report

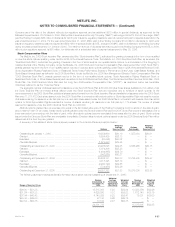

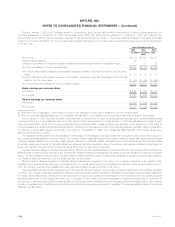

Please find page 111 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

MSI received in 2005 a notice from the Illinois Department of Securities asserting possible violations of the Illinois Securities Act in connection with

sales of a former affiliate’s mutual funds. A response has been submitted and MSI intends to cooperate fully with the Illinois Department of Securities.

In August 1999, an amended putative class action complaint was filed in Connecticut state court against The Travelers Life and Annuity Company

(‘‘TLAC’’), Travelers Equity Sales, Inc. and certain former affiliates. The amended complaint alleges Travelers Property Casualty Corporation, a former

TLAC affiliate, purchased structured settlement annuities from TLAC and spent less on the purchase of those structured settlement annuities than agreed

with claimants, and that commissions paid to brokers for the structured settlement annuities, including an affiliate of TLAC, were paid in part to Travelers

Property Casualty Corporation. On May 26, 2004, the Connecticut Superior Court certified a nationwide class action involving the following claims against

TLAC: violation of the Connecticut Unfair Trade Practice Statute, unjust enrichment, and civil conspiracy. On June 15, 2004, the defendants appealed

the class certification order and the appeal is now pending before the Connecticut Supreme Court.

A former registered representative of Tower Square Securities, Inc. (‘‘Tower Square’’), a broker-dealer subsidiary of The Travelers Insurance

Company (‘‘TIC’’), is alleged to have defrauded individuals by diverting funds for his personal use. In June 2005, the SEC issued a formal order of

investigation with respect to Tower Square and served Tower Square with a subpoena. The Securities and Business Investments Division of the

Connecticut Department of Banking and the NASD are also reviewing this matter. Tower Square intends to fully cooperate with the SEC, the NASD and

the Connecticut Department of Banking. In the context of the above, two arbitration matters were commenced in 2005 against Tower Square. In one of

the matters, defendants include other unaffiliated broker-dealers with whom the registered representative was formerly registered. It is reasonably

possible that other actions will be brought regarding this matter. Tower Square intends to defend itself vigorously in all such cases.

Metropolitan Life also has been named as a defendant in a number of silicosis, welding and mixed dust cases in various states. The Company

intends to defend itself vigorously against these cases.

Various litigation, including purported or certified class actions, and various claims and assessments against the Company, in addition to those

discussed above and those otherwise provided for in the Company’s consolidated financial statements, have arisen in the course of the Company’s

business, including, but not limited to, in connection with its activities as an insurer, employer, investor, investment advisor and taxpayer. Further, state

insurance regulatory authorities and other federal and state authorities regularly make inquiries and conduct investigations concerning the Company’s

compliance with applicable insurance and other laws and regulations.

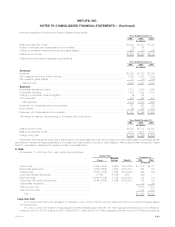

Summary

It is not feasible to predict or determine the ultimate outcome of all pending investigations and legal proceedings or provide reasonable ranges of

potential losses, except as noted above in connection with specific matters. In some of the matters referred to above, very large and/or indeterminate

amounts, including punitive and treble damages, are sought. Although in light of these considerations it is possible that an adverse outcome in certain

cases could have a material adverse effect upon the Company’s consolidated financial position, based on information currently known by the Company’s

management, in its opinion, the outcomes of such pending investigations and legal proceedings are not likely to have such an effect. However, given the

large and/or indeterminate amounts sought in certain of these matters and the inherent unpredictability of litigation, it is possible that an adverse outcome

in certain matters could, from time to time, have a material adverse effect on the Company’s consolidated net income or cash flows in particular quarterly

or annual periods.

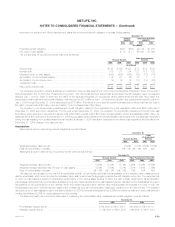

Insolvency Assessments

Most of the jurisdictions in which the Company is admitted to transact business require life insurers doing business within the jurisdiction to

participate in guaranty associations, which are organized to pay contractual benefits owed pursuant to insurance policies issued by impaired, insolvent or

failed life insurers. These associations levy assessments, up to prescribed limits, on all member insurers in a particular state on the basis of the

proportionate share of the premiums written by member insurers in the lines of business in which the impaired, insolvent or failed insurer engaged. Some

states permit member insurers to recover assessments paid through full or partial premium tax offsets. Assessments levied against the Company were

$4 million, $10 million and $6 million for the years ended December 31, 2005, 2004 and 2003, respectively. The Company maintained a liability of

$90 million, and a related asset for premium tax offsets of $54 million, at December 31, 2005 for undiscounted future assessments in respect of currently

impaired, insolvent or failed insurers.

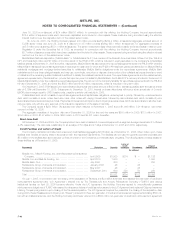

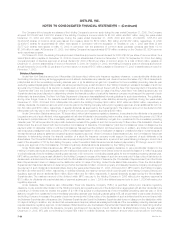

Impact of Hurricanes

On August 29, 2005, Hurricane Katrina made landfall in the states of Louisiana, Mississippi and Alabama causing catastrophic damage to these

coastal regions. As of December 31, 2005, the Company recognized total net losses related to the catastrophe of $134 million, net of income taxes and

reinsurance recoverables and including reinstatement premiums and other reinsurance-related premium adjustments, which impacted the Auto & Home

and Institutional segments. The Auto & Home and Institutional segments recorded net losses related to the catastrophe of $120 million and $14 million,

each net of income taxes and reinsurance recoverables and including reinstatement premiums and other reinsurance-related premium adjustments,

respectively. MetLife’s gross losses from Katrina were approximately $335 million, primarily arising from the Company’s homeowners business.

On October 24, 2005, Hurricane Wilma made landfall across the state of Florida. As of December 31, 2005, the Company’s Auto & Home segment

recognized total losses related to the catastrophe of $32 million, net of income taxes and reinsurance recoverables. MetLife’s gross losses from

Hurricane Wilma were approximately $57 million arising from the Company’s homeowners and automobile businesses.

Additional hurricane-related losses may be recorded in future periods as claims are received from insureds and claims to reinsurers are processed.

Reinsurance recoveries are dependent on the continued creditworthiness of the reinsurers, which may be affected by their other reinsured losses in

connection with Hurricanes Katrina and Wilma and otherwise. In addition, lawsuits, including purported class actions, have been filed in Mississippi and

Louisiana challenging denial of claims for damages caused to their property during Hurricane Katrina. MPC is a named party in some of these lawsuits. In

addition, rulings in cases in which MPC is not a party may affect interpretation of its policies. MPC intends to vigorously defend these matters. However,

any adverse rulings could result in an increase in the Company’s hurricane-related claim exposure and losses. Based on information currently known by

management, it does not believe that additional claim losses resulting from Hurricane Katrina will have a material adverse impact on the Company’s

consolidated financial statements.

MetLife, Inc. F-49