MetLife 2005 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

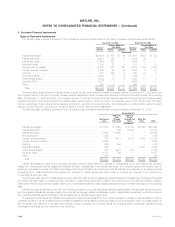

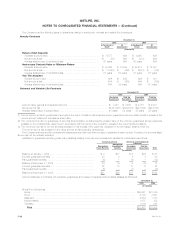

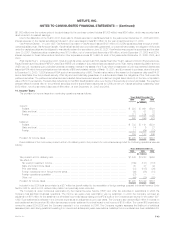

The Company had the following types of guarantees relating to annuity and universal and variable life contracts at:

Annuity Contracts

December 31,

2005 2004

In the Event of At In the Event of At

Death Annuitization Death Annuitization

(In millions)

Return of Net Deposits

Separate account value ******************************************** $ 9,577 N/A $ 6,925 N/A

Net amount at risk************************************************* $ 3(1) N/A $ 22(1) N/A

Average attained age of contractholders******************************* 60 years N/A 60 years N/A

Anniversary Contract Value or Minimum Return

Separate account value ******************************************** $ 80,368 $ 18,936 $ 43,414 $ 14,297

Net amount at risk************************************************* $ 1,614(1) $ 85(2) $ 990(1) $ 51(2)

Average attained age of contractholders******************************* 61 years 59 years 61 years 58 years

Two Tier Annuities

General account value ********************************************* N/A $ 299 N/A $ 301

Net amount at risk************************************************* N/A $ 36(3) N/A $ 36(3)

Average attained age of contractholders******************************* N/A 58 years N/A 58 Years

Universal and Variable Life Contracts

December 31,

2005 2004

Secondary Paid Up Secondary Paid Up

Guarantees Guarantees Guarantees Guarantees

(In millions)

Account value (general and separate account) ********************************** $ 7,357 $ 4,505 $ 4,715 $ 4,570

Net amount at risk ********************************************************** $124,702(1) $39,979(1) $94,163(1) $42,318(1)

Average attained age of policyholders****************************************** 48 years 54 years 45 years 52 years

(1) The net amount at risk for guarantees of amounts in the event of death is defined as the current guaranteed minimum death benefit in excess of the

current account balance at the balance sheet date.

(2) The net amount at risk for guarantees of amounts at annuitization is defined as the present value of the minimum guaranteed annuity payments

available to the contractholder determined in accordance with the terms of the contract in excess of the current account balance.

(3) The net amount at risk for two tier annuities is based on the excess of the upper tier, adjusted for a profit margin, less the lower tier.

The net amount at risk is based on the direct amount at risk (excluding reinsurance).

The Company’s annuity and life contracts with guarantees may offer more than one type of guarantee in each contract. Therefore, the amounts listed

above may not be mutually exclusive.

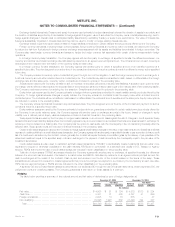

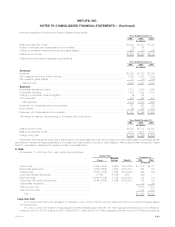

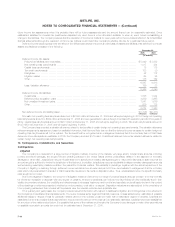

Liabilities for guarantees (excluding base policy liabilities) relating to annuity and universal and variable life contracts are as follows:

Annuity Contracts Universal and Variable Life

Contracts

Guaranteed

Guaranteed Annuitization Secondary Paid Up

Death Benefits Benefits Guarantees Guarantees Total

(In millions)

Balance at January 1, 2004 *************************************** $ 9 $17 $ 6 $25 $ 57

Incurred guaranteed benefits ************************************** 23 2 4 4 33

Paid guaranteed benefits****************************************** (8) — (4) — (12)

Balance at December 31, 2004 *********************************** 24 19 6 29 78

Incurred guaranteed benefits ************************************** 22 10 10 10 52

Paid guaranteed benefits****************************************** (5) — (1) — (6)

Balance at December 31, 2005 *********************************** $41 $29 $15 $39 $124

Account balances of contracts with insurance guarantees are invested in separate account asset classes as follows at:

December 31,

2005 2004

(In millions)

Mutual Fund Groupings

Equity ******************************************************************************************* $58,461 $31,829

Bond******************************************************************************************** 6,133 3,621

Balanced **************************************************************************************** 4,804 1,730

Money Market ************************************************************************************ 1,075 383

Specialty***************************************************************************************** 1,004 245

Total ***************************************************************************************** $71,477 $37,808

MetLife, Inc.

F-36